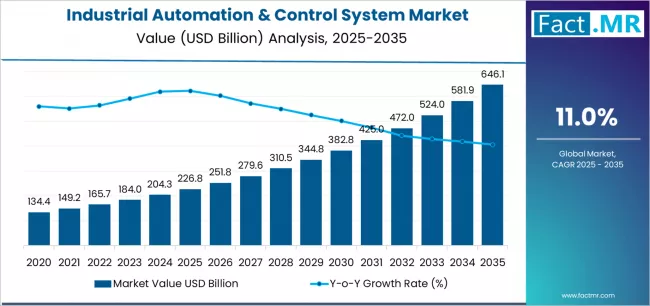

The global Industrial Automation & Control Systems market is on a steep growth path, projected to expand from USD 226.8 billion in 2025 to USD 646.1 billion by 2035, adding USD 419.3 billion in new revenue and advancing at a robust CAGR of 11.0%. This rapid growth reflects escalating demand for advanced automation solutions, expanding industrial digitization worldwide, and surging adoption of smart factory and Industry 4.0 initiatives across both developed and emerging markets. As manufacturers and process industries strive for higher operational efficiency, productivity, and cost optimization, industrial automation systems are becoming core infrastructure — from discrete manufacturing floors to continuous process plants.

Quick Stats for IACS Market

-

Market Value (2025): USD 226.8 billion

-

Forecast Market Value (2035): USD 646.1 billion

-

Forecast CAGR (2025–2035): 11.0%

-

Leading Component (2025): Industrial Robots — 32.5% share

-

Leading Control System Segment (2025): Distributed Control Systems (DCS) — 38.4% share

-

Key Growth Regions: Asia Pacific, North America, Europe

-

Top Players: Siemens AG, ABB Ltd., Emerson Electric Co., Honeywell International Inc., Kawasaki Heavy Industries Ltd., Mitsubishi Electric Corporation, OMRON Corporation, Rockwell Automation Inc., Schneider Electric, Yokogawa Electric Corporation

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12111

Market Overview

The IACS market spans residential, commercial, and industrial sectors, including manufacturing facilities, oil & gas plants, chemical processing units, power utilities, and large infrastructure projects. Key segments include industrial robots, control systems (DCS, SCADA, PLC), and smart factory solutions. IoT and AI-driven systems support predictive maintenance, energy optimization, real-time monitoring, and automated decision-making.

Industrial robots dominate the component segment, accounting for 32.5% of the market in 2025, and are widely used for material handling, welding, assembly, painting, and repetitive or hazardous tasks. Distributed Control Systems (DCS) hold 38.4% of the control system segment, highlighting their importance in process-heavy industries for monitoring and controlling complex operations.

Key Growth Drivers

1. Industrial Digitization & Industry 4.0 Adoption

The shift toward smart factories, IIoT-enabled devices, edge computing, and AI-based predictive maintenance is driving strong demand for integrated automation solutions. Companies increasingly adopt these technologies to enhance efficiency, improve product quality, reduce operational costs, and minimize manual labor.

2. Labor Optimization & Safety

Rising labor costs and the scarcity of skilled workers encourage automation to handle repetitive, dangerous, or high-precision tasks. Robotics and automated control systems improve safety, reduce human error, and enable higher throughput without compromising quality.

3. Wide Industrial Applications

The IACS market serves diverse sectors including discrete manufacturing, automotive, energy & utilities, oil & gas, food & beverage, chemicals, mining, and transport. This broad applicability ensures resilience against cyclical downturns in specific industries and provides multiple avenues for growth.

4. Regional Expansion

Asia Pacific, North America, and Europe are key growth regions. Asia Pacific is emerging as the largest growth hub, driven by rapid industrialization, modernization of manufacturing facilities, and increasing acceptance of advanced automation technologies in countries like China, India, and South Korea.

Challenges

Despite robust growth, the market faces challenges:

-

High upfront costs for automation infrastructure and robotics.

-

Integration complexities between legacy systems and modern smart platforms.

-

Requirement for skilled workforce to operate, maintain, and program advanced systems.

-

Cybersecurity risks in networked and IoT-enabled automation environments.

-

Regulatory compliance in industries like oil & gas, chemicals, and utilities.

Manufacturers and integrators are addressing these challenges through modular product designs, service-based offerings, and specialized training programs.

Where Revenue Comes From — Now vs Next

Current Revenue Mix (“Now”):

-

Equipment Sales (55%) – Core revenue from robotics, controllers, and automation hardware.

-

Service & Maintenance (18%) – Recurring revenue via preventive maintenance and repair contracts.

-

Installation & Commissioning (15%) – One-time revenue from system setup.

-

Controls & Retrofits (7%) – Upgrades and additional control modules.

-

Software & Consumables (5%) – Licensing, sensors, and consumables for automation systems.

Future Revenue Mix (“Next”):

-

Integrated Solutions & Smart Systems (40%) – Bundled hardware with software, analytics, and IAQ/sustainability controls.

-

Service + SaaS (30%) – Subscription-based predictive maintenance, AI-driven optimization, and monitoring.

-

Retrofit & Efficiency Upgrades (15%) – Large-scale plant modernization and process automation projects.

-

IoT Platforms & Advanced Controls (10%) – Industrial software, connectivity modules, and digital twins.

-

Consulting & Financing Solutions (5%) – Energy optimization, decarbonization advisory, and managed services.

This evolution reflects the industry’s shift from hardware-centric sales toward service-led, software-driven, recurring revenue streams.

Market Outlook

By 2035, the Industrial Automation & Control Systems market is poised to more than double in value, driven by smart factory adoption, process optimization, robotics integration, and widespread digitization. The next decade will see greater emphasis on software solutions, predictive maintenance, IoT integration, and energy-efficient automation, positioning the IACS market as a cornerstone of modern industrial operations. For manufacturers, investors, and end-users, embracing automation promises enhanced productivity, safety, and long-term competitiveness.

Browse Full Report: https://www.factmr.com/report/industrial-automation-control-systems-market