The Low-Siloxane Cleanroom Wall Coatings Market is expected to experience steady expansion through 2036 as industries with precision manufacturing, contamination-sensitive processes, and stringent cleanliness standards increasingly invest in advanced surface solutions. Low-siloxane wall coatings are specialized formulations that significantly reduce siloxane outgassing and volatile organic compound (VOC) emissions, addressing critical contamination control requirements in cleanroom environments across semiconductor fabrication, pharmaceutical and biotechnology production, medical device manufacturing, and other high-precision sectors.

As advanced manufacturing technologies evolve and cleanroom infrastructure proliferates worldwide, manufacturers and facility operators are prioritizing coatings that enhance cleanliness, improve surface durability, and support frequent sanitation protocols. These needs are driving adoption of low-siloxane coatings that contribute to consistent ultra-clean environments and long-term operational performance.

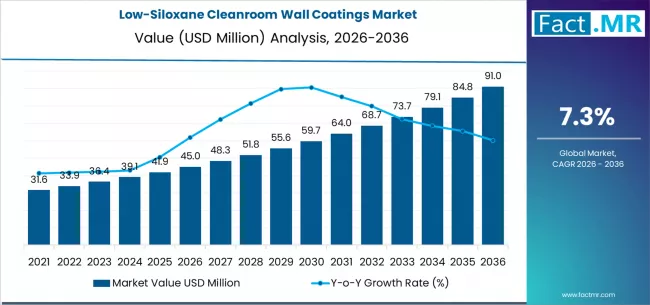

Market Forecast (2026–2036)

-

Market Value (2026): USD 45.0 million

-

Market Forecast Value (2036): USD 91.0 million

-

Forecast CAGR (2026–2036): Approximately 7.3%

-

Leading End-Use Industry: Semiconductor and integrated circuit fabrication

-

Primary Coating Type: Low-siloxane epoxy systems

-

Key Functional Property: Low outgassing and low VOC emissions

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12994

Market Overview

Low-siloxane cleanroom wall coatings are advanced chemical coatings formulated to minimize emissions from cured surfaces that can compromise contamination-sensitive operations. Siloxanes — commonly found in conventional coatings — are known to volatilize under specific environmental conditions. When present in cleanrooms, even trace amounts of siloxane compounds can interfere with semiconductor fabrication, biological products, and precision optical components.

In contrast, low-siloxane coatings are engineered with controlled chemistries that reduce siloxane content and associated outgassing. These coatings are used on walls, ceilings, partitions, and other structural elements in controlled environments where airborne molecular contamination must be carefully managed. The adoption of these coatings enables cleanroom operators to meet stricter air purity classifications, preserve product quality, and protect critical production processes.

Key Demand Drivers

1. Enhanced Contamination Control Standards

Critical industries such as semiconductors, advanced electronics, and biotechnology operate under strict contamination control requirements. Even minimal airborne molecular contamination can result in costly defects, production yield losses, or compromised research outcomes. Low-siloxane coatings contribute to improved cleanroom air quality and surface performance that align with evolving industry standards.

2. Expansion of High-Technology Manufacturing

The ongoing expansion of semiconductor fabrication facilities, pharmaceutical biologics plants, and precision manufacturing hubs worldwide is expanding cleanroom infrastructure. Regions prioritizing advanced manufacturing, including Asia Pacific and North America, are driving demand for specialized coatings that support consistent cleanroom performance over long service periods.

3. Regulatory and Quality Assurance Compliance

Cleanroom environments are subject to rigorous quality control, validation protocols, and regulatory oversight. Coating selection plays a significant role in contamination control plans and cleanroom qualifications. Low-siloxane coatings help manufacturers adhere to documentation requirements, contamination control protocols, and audit standards.

4. Operational Durability and Maintenance Efficiency

Cleanrooms require frequent sanitation with approved disinfectants and cleaning regimens. Coatings must withstand repeated wipe-downs, abrasion, and chemical exposure without degradation. Low-siloxane coatings that are durable, easy to clean, and resistant to surface wear reduce maintenance downtime and support operational efficiency.

