The global recycled PET (rPET) bottle glycols market is increasingly recognized as a critical segment within the chemical recycling and circular economy ecosystem. Recycled PET-derived glycols, including monoethylene glycol (MEG) and diethylene glycol (DEG), are shifting from niche sustainability solutions to mainstream industrial feedstocks. This evolution is being driven by regulatory pressure, corporate sustainability commitments, and rising demand in downstream industries such as polyester fibers and specialty resins.

Market Size and Growth Outlook

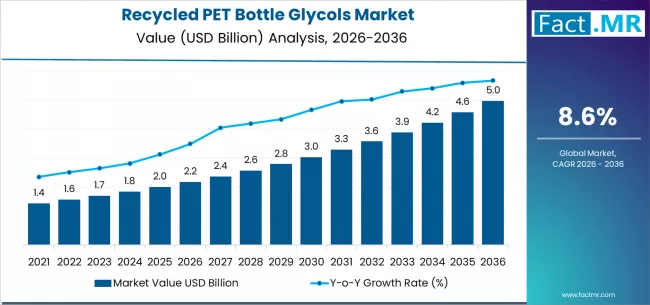

The global recycled PET bottle glycols market is projected to grow from approximately USD 2.2 billion in 2026 to USD 5.0 billion by 2036, reflecting a compound annual growth rate (CAGR) of around 8.6%. This rate outpaces conventional ethylene glycol growth, signaling structural shifts favoring recycled alternatives. Today, rPET-derived glycols already constitute over 50% of output by product type, indicating strong market adoption and a transition toward more sustainable chemical processes.

Key Demand Drivers

1. Regulatory Pressure and Circular Economy Mandates

Government regulations across Europe, North America, and Asia-Pacific are driving higher recycled content in packaging and textiles. Extended producer responsibility (EPR) frameworks and circular economy policies are accelerating investments in chemical recycling infrastructure. Recycled PET glycols enable “like-for-like” polymer regeneration, providing an advantage over mechanically recycled PET, which is prone to contamination and degradation.

2. Textile and Polyester Fiber Demand

Polyester fiber production remains the largest end-use segment, accounting for approximately 42% of rPET bottle glycol consumption. Global demand for polyester continues to rise, driven by fast fashion, athleisure, and technical textiles. Recycled glycols allow fiber producers to meet sustainability commitments without compromising performance, reinforcing the strategic value of these materials.

3. Corporate Sustainability Commitments

Leading consumer brands have pledged to increase recycled content in packaging and textiles to between 25% and 50% by 2030. These commitments provide long-term demand visibility for recycled PET intermediates. As ESG metrics increasingly influence corporate strategy and investment decisions, recycled glycols are becoming both a sustainable input and a competitive differentiator.

Technology Shifts and Disruption Signals

Chemical Recycling at Scale

The most notable disruption is the rise of chemical depolymerization technologies such as glycolysis, methanolysis, and hydrolysis. These processes convert PET waste into monomers, primarily MEG and terephthalic acid, enabling infinite recycling loops and higher material purity. Chemical recycling overcomes the contamination and polymer degradation challenges inherent in mechanical recycling and is expected to drive significant market share gains over the next decade.

Cost Convergence with Virgin Glycols

Historically, recycled glycols were priced at a premium compared to fossil-based alternatives. Rising oil and gas price volatility, coupled with carbon pricing and recycled content incentives, is narrowing this gap. This dynamic enhances the competitiveness of rPET-derived glycols, making them increasingly viable for broader industrial adoption.

Regional Dynamics

Asia-Pacific dominates both PET consumption and recycling capacity expansion. China and India are projected to grow at near double-digit CAGRs (around 9–10%), driven by rising textile exports and domestic sustainability regulations. North America and Europe, while more mature, are at the forefront of advanced chemical recycling investment and regulatory enforcement, positioning these regions for steady growth.

Competitive Landscape and Strategic Moves

The competitive environment is evolving from fragmented recyclers to integrated players spanning collection, depolymerization, and glycol purification. Strategic partnerships among waste management companies, chemical producers, and consumer brands are increasingly common. Securing feedstock supply—post-consumer PET bottles—has emerged as a critical success factor, particularly as recycled PET markets grow at nearly 10% CAGR through the next decade.

Industry Scenarios: 2026–2036

Base Case (Most Likely):

Chemical recycling scales steadily, regulatory frameworks remain supportive, and rPET bottle glycols reach USD 5 billion by 2036. Adoption expands beyond fibers into packaging resins and specialty applications, supporting moderate but consistent growth.

Accelerated Transition Scenario:

Stronger carbon pricing, faster brand adoption, and technological breakthroughs could drive double-digit growth. This scenario would allow rPET glycols to achieve cost parity with virgin alternatives sooner, opening opportunities in higher-volume markets.

Constraint Scenario:

Feedstock shortages, delayed regulatory action, or slower technology scale-up could restrict growth. In this scenario, recycled glycols remain a premium niche, with limited penetration into broader chemical markets.

Market Outlook by Application

-

Polyester Fibers: Growth remains robust due to fashion, technical textiles, and sustainability-driven procurement policies. Fiber producers increasingly prefer chemically recycled glycols for quality consistency.

-

Packaging Resins: Increasing EPR regulations and corporate commitments are creating new demand streams, particularly in beverage and consumer goods packaging.

-

Specialty Applications: Niche markets, such as PET-based films, adhesives, and coatings, are expected to adopt recycled glycols gradually, driven by performance equivalence and sustainability branding.

Strategic Implications

-

Integration Across the Value Chain: Players with control over collection, depolymerization, and glycol purification can secure feedstock and maintain cost advantages.

-

Technology Investment: Early adoption of scalable chemical recycling technologies will determine leadership positions in the next decade.

-

Regulatory Alignment: Staying ahead of regional policies and corporate sustainability commitments ensures long-term offtake security.

-

Brand Partnerships: Collaboration with major brands can guarantee consistent demand and facilitate premium pricing for verified recycled content.

Browse Full Report : https://www.factmr.com/report/recycled-pet-bottle-glycols-market

Conclusion

The global recycled PET bottle glycols market is poised for significant expansion, evolving from a niche sustainability segment to a core industrial feedstock. Key drivers include regulatory mandates, rising polyester fiber demand, brand sustainability commitments, and advancements in chemical recycling technology. By 2036, the market is expected to more than double in size, offering strategic growth opportunities for integrated players who can secure feedstock, scale recycling technology, and align with sustainability-focused customers.

The next decade will define the competitive hierarchy, with leaders emerging based on operational scale, technological innovation, and strategic partnerships across the PET recycling value chain.