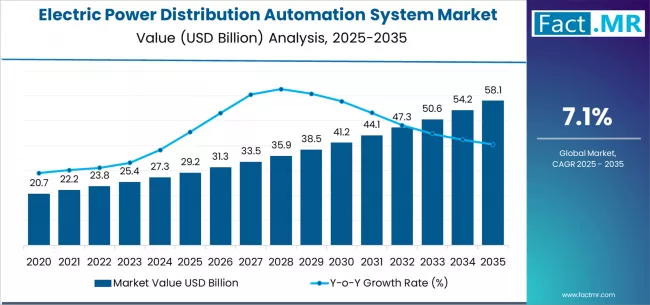

The global electric power distribution automation systems market is poised for significant growth over the next decade, driven by the rising need for resilient power networks, rapid integration of renewable energy sources, and accelerated adoption of smart grid technologies. According to the latest analysis by Fact.MR, the market is estimated to increase from USD 29.2 billion in 2025 to USD 58.1 billion by 2035, reflecting an absolute growth of USD 28.9 billion and a strong CAGR of 7.1% during the forecast period.

As utilities across the world transition toward digital, intelligent, and self-healing power distribution networks, automation technologies are becoming central to efficiency improvements, reliability enhancement, and cost optimization.

Strategic Market Drivers

Smart Grid Expansion Drives Massive Deployment

Rapid modernization of power grids through advanced monitoring, communication, and control technologies is a major factor driving market growth. Automated switching systems, real-time fault detection, and remote management capabilities significantly reduce downtime while improving operational efficiency.

Governments and utility providers are accelerating smart grid rollouts to reduce technical losses and enhance overall grid stability.

Renewable Energy Integration Fuels Automation Demand

As solar and wind capacities expand globally, distribution networks are facing unprecedented load variability. Distribution automation systems enable real-time balancing, voltage regulation, and seamless integration of distributed energy resources (DERs), supporting grid flexibility and sustainability goals.

Browse Full Report: https://www.factmr.com/report/electric-power-distribution-automation-systems-market

Rising Need for Reliability & Outage Management

Increasing urbanization and growing dependence on electricity-intensive infrastructure make outage prevention and rapid fault resolution critical. Automated feeder switching, fault location isolation, and service restoration (FLISR) technologies enable utilities to minimize outage durations and improve customer satisfaction.

Digitalization & IoT Transform Power Distribution

Advanced sensors, substation automation, smart meters, and IoT-enabled grid devices are enhancing visibility and enabling data-driven decision-making. Innovations in edge computing, AI, and predictive analytics are further optimizing distribution grid performance.

Regional Growth Highlights

North America: Leader in Smart Grid Adoption

The U.S. and Canada continue to spearhead investments in smart distribution networks, supported by federal funding and strong focus on grid resilience. Rapid deployment of advanced metering infrastructure (AMI) and DER integration technologies fuels regional growth.

Europe: Sustainability Regulations Accelerate Upgrades

EU-driven decarbonization targets, increasing renewable energy penetration, and stringent grid reliability standards are boosting adoption of distribution automation systems across Germany, the U.K., France, Spain, and Nordic nations.

Asia-Pacific: Massive Urbanization & Energy Demand Surge

China, India, Japan, and South Korea are heavily investing in digital grid upgrades to manage soaring energy demand. Large-scale renewable projects and growing industrialization further drive need for advanced distribution technologies.

Emerging Markets: Infrastructure Modernization Takes Priority

Southeast Asia, Latin America, Africa, and the Middle East are increasingly focusing on reducing transmission losses and building smarter, more efficient grids through automated solutions.

Market Segmentation Insights

By Component

- Field Devices – Largest segment driven by adoption of smart sensors, reclosers, and automated switches

- Software & Services – Rapidly growing segment due to demand for analytics, monitoring, and predictive maintenance solutions

By Utility Type

- Public Utilities – Dominant due to large-scale infrastructure upgrades

- Private Utilities – Increasing automation to improve efficiency and reliability

By Application

- Fault Detection, Isolation, and Restoration (FLISR) – Fastest-growing application

- Voltage/VAR Control – High demand from renewable energy integration

- SCADA Integration – Expanding with digital grid transformation

- Energy Management – Driven by peak load optimization needs

Challenges Impacting Market Growth

High Initial Investment

The cost of smart devices, communication networks, and system integration remains a barrier, especially for price-sensitive utilities.

Cybersecurity Concerns

Growing digitalization increases vulnerability to cyber threats, driving the need for robust security frameworks.

Complex Integration with Legacy Infrastructure

Upgrading aging grids involves technical challenges and significant modernization efforts.

Competitive Landscape

The electric power distribution automation systems market is moderately consolidated, with key players focusing on digital innovation, grid optimization, and large-scale automation projects.

Key Companies Profiled

- Siemens AG

- ABB Ltd.

- Schneider Electric

- General Electric (GE)

- Eaton Corporation

- Landis+Gyr

- Cisco Systems

- Itron Inc.

- Honeywell International

- Schweitzer Engineering Laboratories

Companies are emphasizing AI-based analytics, IoT-enabled grid devices, cybersecurity solutions, and advanced automation platforms.

Recent Developments

- 2024: Launch of AI-powered grid self-healing systems for real-time outage reduction

- 2023: Utilities across North America and Europe expand investments in DER management platforms

- 2022: Major emerging economies initiate smart meter and smart substation modernization programs

Future Outlook: A Decade of Intelligent Grid Evolution

The coming decade will redefine power distribution through:

- Expansion of decentralized energy systems

- Digital twins for grid simulation

- AI-driven predictive maintenance

- Growth of electric vehicle (EV) charging infrastructure

- Advanced automation for net-zero energy targets

As global power networks evolve toward smarter, more resilient, and energy-efficient systems, the electric power distribution automation systems market is set for strong and sustained growth through 2035.