Market Segmentation Insights

By End-Use Industry

-

Semiconductor and Integrated Circuit Fabrication: Dominant segment due to ultra-strict contamination thresholds and proliferating fab capacity.

-

Pharmaceutical and Biotechnology Cleanrooms: Significant demand as biologics and sterile drug product manufacturing expand globally.

-

Medical Device Manufacturing: Requires coatings with low outgassing for precision assembly and sterile environments.

-

Aerospace and Defense Cleanrooms: Adoption driven by precision materials processing and product reliability standards.

-

Optics, Precision Instruments, and Research Laboratories: Specialized cleanrooms with niche coating needs.

By Coating Chemistry

-

Low-Siloxane Epoxy Systems: Most widely used type, valued for strong adhesion, chemical resistance, and low emissions.

-

Low-Siloxane Polyurethane Systems: Selected for flexibility and performance under frequent cleaning cycles.

-

Fluoropolymer-Based and Low-Outgassing Fluorinated Systems: Used in applications demanding high solvent resistance.

-

Ceramic and Inorganic Barrier Coatings: Offer high hardness and long service life.

-

Emerging Hybrid and Nano-Engineered Coatings: Tailored solutions with specific performance enhancements.

By Functional Performance Attribute

-

Low Outgassing/Low VOC Coatings: Primary driver of specification decisions.

-

Particulate Suppression and Smooth Surface: Supports contamination control and easier cleaning.

-

Solvent and Chemical Resistance: Essential for frequent cleaning in biomedical and pharmaceutical environments.

-

Abrasion Resistance: Critical in high-use cleanrooms.

-

Antimicrobial Properties: Growing demand in life sciences and healthcare cleanrooms.

Regional Demand Dynamics

Asia Pacific is anticipated to be a leading regional market due to rapid expansion of semiconductor fabs, growing pharmaceutical manufacturing bases, and investment in advanced electronics production infrastructure. Countries with large volumes of cleanroom installations are seeing accelerated adoption of low-siloxane wall coatings as contamination control becomes a priority.

North America demonstrates strong adoption supported by mature cleanroom markets, stringent quality standards, and extensive research and development activities. The presence of major semiconductor and biotechnology clusters further fuels demand.

Europe remains a significant regional market with steady growth driven by industrial precision manufacturing, regulatory compliance emphasis, and adoption of controlled environments in pharmaceuticals, aerospace, and medical devices.

Emerging regions in Latin America and the Middle East & Africa are gradually increasing uptake as cleanroom adoption expands and regional industrial development accelerates.

Competitive Landscape

The low-siloxane cleanroom wall coatings market features a mix of global coatings manufacturers, specialty formulators, and industrial chemical companies. Key players focus on product innovation, enhancements in coating performance, and service support for cleanroom qualification and installation. Technical differentiation centers on validated low-emission performance, surface durability, compatibility with cleanroom disinfectants, and long-term adhesion under controlled environment conditions.

Increasing collaboration with facility designers, contamination control consultants, and construction integrators is a common industry strategy to ensure coatings are specified correctly during cleanroom builds and retrofits.

Future Outlook

The low-siloxane cleanroom wall coatings market is expected to maintain steady growth through 2036 as global cleanroom deployment continues across advanced manufacturing sectors. Innovation in low-outgassing chemistries, broader application in emerging industries, and heightened awareness of contamination control will drive sustained demand.

With the expansion of semiconductor, pharmaceutical, medical device, and precision research facilities, coatings that contribute to lower contamination risk, enhanced surface performance, and regulatory compliance will remain central to controlled environment infrastructure. Adoption of low-siloxane coatings is anticipated to expand further as advanced manufacturing ecosystems evolve toward higher quality and safety standards.

Browse Full Report: https://www.factmr.com/report/low-siloxane-cleanroom-wall-coatings-market