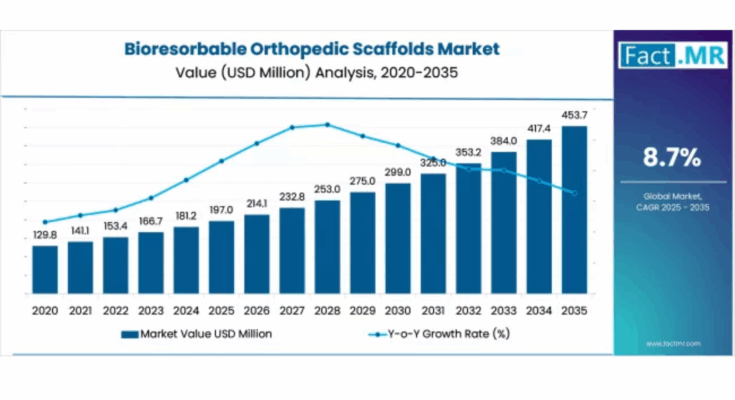

The global bioresorbable orthopedic scaffolds market is set for strong expansion over the next decade, fueled by rapid advancements in regenerative medicine, rising orthopedic injury prevalence, and the growing demand for biocompatible, biodegradable implant solutions. According to a new analysis by Fact.MR, the market is projected to increase from USD 197 million in 2025 to approximately USD 454 million by 2035, marking a 130% jump and an absolute growth of USD 257 million.

This reflects an impressive CAGR of 8.7% from 2025 to 2035.

The increasing adoption of tissue engineering solutions, minimally invasive orthopedic procedures, and bioresorbable alternatives to metallic implants is significantly boosting global demand.

Strategic Market Drivers

Rising Orthopedic Injuries & Musculoskeletal Disorders

Increasing cases of sports injuries, trauma, and age-related orthopedic conditions—such as osteoporosis and osteoarthritis—continue to propel scaffold adoption. Bioresorbable scaffolds eliminate the need for secondary surgeries to remove implants, reducing patient risk and healthcare costs.

Advancements in Regenerative Medicine & Tissue Engineering

Breakthroughs in 3D printing, biomaterials, and stem-cell-based therapies are enhancing the performance of orthopedic scaffolds. Modern scaffolds provide:

- Superior biocompatibility

- Predictable degradation rates

- Enhanced cell growth and tissue regeneration

These innovations are reshaping next-generation orthopedic solutions.

Shift Toward Bioresorbable & Biodegradable Materials

Hospitals and surgeons are increasingly choosing bioresorbable implants over traditional metal implants due to:

- Reduced long-term complications

- No requirement for implant removal

- Better integration with natural bone

Growing awareness of biodegradable solutions is further accelerating market penetration.

Browse Full Report: https://www.factmr.com/report/bioresorbable-orthopedic-scaffolds-market

Increasing Geriatric Population

Global aging trends are boosting the incidence of fractures, joint degeneration, and surgical interventions—driving high demand for advanced orthopedic repair solutions.

Regional Growth Highlights

North America: Strong Adoption of Regenerative Solutions

With advanced healthcare infrastructure, high orthopedic surgery volumes, and rapid adoption of biomaterial technologies, North America remains a leading market.

Europe: Innovation & Clinical Research Strength

Europe’s leadership in biomedical research, supportive reimbursement policies, and strong collaboration between academic institutions and medical device manufacturers drive growth. Germany, the U.K., France, and Switzerland remain key hubs.

East Asia: Expanding Healthcare Investment

China, Japan, and South Korea are experiencing increased surgical volumes and medical technology innovation. Government-led healthcare modernization is supporting strong scaffold adoption.

Emerging Markets: Growing Orthopedic Care Demand

India, Southeast Asia, Latin America, and the Middle East show rising demand due to:

- Expanding healthcare infrastructure

- Higher trauma and fracture rates

- Increasing accessibility to advanced medical devices

Market Segmentation Insights

By Material Type

- Polymers (PLA, PGA, PLGA) – Widely used due to predictable degradation characteristics

- Ceramics (Hydroxyapatite, Calcium Phosphates) – High relevance in bone regeneration

- Composite Materials – Growing adoption for enhanced mechanical strength

By Application

- Bone Regeneration – Largest segment driven by fracture repairs and trauma surgeries

- Cartilage Repair – High growth with sports injury prevalence

- Ligament & Tendon Reconstruction – Increasing use in minimally invasive procedures

- Spinal Fusion & Disc Repair – Advanced biomaterial applications expanding steadily

By End User

- Hospitals & Surgical Centers – Dominant share due to rising orthopedic surgery volumes

- Specialty Orthopedic Clinics – Fastest-growing segment with personalized treatment expansion

Challenges Impacting Market Growth

High Manufacturing Costs

Advanced biomaterials and 3D-printed scaffolds involve expensive production processes, limiting their affordability in cost-sensitive markets.

Strict Regulatory Requirements

Bioresorbable devices must undergo extensive testing for biocompatibility, degradation behavior, and safety, leading to long approval cycles.

Limited Availability of Skilled Professionals

Adoption is restrained in certain regions due to limited expertise in regenerative medicine techniques.

Competitive Landscape

The market is moderately consolidated, with companies focusing on innovative biomaterial development, patient-specific scaffolds, and collaboration with research institutes.

Key Companies Profiled

- Stryker Corporation

- Johnson & Johnson (DePuy Synthes)

- Biomet Inc.

- Smith & Nephew plc

- Medtronic plc

- Evonik Industries

- Regenity Biosciences

- Baxter International

- Collagen Matrix Inc.

These companies invest heavily in:

- 3D-printed scaffolds

- Novel bioresorbable polymers

- Regenerative medicine R&D

- Patient-customized implant solutions

Recent Developments

- 2024: Introduction of next-generation 3D-printed scaffolds for accelerated bone regeneration.

- 2023: Orthopedic device makers expand biodegradable implant portfolios for trauma and sports medicine.

- 2022: Major advances in composite biomaterials improving mechanical performance and controlled degradation.

Future Outlook: A Decade of Regenerative Innovation

From 2025 to 2035, the bioresorbable orthopedic scaffolds market will be shaped by:

- Breakthroughs in tissue engineering & 3D bioprinting

- Rising orthopedic surgical volumes

- Improved biomaterial strength and degradation profiles

- Growing preference for minimally invasive solutions

- Expansion of personalized, patient-specific implants

As healthcare systems shift toward faster healing, reduced complications, and advanced regenerative therapies, the global bioresorbable orthopedic scaffolds market is positioned for robust, long-term growth through 2035