The global Hand Truck & Dolly Market is on track for robust expansion over the next decade, underpinned by rising demand across warehousing, logistics, e-commerce fulfillment, retail distribution, manufacturing, and construction sectors. As companies and warehouses increasingly prioritize efficient, ergonomic, and safe material handling solutions, hand trucks and dollies remain indispensable — bridging the gap between manual labour and fully mechanized systems.

Quick Stats (2025–2035)

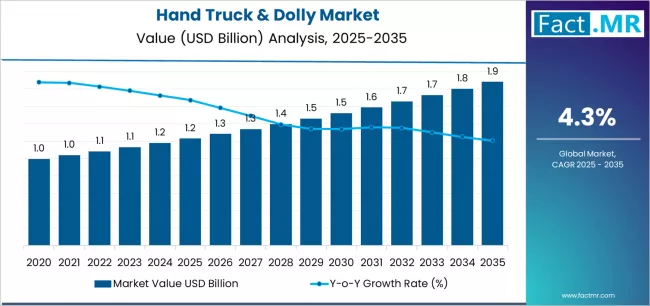

Market Value 2025: USD 1.23 billion

Forecast Value 2035: USD 1.88 billion

Absolute Growth (2025–2035): USD 0.65 billion

Forecast CAGR (2025–2035): 4.3%

Leading Product Type (2025): Hand Trucks (≈ 68.8% share)

Leading Material Segment (2025): Steel (≈ 51.4% share)

Key Growth Regions: Asia-Pacific, North America, Europe

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12258

Key Market Drivers

• Surge in E-commerce, Logistics & Warehouse Expansion

The rising volume of online commerce globally has significantly driven the need for efficient last-mile and warehouse handling equipment. Distribution centers, fulfillment hubs, and retail warehouses rely heavily on manual material handling devices like hand trucks and dollies to move parcels, cartons, appliances, and inventory — especially where automation is either impractical or cost-inefficient. This continuing growth in e-commerce and omnichannel retail underpins consistent demand for durable, reliable hand trucks and dollies.

• Versatility Across Industries: Retail, Manufacturing, Construction, Residential

Beyond warehousing and logistics, hand trucks and dollies find applications across manufacturing plants, construction sites, retail stores, food and beverage industries, hospitality, and even residential moving services. Their adaptability for vertical lifting (two-wheel hand trucks) and horizontal load transport (platform dollies) makes them valuable for many use-cases including moving heavy goods, appliances, building materials, and bulk items.

• Growing Focus on Ergonomics and Workplace Safety

Employers and warehouse operators are increasingly conscious about worker safety, reduction of manual strain, and compliance with ergonomic standards. Modern hand trucks with ergonomic designs, improved handling, stair-climbing capabilities, and load stability features help reduce workplace injuries and fatigue — making them a sensible choice for both traditional warehouses and modern fulfillment centres.

• Demand for Cost-Effective, Low-Tech Solutions vs High-Cost Automation

While automation and powered material-handling systems are growing, many small- and medium-scale operations (especially in emerging markets) still prefer cost-effective manual handling equipment due to lower capital expenditure, minimal maintenance, and simplicity. Hand trucks and dollies deliver value where flexibility, low cost, and ease-of-use need to coexist — sustaining their demand across diverse geographies.

Market Structure & Segment Insights

By Product Type

The hand trucks segment dominates with roughly 68.8% market share in 2025, driven by their versatility in vertical loads, stair navigation, and heavy-item transport. Meanwhile, the dolly (platform/flat-bed four-wheel) segment — though smaller — remains important for moving bulky, heavy, or awkwardly shaped items such as appliances, furniture, or crates, particularly in retail, manufacturing, and home-moving scenarios.

By Material

In 2025, steel-based hand trucks and dollies lead with about 51.4% market share, thanks to their structural strength, load-bearing capacity, durability, and suitability for heavy-duty and industrial applications. Aluminum follows as a lighter alternative — preferred in contexts where portability and frequent mobility matter (e.g. delivery services, residential moving, smaller warehouses). Plastics and lighter composite materials serve niche, light-duty segments.

