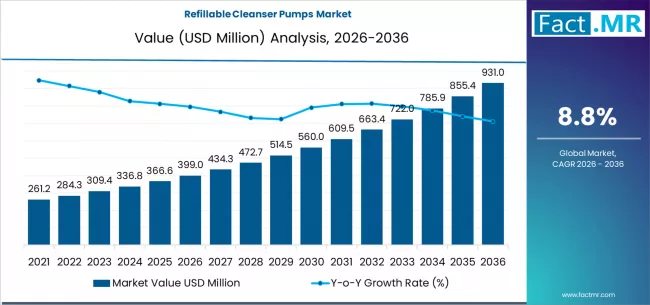

The global refillable cleanser pumps market is undergoing a significant transformation as sustainability initiatives, technological innovation, and evolving consumer behavior reshape the personal care and household product landscape. The market is projected to grow from USD 399 million in 2026 to USD 931 million by 2036, expanding at a robust CAGR of 8.8% over the decade. This growth trajectory reflects a decisive shift from single-use packaging toward durable, refill-oriented dispensing systems that align with circular economy principles and consumer demand for eco-conscious solutions.

Sustainability as a Core Growth Driver

Sustainability has become a central factor in packaging decisions rather than a peripheral consideration. Refillable cleanser pumps address rising regulatory pressure on single-use plastics, corporate ESG commitments, and consumer interest in waste reduction. By transforming the pump from a disposable item into a reusable asset, brands significantly reduce plastic consumption and environmental impact.

Material innovation reinforces this trend. Polypropylene (PP) combined with post-consumer recycled (PCR) resins accounts for nearly half of material usage, reflecting a balance between durability, regulatory compliance, and reduced carbon footprint. These materials support multiple refill cycles while lowering dependency on virgin plastics, helping brands meet sustainability targets while retaining product performance.

Innovation Trends in Pump Design

Technological innovation in pump mechanisms is central to market transformation. Reusable pumps dominate market share due to advancements in spring durability, precision dosing, and leak-resistant designs. Manufacturers are increasingly adopting modular pump architectures that allow for easy disassembly, cleaning, and compatibility across multiple refill formats.

Standardization is emerging as a key competitive differentiator. Pumps designed to function across multiple SKUs and product viscosities reduce operational complexity and tooling costs. They also simplify consumer usage and accelerate adoption, enabling refillable formats to transition from premium niche products to mass-market offerings. This interoperability supports scalable refill ecosystems, which are essential as sustainability becomes a critical brand differentiator.

End-Use Dynamics

Skincare remains the largest segment, accounting for approximately 44% of global demand. The high adoption in skincare reflects consumer willingness to embrace refillable formats for daily-use products such as facial cleansers, hand washes, and body washes, where precise dosing and hygiene are paramount.

However, adoption is broadening into household cleaning, hospitality amenities, and institutional hygiene sectors. These segments value refillable pumps for cost efficiency, waste reduction, and operational consistency. As refill logistics mature and refill packs become widely available, penetration in these adjacent sectors is expected to accelerate over the next decade.

Packaging Formats and Market Positioning

Refillable pump bottles lead the packaging format segment with more than 50% of market share. Pump bottles offer versatility, premium aesthetics, and sustainability benefits—critical factors in winning consumer trust. Unlike pouch-only refill systems, pump bottles retain the look and feel of conventional products while delivering measurable environmental impact reductions.

Competitive positioning in this market increasingly depends on three factors: durability, compatibility, and sustainability credentials. Leading manufacturers focus on long-life pumps, recyclable mono-material designs, and integration of PCR plastics to differentiate their offerings. Collaborations with FMCG brands are intensifying as packaging suppliers transition from being transactional vendors to strategic partners in sustainability initiatives.

Regional Market Dynamics

While the market is global, growth is particularly strong in regions with stringent environmental regulations and high personal care consumption. North America and Europe continue to lead adoption due to regulatory pressures on plastic waste and strong consumer awareness. Meanwhile, emerging economies in Asia-Pacific are expected to experience rapid growth due to rising disposable incomes, expanding skincare markets, and increasing awareness of sustainable products.

Market growth over the next decade can be divided into two phases. The initial phase focuses on adoption, product redesign, and pilot programs. The second phase, from the early 2030s onward, will be characterized by repeat refill purchases and growth in installed pump bases. This shift from adoption-led to usage-led growth improves revenue predictability and operational efficiency for manufacturers.

Browse Full Report : https://www.factmr.com/report/refillable-cleanser-pumps-market

Strategic Outlook to 2036

By 2036, the refillable cleanser pumps market is expected to be more than twice its 2026 value, signaling a structural and long-term shift in consumer packaging preferences. Companies that invest early in standardized, high-durability pump platforms and align them with refill-friendly product strategies are likely to capture the most value.

In an era where packaging decisions are inseparable from brand trust and environmental responsibility, refillable cleanser pumps are emerging as a cornerstone of next-generation consumer packaging. Innovation, sustainability integration, and strategic partnerships are poised to define competitive leadership in this rapidly evolving market. Brands that embrace these drivers will not only meet consumer expectations but also contribute meaningfully to global sustainability goals while establishing long-term growth in a highly competitive market.