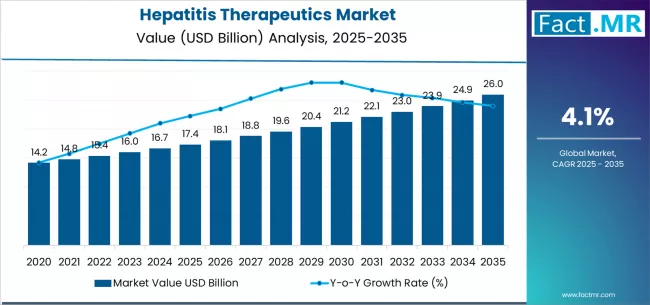

The global hepatitis therapeutics market is poised for steady growth, expanding from USD 17.36 billion in 2025 to USD 25.95 billion by 2035, an increase of approximately USD 8.59 billion and a compound annual growth rate of 4.1%. This steady trajectory is propelled by ongoing screening programs, wider access to antiviral therapies, sustained public-health initiatives aimed at viral hepatitis elimination, and continued investment in novel drugs and treatment regimens for hepatitis C and hepatitis B. Improved diagnostics, better linkage to care, and greater awareness of long-term consequences of untreated hepatitis are also expanding the addressable treatment population.

Quick Stats

-

Market Value (2025): USD 17.36 billion

-

Forecast Market Value (2035): USD 25.95 billion

-

Forecast CAGR (2025–2035): 4.1%

-

Leading Disease Segment (2025): Hepatitis C (~83.6% share)

-

Key Growth Regions: North America, Europe, Asia Pacific

-

Market Drivers: Direct-acting antivirals (DAAs), screening programs, expanding healthcare access

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12075

Market Overview

The hepatitis therapeutics market comprises treatments for viral hepatitis—primarily hepatitis C (HCV) and hepatitis B (HBV)—ranging from curative direct-acting antivirals for HCV to long-term suppressive therapies for HBV. HCV dominates the market because highly effective pan-genotypic therapies can achieve viral cure in the majority of treated patients. HBV remains a substantial segment due to the chronic nature of infection, ongoing need for viral suppression in many patients, and continued prevalence in endemic regions.

Distribution and delivery channels are typically specialty pharmacy networks and hospital systems, where patient management, monitoring, and adherence support are coordinated alongside antiviral regimens. Pricing dynamics vary widely by region due to generic penetration, government procurement, and reimbursement policies.

Key Growth Drivers

1. Expanded Screening and Diagnosis

Enhanced public-health screening and targeted case-finding initiatives are identifying previously undiagnosed hepatitis cases. Increased diagnosis naturally expands the pool of patients eligible for therapeutic intervention, particularly for HCV where cure is achievable.

2. Therapeutic Advances

The introduction and adoption of direct-acting antivirals have reshaped HCV treatment, delivering high cure rates with short, well-tolerated oral regimens. For HBV, advances in long-acting suppressive agents and ongoing research into functional cures sustain demand for improved therapeutics.

3. Policy & Public-Health Programs

National elimination targets and global health programs focusing on viral hepatitis have prioritized investment in diagnosis, treatment access, and awareness—boosting uptake of therapies, especially in regions with high disease burden.

4. Greater Access & Affordability

Generic manufacturing, tiered pricing, and expanded procurement in low- and middle-income countries have improved affordability and treatment volumes. As more countries adopt large-scale treatment programs, volumes rise even where per-patient prices are lower.

Challenges & Restraints

-

Generic Competition: Patent expirations and generic entrants exert price pressure on branded therapies, affecting revenue even as volumes increase.

-

Shrinking Treatment-Eligible Pools: In regions with high treatment uptake, the pool of untreated HCV patients may shrink, limiting long-term growth unless new infections or improved case-finding occur.

-

Chronic Management for HBV: HBV often requires long-term therapy rather than finite cures, necessitating sustained adherence, monitoring, and payer support.

-

Access Gaps: Stigma, underdiagnosis, and limited specialist care in some regions hinder timely treatment initiation.

-

Regulatory & Reimbursement Barriers: Differences in national regulatory approvals and reimbursement frameworks continue to affect market penetration and speed of uptake.

Market Segmentation & Revenue Dynamics

Current Revenue Mix: HCV therapeutics represent the majority of market revenue due to curative DAAs and widespread treatment programs. Hospital and specialty pharmacy channels account for a large share of distribution. HBV therapies contribute a steady share driven by chronic disease management needs.

Future Revenue Trends: Expect continued volume growth in emerging markets due to expanded screening and generic availability, partially offset by pricing erosion for older therapies. Innovative therapies offering improved durability, simplified dosing, or functional cure potential for HBV could introduce new high-value segments. Additionally, services such as diagnostics, adherence support, and population-level treatment programs will underpin broader market activity.

Outlook (2025–2035)

Over the next decade, the hepatitis therapeutics market will mature: HCV treatment volumes will remain strong in regions with active diagnosis and treatment programs, while HBV therapies will sustain steady demand for chronic management. Market growth will be shaped by the balance between wider access (volume expansion) and pricing pressures (margin compression). Innovation—particularly any advances toward HBV functional cure—would materially change the market landscape and create new revenue opportunities.

Overall, improved diagnostics, public-health prioritization, and continued therapeutic innovation position the hepatitis therapeutics market for sustained, moderate growth through 2035, with meaningful public-health gains as treatment access improves globally.

Browse Full Report: https://www.factmr.com/report/hepatitis-therapeutics-market