The global cement packaging market is poised for steady expansion through 2035 as construction activity, infrastructure investment, and urbanization continue to drive cement consumption worldwide. Packaging remains a critical part of the cement value chain — protecting product quality, supporting efficient logistics, enabling retail and bulk distribution models, and meeting regulatory and sustainability requirements. From multiwall paper bags for retail and small-scale construction projects to large bulk and flexible intermediate bulk containers (FIBCs) for industrial users, packaging choices directly influence handling costs, storage stability, and supply-chain efficiency.

Manufacturers and packers are increasingly focused on packaging that combines strength, moisture resistance, cost efficiency, and environmental credentials. This balance is shaping innovation across materials (multiwall paper, polypropylene woven sacks, FIBCs), closure systems, liner technologies, and recycling-friendly designs. As demand for both packaged and bulk cement continues to rise across developed and emerging markets, suppliers that can deliver durable, sustainable, and cost-effective packaging solutions will capture the greatest share of growth.

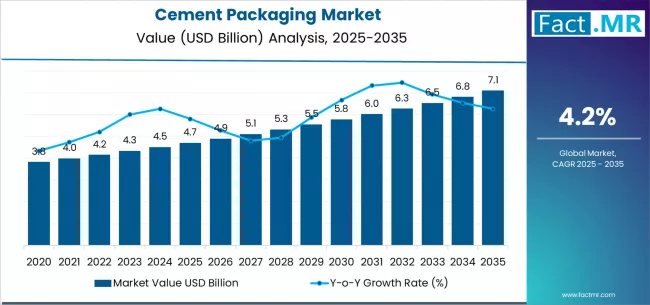

Quick Stats (2025–2035)

-

Market Value 2025: USD 8.2 billion

-

Market Forecast Value 2035: USD 12.5 billion

-

Absolute Growth (2025–2035): USD 4.3 billion

-

Forecast CAGR (2025–2035): 4.3%

-

Leading Packaging Type (2025): Multiwall Paper Bags (≈ 58% share)

-

Leading End-Use (2025): Construction (≈ 72% share)

-

Key Growth Regions: Asia-Pacific, Africa, Latin America

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12276

Market Drivers

Surging Construction and Infrastructure Spending

Large-scale public infrastructure projects, affordable housing programs, and private real estate development are the principal demand drivers for cement — and, by extension, cement packaging. Governments and private players investing in roads, ports, energy, and urban redevelopment increase both bulk and bagged cement consumption, expanding demand for robust packaging solutions that withstand long supply chains and varied storage conditions.

Urbanization and Last-Mile Distribution Needs

Rapid urbanization in emerging markets is increasing small-scale construction and renovation activity, where bagged cement remains essential. Multiwall paper bags and polypropylene sacks facilitate last-mile distribution to retail outlets, small contractors, and individual consumers. Efficient, lightweight, and tear-resistant bags help reduce spillage and waste in dense urban delivery environments.

Shift Toward Bulk & On-Site Handling

For large projects and ready-mix industries, bulk packaging (tankers, silo systems, and FIBCs) is increasingly preferred due to labor cost savings, faster discharge, and reduced packaging waste. This coexistence of bagged and bulk segments creates dual opportunities for packaging suppliers: secure, reusable bulk handling systems for industrial buyers and high-performance single-use bags for retail and small contractors.

Sustainability & Circularity Imperatives

Environmental regulations and corporate sustainability goals are accelerating the adoption of recyclable and lower-carbon packaging. Multiwall paper bags with recyclable liners, post-consumer recycled polymer components, and reusable bulk containers are becoming commercially important. Brands emphasizing recyclable materials and lower lifecycle emissions often gain favor with large cement producers and distributors.

Market Structure & Segment Insights

By Packaging Type

Multiwall paper bags dominate the market due to cost efficiency, adequate barrier characteristics when combined with liners, and widespread infrastructure for filling and handling. Polypropylene woven sacks compete strongly where higher tear resistance or moisture protection is required. Flexible bulk containers and silo systems capture the industrial side, especially in ready-mix and large construction contracts.

By End-Use

Construction remains the largest end-use, accounting for the vast majority of demand for bagged and bulk cement. Precast and ready-mix plants, industrial construction, and public infrastructure projects represent significant bulk consumption, while retail and small contractor segments sustain demand for branded bagged cement.

By Region

Asia-Pacific leads due to high population density, ongoing urbanization, and sustained infrastructure investment. Africa and Latin America are notable growth regions driven by urban expansion and increased public works spending. Developed markets continue to prefer bulk and silo distribution for cost efficiency, though niche high-performance bag applications persist.

Challenges & Risks

Volatile Raw Material Costs

Price fluctuations in paper, polypropylene, and coatings affect packaging manufacturers’ margins. Sudden spikes in input costs can force supply-chain adjustments or price increases that impact end-users.

Logistics & Storage Constraints

Poor transport infrastructure, long lead times, and exposure to humidity can compromise bagged cement quality, increasing returns and waste. Packaging that fails to protect product integrity can undermine brand trust and profitability.

Competition from Bulk Delivery Models

As ready-mix and large construction projects shift to silo and tanker deliveries, the growth rate for bagged packaging may be moderated in specific segments, pushing suppliers to diversify into bulk-compatible solutions.

Future Outlook

The cement packaging market is forecast to grow from roughly USD 8.2 billion in 2025 to approximately USD 12.5 billion by 2035, reflecting a healthy CAGR of about 4.3%. Long-term opportunities favor suppliers that combine durability with sustainability—paper-based solutions with recyclable liners, robust woven sacks, and reusable bulk systems. Investments in digital traceability, automation at filling lines, and lightweight yet strong materials will help reduce total cost of ownership for cement producers and distributors.

Manufacturers who offer integrated solutions—packaging plus filling, logistics support, and recycling programs—will be best positioned to capture the shifting needs of a construction market that values performance, cost efficiency, and environmental responsibility. As urbanization and infrastructure programs continue to expand globally, the cement packaging market will remain an essential enabler of construction productivity and supply-chain resilience.

Browse Full Report: https://www.factmr.com/report/cement-packaging-market