Introduction:

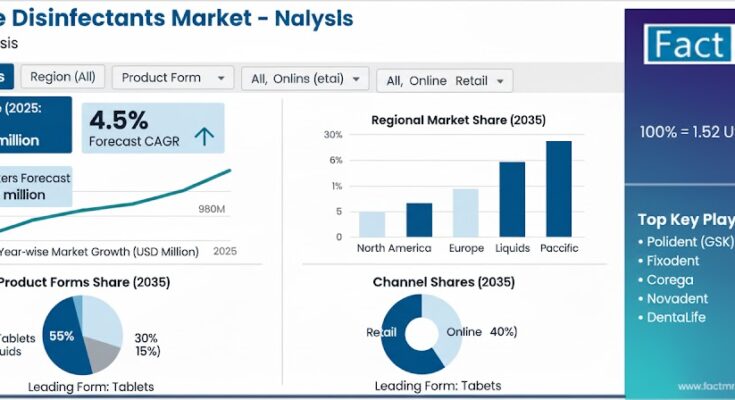

The global denture disinfectants market is entering a phase of significant expansion, driven by the growing importance of oral hygiene and specialized dental care. Valued at USD 980.0 million in 2025, the market is projected to reach USD 1,520.0 million by 2035, registering a CAGR of 4.5%. Increasing consumer awareness, combined with the rise of the elderly population and modernized healthcare distribution networks, is fueling demand for advanced, convenient, and effective denture cleaning solutions. Retail pharmacies, online channels, and healthcare facilities are expected to play a pivotal role in the widespread adoption of denture disinfectants over the coming decade.

Market Analysis & Trends:

Between 2025 and 2030, the market is projected to expand from USD 980.0 million to USD 1,210.0 million, contributing USD 230.0 million (43% of total forecast growth). This phase will be defined by the adoption of tablet-based disinfectants, which offer superior convenience and cleaning efficiency for elderly consumers. From 2030 to 2035, growth will continue from USD 1,210.0 million to USD 1,520.0 million, adding USD 310.0 million (57% of total growth). The latter phase will emphasize integration with healthcare platforms, mass-market penetration, and seamless pharmacy distribution.

Key growth drivers include:

-

Aging population: Increased prevalence of denture usage requires convenient, effective oral care solutions.

-

Pharmacy modernization: Retailers and healthcare providers are adopting advanced products compatible with existing distribution systems.

-

Rising oral hygiene awareness: Health-conscious consumers demand efficient cleaning solutions that reduce bacterial contamination and maintain oral health.

Challenges to market growth include variations in product differentiation among suppliers, price sensitivity in emerging markets, and technical limitations affecting cleaning performance in complex oral care environments.

Competitive Landscape / Key Players:

The global denture disinfectants market exhibits moderate concentration, with top companies controlling approximately 42–47% of the global market share. Leading participants include:

-

Polident (GSK) – ~14% global share, offering premium tablet and liquid products.

-

Fixodent (GSK/Haleon) – strong distribution and integrated healthcare solutions.

-

Corega (GSK/Haleon) – emphasis on tablet formulations with superior cleaning features.

Other notable players include Novadent, DentaLife, Secure, Prestige Brands, Colgate-Palmolive, Dental Herb Company, and Dentsply Sirona. Competition is primarily driven by formulation innovation, precision cleaning, operational reliability, and integration with healthcare and pharmacy systems rather than price.

Future Outlook:

The denture disinfectants market is expected to mature technologically and geographically over the next decade. Key opportunities include:

-

Tablet dominance (54% market share): Enhanced convenience, dissolution consistency, and automated packaging systems.

-

North American expansion: Localized distribution and partnerships aligned with growing geriatric care needs.

-

Retail pharmacy focus (52% market share): Optimized accessibility and quality compliance.

-

Online channel growth (28% market share): Direct-to-consumer sales with specialized packaging and distribution efficiency.

-

Daily use innovation (61% market share): Routine-optimized formulations offering convenience and reliability.

-

Liquid product development (31% market share): Specialized clinical applications requiring immediate cleaning performance.

-

Sustainable formulation practices: Eco-friendly products that meet regulatory compliance and consumer environmental expectations.

Regional Insights:

-

North America leads adoption with a 4.8% CAGR, supported by pharmacy modernization, healthcare innovations, and geriatric care initiatives.

-

Europe shows steady expansion at 4.0–4.5% CAGR, driven by Germany, France, and the UK, emphasizing pharmacy infrastructure and oral care standardization.

-

Asia-Pacific demonstrates moderate growth, with Japan and South Korea prioritizing tablet systems for precision cleaning and operational reliability.

-

Emerging markets, including Mexico, are experiencing accelerated adoption (4.5% CAGR) due to healthcare modernization and oral care awareness programs.

Application & Channel Insights:

Tablet formulations dominate the market, offering 54% share due to convenience, consistency, and hygiene optimization. Liquid products account for 31% of market value, favored for immediate-use and clinical applications. Retail pharmacies capture 52% of the distribution market, emphasizing accessibility, operational reliability, and integration with healthcare standards. Online channels account for 28% of the market, supporting e-commerce and direct-to-consumer strategies. Hospitals and clinical settings represent 20% of applications, reflecting demand for professional-grade oral care solutions.

Browse Full Report : https://www.factmr.com/report/1110/denture-disinfectants-market

As denture disinfectants evolve from basic cleaning agents to sophisticated oral care solutions, manufacturers, investors, and dental healthcare providers have a unique opportunity to capitalize on market growth. Companies focusing on tablet and liquid innovation, efficient distribution channels, sustainability, and compliance with healthcare standards are well-positioned to capture significant market share.

The projected growth from USD 980.0 million in 2025 to USD 1,520.0 million by 2035 signals robust, sustained demand. Stakeholders can leverage trends in formulation technology, pharmacy modernization, and e-commerce integration to deliver high-performance, convenient, and environmentally responsible denture disinfectants that meet global oral care needs.