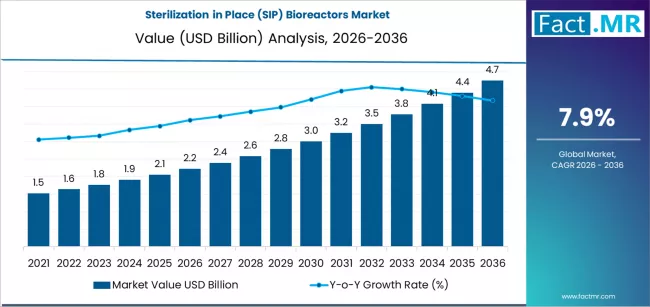

The global Sterilization in Place (SIP) Bioreactors Market is poised for robust expansion over the next decade, presenting transformative opportunities for biopharma manufacturers, process innovators, automation technology providers, CDMOs, and strategic investors. The SIP bioreactors market is projected to grow from USD 2.22 billion in 2026 to USD 4.75 billion by 2036, representing a strong CAGR of 7.9% over the forecast period.

Market Growth Driven by Aseptic Processing Imperatives

This anticipated growth is anchored in the biopharmaceutical industry’s ongoing drive to enhance aseptic production standards, minimize contamination risk, and support global scale-up of biologics, vaccines, and advanced therapies. SIP bioreactors, which enable automated sterilization without manual intervention between batches, are increasingly indispensable as manufacturers seek higher throughput and regulatory compliance in GMP environments.

Key Market Highlights

-

Market Size & Forecast: USD 2.22 billion in 2026 → USD 4.75 billion by 2036 at 7.9% CAGR.

-

Top Product Segment: Stainless steel SIP bioreactor systems — commanding 28.5% share in 2026 due to their critical role in high-volume commercial production.

-

Top Application Segment: Monoclonal antibody (mAb) manufacturing — leading with 24.7% market share as mAbs remain central to biologic therapeutics.

-

Major End User: Large biopharma manufacturers — holding 26.6% share, reflecting capacity expansion and modernization initiatives.

-

High-Growth Regions: India (10.7% CAGR), Brazil (10.3%), China (9.8%) — showcasing rapid biomanufacturing growth trajectories.

Segment Analysis: What’s Fueling Growth?

1. Product Innovation: Robust Stainless Steel & Automation Integration

Stainless steel SIP bioreactors remain the backbone of large-scale biologics manufacturing due to their durability, integration with clean-in-place (CIP) and steam infrastructure, and economic value for multi-product facilities. Emerging sub-segments such as control systems & automation software, sensors & PAT instrumentation, and retrofit & upgrade kits are gaining traction, enhancing real-time process control, reducing cycle times, and improving data integrity — increasingly essential for regulatory scrutiny and process reliability.

2. Application Mix: Therapeutics & Vaccine Production Leads

Monoclonal antibody manufacturing stands out due to its production scale and revenue impact. SIP bioreactors ensure sterility for weeks-long cultures essential for mAb yields. Other contributors include vaccine production, microbial fermentation, cell & gene therapy, and biosimilars, where cost-effective SIP systems can drive competitive manufacturing economics.

3. End User Dynamics: From Tier-1 Biopharma to Innovative CDMOs

Large biopharma companies are the largest adopters, driven by enterprise-wide capacity growth and compliance requirements. Meanwhile, expanding CDMO networks and emerging biotech innovators are driving broader adoption, relying on standardized, flexible SIP solutions to support diverse portfolios from early-stage clinical production to commercial launches.

Geographic Insights: Regional Demand & Strategic Priorities

-

North America: The U.S. leads with ~6.9% CAGR, driven by facility upgrades that support legacy products and new modalities like mRNA vaccines.

-

Asia Pacific & Emerging Markets: India (10.7%), China (9.8%), and Brazil (10.3%) exhibit rapid expansion, fueled by government incentives and private investment. SIP adoption supports domestic healthcare needs and global export pipelines.

-

Europe: Germany, the UK, and France show stable growth, backed by precision engineering capabilities and investments in next-generation biologics and biosimilars.

Industry Trends Shaping the Next Decade

-

Automation & Digitalization: Advanced automation and Process Analytical Technology (PAT) enhance efficiency, reduce manual intervention, and improve data integrity for regulatory compliance.

-

Hybrid & Retrofit Solutions: Opportunities are emerging in hybrid systems and retrofit kits that modernize existing assets without full replacement.

-

Predictive Maintenance & AI Integration: Real-time sensor data and predictive analytics are critical for shortening validation timelines, predicting cycle deviations, and enabling parametric release strategies.

Competitive Landscape: Leaders & Strategic Positioning

Key players include Sartorius AG, Thermo Fisher Scientific Inc., Cytiva, Merck & Co. Inc., and GEA Group AG, leveraging integrated portfolios, lifecycle services, and global support networks. Success factors include expanding automation offerings, building retrofit/service ecosystems, and forming strategic alliances with CDMOs and emerging biotech companies to drive recurring revenue.

Browse Full Report : https://www.factmr.com/report/sterilization-in-place-sip-bioreactors-market

Strategic Recommendations for Growth

-

Expand Hybrid & Flexible Platforms: Bridge stainless steel and modular configurations for diverse manufacturing scales.

-

Solidify Lifecycle Service Offerings: Include validation support, digital upgrades, and performance optimization.

-

Leverage Strategic Partnerships: Collaborate with CDMOs and regional hubs to tailor SIP systems to specific capacity and compliance needs.

-

Embrace Flexible Financing Models: Offer leasing, capacity-based contracts, and flexible financing for emerging biotech and mid-tier manufacturers.