By End-Use Application

The retail & e-commerce segment accounts for the largest share (≈ 42.3% in 2025) of market demand — reflecting mega-trends in online shopping, distribution center expansion, and need for efficient merchandise handling in fulfillment/delivery workflows. Manufacturing and industrial facilities also contribute meaningfully (≈ 24.7%), requiring equipment for inter-department transport, raw material movement, and internal logistics. Construction, food & beverage, residential/home-use, and other industry verticals make up the remainder.

Regional Trends & Growth Markets

Growth is particularly strong in Asia-Pacific, driven by rapid expansion of warehousing, logistics infrastructure, booming e-commerce, and rising manufacturing activity. Other established markets — including North America and Europe — continue to see steady adoption due to sustained retail, manufacturing, and distribution operations.

Specifically, countries like India are projected to grow at a faster pace (higher-than-average CAGR) through 2035, fueled by expanding logistics networks, warehouse construction, and e-commerce penetration — offering significant opportunities for material-handling equipment suppliers.

Market Challenges & Restraints

• Volatile Raw Material Costs (e.g., Steel)

Since steel remains the dominant material for heavy-duty hand trucks and dollies, fluctuations in steel prices and raw-material supply chain instability can affect manufacturing costs, pricing strategies, and profitability. This volatility may constrain market growth or force manufacturers to explore alternative materials, potentially increasing costs.

• Competition from Powered & Automated Material-Handling Equipment

With increasing adoption of powered pallet jacks, automated guided vehicles (AGVs), conveyors, and robotics in advanced warehouses and distribution centers, manual hand trucks and dollies may face declining demand in highly automated settings — especially for heavy or repetitive tasks. This shift could erode part of the addressable market.

• Market Fragmentation, Low Differentiation & Standardisation Difficulties

Many hand truck/dolly offerings remain functionally similar, limiting differentiation. For larger buyers, this may lead to price-based competition rather than value-based differentiation. Additionally, standardized specifications for durability, ergonomics, and safety vary across regions — complicating design, manufacturing, and global distribution strategies.

• Limited Adoption Among Small Operators in Developing Regions

Smaller businesses or informal sectors in developing countries may find even manually operated hand trucks expensive to procure or maintain, particularly when specialized or heavy-duty models are required. In regions with limited infrastructure for maintenance or replacement, equipment downtime or breakage can deter investment.

Future Outlook & Strategic Implications

Looking ahead to 2035, the Hand Truck & Dolly Market is well-positioned for sustained growth. With an expected rise from USD 1.23 billion in 2025 to USD 1.88 billion by 2035 — nearly a 1.5× increase — the market reflects structural shifts in warehousing, logistics, manufacturing, retail, and e-commerce globally.

Manufacturers and suppliers who invest in innovative, ergonomic, lightweight, and application-specific designs — such as foldable hand trucks, stair-climbing models, convertible hand trucks, heavy-duty platform dollies, and lightweight aluminum or composite equipment — will be best placed to capture demand across a range of use cases.

Furthermore, growth in emerging markets — particularly in Asia-Pacific countries undergoing rapid industrialization and e-commerce expansion — suggests a geographic rebalancing of demand away from traditional strongholds like North America and Europe toward high-growth regions.

Meanwhile, organizations and industry bodies promoting equipment safety standards, ergonomic guidelines, and performance certifications can help accelerate adoption — especially among mid-sized and small enterprises — by building trust in equipment reliability, reducing workplace injuries, and enabling cost-effective material handling.

In conclusion, as companies globally continue to expand warehouse operations, logistics footprints, retail networks, and manufacturing capacities, demand for manual material handling tools — especially versatile, durable, and ergonomically designed hand trucks and dollies — will remain strong. The Hand Truck & Dolly Market is set to deliver stable, sustained growth over the coming decade, offering attractive opportunities for innovators, suppliers, and industrial operators.

Browse Full Report: https://www.factmr.com/report/hand-truck-dolly-market