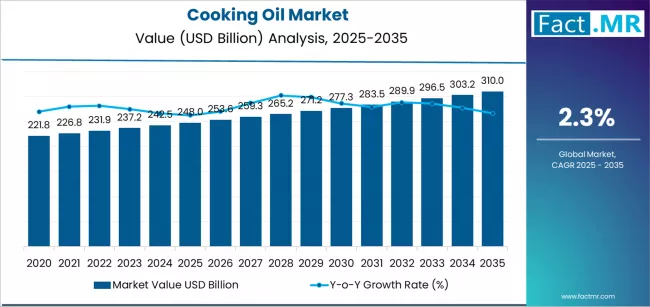

The global cooking oil market is on a stable growth trajectory, underpinned by evolving dietary preferences, expanding foodservice operations, and the global shift toward healthier and sustainable edible oil options. According to a recent report by Fact.MR, the market is projected to increase from USD 248.0 billion in 2025 to approximately USD 310.0 billion by 2035, marking an absolute growth of USD 62.0 billion over the decade. This reflects a CAGR of 2.3% during the forecast period.

As consumers and industries alike emphasize nutritional value, sustainability, and product traceability, cooking oil manufacturers are innovating across supply chains — from seed cultivation to refining and packaging — to meet changing global demand.

Strategic Market Drivers

- Health and Wellness-Oriented Consumption:

Growing consumer awareness of trans fats, cholesterol, and cardiovascular health has accelerated the demand for healthier oils such as canola, olive, sunflower, and rice bran oils. Producers are fortifying oils with omega-3 fatty acids, vitamins, and antioxidants to appeal to health-conscious consumers. - Expanding Foodservice and Packaged Food Sector:

The rapid expansion of the foodservice and convenience food industry—particularly in Asia-Pacific and Latin America—is driving large-scale consumption of refined vegetable oils. The use of cooking oils in snacks, frozen foods, and ready-to-eat meals continues to increase in both commercial and household applications. - Shift Toward Sustainable and Traceable Production:

Rising environmental and ethical concerns are fostering the use of sustainably sourced palm, soybean, and sunflower oils. Companies are adopting RSPO (Roundtable on Sustainable Palm Oil) certifications and implementing blockchain-based traceability systems to ensure transparent supply chains. - Biofuel Integration and Circular Economy Models:

The growing use of used cooking oil (UCO) in biodiesel production is creating new revenue streams, particularly in Europe and North America. This trend aligns with global decarbonization goals and promotes a circular economy in the edible oil sector.

Browse Full Report: https://www.factmr.com/report/670/cooking-oil-market

Regional Growth Highlights

Asia-Pacific: The Global Epicenter of Demand

Asia-Pacific dominates the global cooking oil market, led by India, China, Indonesia, and Malaysia, which collectively account for the majority of global consumption and production. Expanding middle-class populations, increasing disposable incomes, and rapid urbanization continue to boost demand for branded, packaged edible oils.

North America: Focus on Functional and Organic Oils

In the U.S. and Canada, the market is shifting toward cold-pressed, non-GMO, and organic oils. Consumer preference for olive, avocado, and coconut oils is reshaping the retail landscape, while leading brands are investing in plant-based innovation and eco-friendly packaging.

Europe: Sustainability-Driven Market Evolution

Europe’s cooking oil market is governed by stringent sustainability regulations and a strong push toward carbon-neutral production. Countries like Germany, Italy, and France are witnessing rising adoption of premium and organic oils, coupled with industry efforts to reduce plastic waste in packaging.

Emerging Economies: Rising Household Penetration

Regions such as Latin America, the Middle East, and Africa are experiencing a steady rise in per capita oil consumption, supported by dietary diversification, local processing facilities, and improving retail infrastructure.

Market Segmentation Insights

By Type

- Palm Oil: Dominant segment, particularly in Asia and Africa due to high yield and cost efficiency.

- Soybean Oil: Widely used across the foodservice and processed food industry.

- Sunflower and Canola Oil: Preferred for health benefits and light flavor profile.

- Olive Oil: Premium segment driven by Mediterranean and global health trends.

- Coconut and Rice Bran Oil: Gaining traction for functional and nutritional attributes.

By End Use

- Household Consumption: Sustained growth with the rise in packaged and branded oil sales.

- Food Processing Industry: Major driver, utilizing oils for frying, baking, and product formulation.

- Foodservice Sector: Expanding demand from restaurants, hotels, and QSR chains.

- Biofuel and Industrial Applications: Emerging segment using refined and waste oils for biodiesel.

Challenges and Market Considerations

- Volatile Commodity Prices: Fluctuations in palm, soybean, and sunflower oil prices affect cost structures.

- Sustainability Compliance: Pressure to reduce deforestation and adopt traceable sourcing practices.

- Health and Regulatory Constraints: Increasing restrictions on trans fats and saturated oils in several countries.

- Supply Chain Vulnerability: Geopolitical tensions and climatic variations impacting raw material availability.

Competitive Landscape

The cooking oil market is moderately consolidated, with major players focusing on sustainable sourcing, product diversification, and regional expansion. Innovation in refining, fortification, and eco-friendly packaging remains central to competitive differentiation.

Key Players in the Cooking Oil Market:

- Wilmar International

- Bunge Limited

- Cargill, Incorporated

- Archer Daniels Midland (ADM)

- COFCO Corporation

- Sime Darby Plantation

- Ruchi Soya Industries

- Marico Limited

- Savola Group

- Golden Agri-Resources

Recent Developments

- 2024: Wilmar International expanded its sustainable palm oil refining capacity in Indonesia to meet growing regional demand.

- 2023: ADM and Marico launched fortified edible oils with added vitamins and antioxidants targeting the Indian and Southeast Asian markets.

- 2022: Cargill introduced blockchain-enabled traceability for soybean oil supply chains in Latin America.

Future Outlook: Health, Traceability, and Circular Value Chains

The cooking oil industry is entering a new era defined by health-focused innovation, ethical sourcing, and digital transformation. With rising demand for fortified and low-saturated-fat oils, manufacturers are increasingly investing in biotechnology, cold-press extraction, and AI-driven supply optimization.

As consumers demand greater transparency and sustainability, companies that align with evolving health trends, invest in traceable value chains, and innovate across product categories will shape the future of the global cooking oil market — one that balances nutrition, efficiency, and environmental responsibility.