The U.S. market for polymer blends and alloys is poised for steady, value-led growth through 2035 as manufacturers across automotive, packaging, electrical & electronics, consumer goods, and medical devices seek materials that balance performance, cost, and sustainability. Polymer blends and engineered alloys — including polypropylene blends, PC/ABS, TPU blends, ASA/PPO, and specialty alloyed grades — deliver tailored mechanical properties, improved processability, and enhanced end-use performance without the full cost or complexity of specialty engineering polymers. This positions them as a favored solution where cost-effective performance and design flexibility are required.

Demand is being driven by vehicle lightweighting and electrification, higher-performance consumer electronics, growth in flexible and rigid packaging that requires barrier and toughness tradeoffs, and rising expectations for recycled and circular material content. Suppliers that offer certified, application-ready compounds (including post-consumer recyclate blends and flame-retardant or UV-stabilized grades) are well positioned to capture both OEM and contract-manufacturer business.

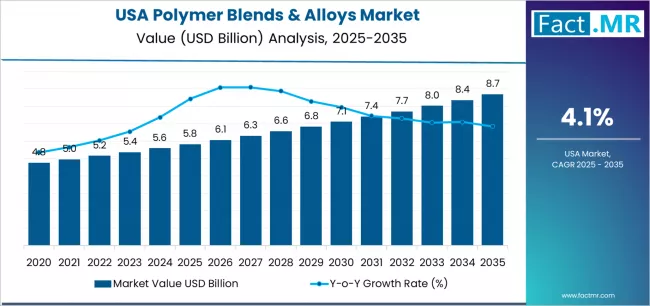

Quick Stats (2025–2035)

-

Market Value 2025 (USA): ≈ USD 6.2 billion (polymer blends & alloys, compounding and pellet volumes).

-

Market Forecast Value 2035 (USA): ≈ USD 9.1 billion.

-

Absolute Growth (2025–2035): ≈ USD 2.9 billion.

-

Forecast CAGR (2025–2035): ≈ 3.8% (value).

-

Leading End-Use (2025): Automotive components & interior/exterior trim.

-

Fastest-Growing End-Use: Electrical & electronics, and recycled-content packaging blends.

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12289

Market Drivers

Automotive Lightweighting & EV Growth

Automakers continue substituting metal components with high-performance polymer blends to reduce vehicle weight and extend EV range. Polymer alloys that offer improved thermal stability, creep resistance, and surface finish are increasingly used for under-hood components, battery housings, and interior structural parts. The rise of electrification also raises demand for blends with enhanced dielectric and thermal-management properties.

Performance Demands in Electronics & Appliances

Consumer electronics and small appliances require materials that combine dimensional stability, glossy aesthetics, and flame retardancy. Engineered blends such as PC/ABS and modified polycarbonate alloys meet these needs at lower cost than pure engineering polymers, driving adoption in housings, bezels, and connectors.

Packaging & Circularity Pressures

Packaging converters are blending recycled polymers with virgin resins to meet sustainability targets while preserving processability and barrier properties. Additive-enabled blends, compatibilized recyclate compounds, and alloyed PE/PP grades enabling higher recycled content are gaining traction as brand owners seek to reconcile performance with circularity.

Cost & Processing Efficiency

Blends and alloys allow formulators to fine-tune melt flow, impact resistance, and cycle time—optimizing parts production on existing injection-molding and extrusion lines. For many manufacturers, blends provide the best compromise between product performance and per-unit cost.

Regulatory & Fire Safety Requirements

Flame-retardant alloys and halogen-free formulations are increasingly specified in consumer, building, and transport applications. Demand for compliant alloy systems that meet UL94, VW/GM/other OEM specs, and regional regulations is rising.

Market Structure & Segment Insights

By Product Type

-

Commodity Blends: PP/PE blends and filled polyethylene compounds dominate volume markets like packaging and consumer goods.

-

Engineering Blends & Alloys: PC/ABS, PA/PEI blends and TPU/alloyed systems command higher value in technical applications.

-

Recyclate-Enhanced Compounds: Compatibilized blends with PCR or PIR content are the fastest-growing subsegment.

By End-Use

-

Automotive: Leading value contributor, especially for exterior trim, bumpers, and non-structural components.

-

Electrical & Electronics: Rapid growth due to miniaturization and thermal-management needs.

-

Packaging: Volume growth driven by flexible and rigid packaging blends enabling recyclability.

-

Construction & Consumer Goods: Stable demand for weatherable, UV-stable alloys in outdoor products and durable goods.

By Channel

Compounders and masterbatch suppliers provide ready-to-use pellets; specialty chemical companies supply compatibilizers and performance additives. Tier-1 OEMs often partner with compounders for custom grades and just-in-time deliveries.

Challenges & Constraints

Feedstock & Resin Price Volatility

Polymer blend margins are sensitive to swings in virgin resin and additive costs. Volatile feedstock pricing can compress compounding margins and challenge pricing for both suppliers and buyers.

Recycled Feedstock Quality & Consistency

Scaling PCR/PIR blends demands consistent recyclate quality. Variability in contaminant levels, molecular weight, and color complicates formulation and quality control, limiting some brands’ willingness to accept high recycled content.

Technical Complexity & Qualification Time

Highly regulated sectors (automotive, medical) require rigorous qualification, long testing cycles, and traceable supply chains—raising entry barriers for new blend formulations.

Sustainability Trade-Offs

Achieving desired performance while meeting eco-claims (e.g., recycled content, recyclability) remains technically challenging; tradeoffs between durability and end-of-life recyclability persist.

Opportunities & Strategic Imperatives

1. Invest in Compatibilizers & Circular Blends

Developing high-performance compatibilizers and formulation expertise enables higher recycled content without sacrificing mechanical or aesthetic properties.

2. Co-Develop Application-Specific Grades with OEMs

Partnerships that accelerate qualification of bespoke alloys for EV battery enclosures, HVAC parts, or medical housings shorten time-to-market and lock in long-term offtake.

3. Scale Local Compounding & Nearshoring

Regional compounding hubs reduce logistics cost, enable faster color/compound customization, and mitigate supply-chain risk for just-in-time manufacturers.

4. Value-Added Services (Kitting, Testing, Sustainability Documentation)

Offering lab testing, PPAP support, and embedded sustainability data (LCA, recycled content certification) strengthens OEM relationships.

Outlook

The U.S. demand for polymer blends and alloys will grow steadily through 2035, supported by automotive electrification, electronics miniaturization, and stronger commercial incentives for recycled-content materials. Value growth will outpace unit growth as technical blends and certified circular compounds command premium pricing. Suppliers that combine formulation innovation, supply-chain resilience, and demonstrable sustainability credentials will capture the strongest share of this evolving market.

Browse Full Report: https://www.factmr.com/report/united-states-polymer-blends-alloys-market