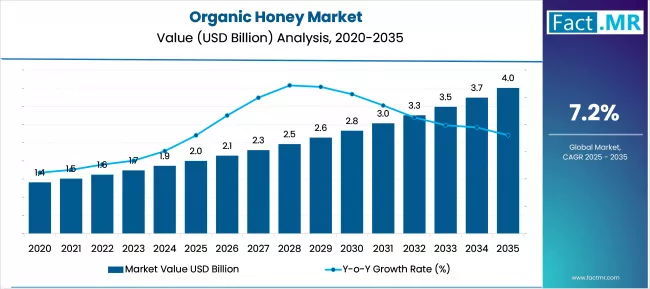

The global organic honey market is poised for robust growth, fueled by increasing consumer preference for natural, chemical-free alternatives to processed sugars. According to a recent report by Fact.MR, the market is projected to rise from USD 2 billion in 2025 to USD 4 billion by 2035, reflecting a CAGR of 7.2% during the forecast period.

As health-conscious consumers embrace organic diets, organic honey has emerged as a preferred natural sweetener and functional food ingredient, offering nutritional benefits, purity, and versatility in culinary and wellness applications.

Strategic Market Drivers:

Rising Health and Wellness Trends: Growing awareness of the health impacts of refined sugars has led consumers to shift toward natural and organic alternatives. Organic honey is widely recognized for its antioxidant properties, immunity-boosting benefits, and role in digestive health, driving widespread adoption across households and the foodservice industry.

Expanding Organic Food and Beverage Industry: The proliferation of organic product offerings in retail, grocery, and online channels has accelerated the consumption of organic honey. Increasing integration in functional beverages, bakery products, and nutraceutical formulations is creating new growth avenues for manufacturers.

Premiumization and Flavor Innovation: Consumers are seeking unique honey varieties, such as raw, single-origin, and specialty-infused options. Flavor innovation and product differentiation enhance market appeal, especially among millennials and urban households willing to pay a premium for quality and authenticity.

Browse Full Report: https://www.factmr.com/report/357/organic-honey-market

Regional Growth Highlights:

North America: Health-Conscious Consumption Leads Growth

The U.S. and Canada are witnessing strong demand for certified organic honey, supported by stringent food labeling regulations and rising preference for sustainable, locally sourced products. Organic honey is increasingly incorporated into functional foods and beverages, enhancing its market penetration.

Europe: Regulatory Compliance and Sustainability Drive Adoption

Germany, France, and the U.K. are at the forefront of Europe’s organic honey market, supported by high consumer awareness, strict organic certification standards, and growing interest in natural sweeteners. The market is expanding across food manufacturing, retail, and wellness sectors.

Asia-Pacific: Emerging Middle-Class and Urbanization

Rapid urbanization and rising disposable incomes in countries such as India, China, and Japan are driving demand for premium and authentic organic honey products. E-commerce and modern retail channels further facilitate market accessibility.

Emerging Markets: Latin America and the Middle East are gaining traction as consumers increasingly adopt natural and organic diets. Government-backed agricultural initiatives and honey-focused cooperatives are expected to bolster supply and demand in these regions.

Market Segmentation Insights:

By Product Type

- Raw Organic Honey – Retains natural enzymes and nutrients, favored for direct consumption.

- Flavored & Infused Organic Honey – Gaining popularity for culinary and gourmet applications.

- Liquid vs. Creamed Honey – Diverse formats enhance convenience and market reach.

By End Use Industry

- Food & Beverages – Largest segment driven by bakery, confectionery, and beverage applications.

- Health & Wellness – Functional foods, supplements, and natural remedies.

- Retail & E-Commerce – Expanding sales through supermarkets, specialty stores, and online platforms.

Challenges and Market Considerations:

- Price Sensitivity – Organic honey commands a premium, limiting adoption in cost-sensitive markets.

- Certification Complexity – Strict organic labeling and compliance requirements can pose barriers for small-scale producers.

- Supply Constraints – Seasonal fluctuations and dependency on natural bee populations may impact production.

Competitive Landscape:

The global organic honey market is highly competitive, with key players emphasizing product innovation, sustainability, and geographic expansion. Companies are investing in certified organic sourcing, eco-friendly packaging, and premium product lines to differentiate themselves.

Key Players Profiled:

- Barkman Honey LLC

- Wedderspoon Organic Holdings, L.P.

- Heavenly Organics, LLC

- North Dallas Honey Company L.P.

- Y.S. Eco Bee Farms

- Dabur

- Comvita

- Patanjali Ayurved

- New Zealand Honey Co.

- Wholesome Sweeteners Inc

- Madhava Honey Ltd

- Little Bee Impex

- Glorybee Inc.

Recent Developments:

- January 2024: Dabur India Ltd. announced an investment of approximately USD 0.16 billion to establish a new manufacturing plant in South India, producing a variety of honey products, including Dabur Honey.

- May 2024: Rowse Honey relaunched its limited-edition ‘Hot Honey,’ exclusively available at Waitrose in-store and online. The spicy-sweet fusion offers a bold flavor twist for heat-loving consumers, reinforcing brand innovation and market engagement.

Future Outlook: Toward Sustainable and Premium Honey Solutions

The coming decade will witness growth driven by sustainability, product innovation, and increasing consumer preference for natural, high-quality sweeteners. Companies that prioritize authenticity, eco-friendly production, and strategic regional expansion are set to lead the organic honey market—delivering wholesome, flavorful, and health-promoting honey products to a global audience.