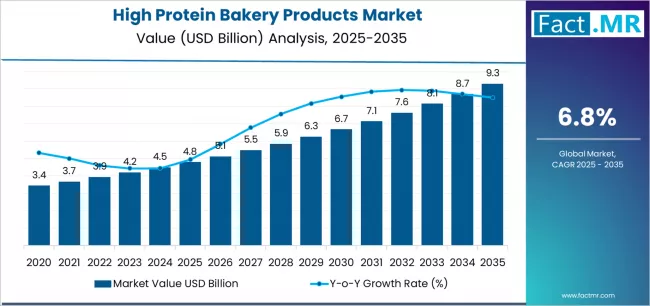

The Global High Protein Bakery Products Market is positioned for exceptional expansion from 2025 through 2035, driven by rising consumer health awareness, evolving dietary preferences, and increasing demand for functional foods that marry nutrition with convenience. The market is projected to grow from approximately USD 4.8 billion in 2025 to USD 9.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

Market Dynamics & Growth Drivers

The surge in demand for high protein bakery products reflects broader global shifts toward wellness-oriented eating habits. Consumers are increasingly prioritizing protein as part of daily nutrition—not just for muscle building but for overall health, satiety, and metabolic support. Functional bakery formats, such as protein-enriched breads, cookies, and muffins, are emerging as mainstream alternatives to traditional baked goods, providing a tasty yet nutritious choice for consumers across demographics.

Key growth drivers include:

-

Heightened health and fitness awareness, with more consumers seeking products that support active lifestyles.

-

Clean-label and natural ingredient trends, encouraging manufacturers to innovate with legumes, grains, and plant protein sources.

-

Retail and e-commerce expansion, providing broader access and visibility for high-protein bakery items.

Market Snapshot: 2025–2035

| Metric | Value |

|---|---|

| 2025 Market Size | ~USD 4.8 billion |

| 2035 Forecast | ~USD 9.3 billion |

| Decade CAGR | 6.8% |

| Dominant Product (2025) | Bread (53% share) |

| Leading Distribution Channel | Hypermarkets & Supermarkets (37.6%) |

By product type, high protein bread commands a dominant share, holding more than half of current market revenue due to its versatility and daily consumption patterns. Meanwhile, cookies and other snacking formats are rapidly gaining traction, capturing consumer interest for on-the-go protein options and flavor diversity.

Regional Market Themes

North America remains a powerhouse for high protein bakery products, reflecting the region’s strong health and fitness culture and robust retail infrastructure. North America accounted for approximately 37.6% of global revenue in 2024, underlining its leadership role in the segment.

Asia Pacific represents the fastest growing regional market, propelled by rising disposable incomes, growing health consciousness, and expanding middle-class populations. The Asia Pacific high protein bakery products market is projected to grow at a CAGR of 8% from 2025 to 2030, with India forecast to record the highest regional growth rate.

India’s market data reveals notable momentum: the country’s revenue is expected to grow from approximately USD 196.7 million in 2024 to USD 328.9 million by 2030, at a 9% CAGR, illustrating strong domestic demand for high protein bakery innovations.

In contrast, Middle East & Africa shows moderate but steady growth, with the market anticipated to expand at a 5.1% CAGR from 2025 to 2030. This reflects evolving consumer awareness and expanding distribution channels across urban centers.

Distribution Channel Evolution

Retail chains remain the primary avenue for high protein bakery products, with hypermarkets and supermarkets controlling roughly 37.6% of the global distribution share in 2025. These outlets offer strong product visibility and a wide selection of brands, drawing consumers seeking healthy alternatives to traditional bakery items.

E-commerce channels are experiencing rapid growth, supported by rising online grocery adoption and direct-to-consumer platforms. Online retail is forecast to expand at an estimated 7.7% CAGR from 2025 to 2030, enabling brands to broaden reach and tailor offerings to niche consumer segments.

Competitive Landscape & Innovation

The competitive structure in the high protein bakery products market is moderately fragmented, with a mix of global leaders and emerging specialty brands. Established players such as Mondelēz International, Grupo Bimbo, Kellanova, Quest Nutrition, and ARYZTA are investing in product innovation, broader distribution, and strategic partnerships to strengthen their market positions.

Innovation centers on:

-

Plant-based protein integration, appealing to vegetarian and flexitarian consumers.

-

Keto-friendly and functional formulations, attracting consumers focused on weight management and metabolic health.

-

Clean-label and allergen-free products, responding to demand for natural, transparent ingredients.

Emerging brands specializing in niche segments—such as gluten-free, low sugar, and fortified mixes—are increasingly securing market share by targeting health-conscious and specialty dietary consumers, often via digital platforms and subscription models.

Consumer Insights & Future Trends

Consumer research underscores a broader cultural shift toward protein-rich diets. Across global markets, individuals are integrating protein into daily meals—not just through supplements but via familiar staples like bread, cookies, and muffins enriched with functional ingredients. This trend aligns with broader health and lifestyle priorities, including muscle maintenance, weight control, and overall nutrient adequacy.

Manufacturers are responding with products balancing taste, texture, and nutrition—an essential strategy for mainstream acceptance. Clean-label protein sources such as pea, chickpea, and lentil flours are gaining traction due to their natural appeal and nutritional credentials.

Browse Full Report : https://www.factmr.com/report/high-protein-bakery-products-market

Outlook: 2025–2035

Looking ahead, the high protein bakery products market is poised for continued double-digit innovation and category expansion. As consumers increasingly seek foods that support health without sacrificing convenience or flavor, high protein bakery offerings will become integral to modern diets worldwide.

The anticipated USD 9.3 billion valuation by 2035 represents more than just revenue growth—it reflects evolving consumer priorities, expanding retail ecosystems, and dynamic product innovation capable of meeting diverse dietary needs.