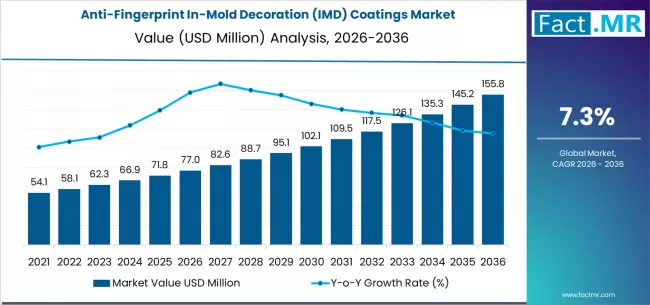

The global anti-fingerprint in-mold decoration (IMD) coatings market is set for steady expansion, driven by increasing demand for premium aesthetics, durability, and smudge-resistant surfaces across consumer electronics, automotive interiors, and smart appliances. According to a new study by Fact.MR, the market is projected to grow from USD 77.00 million in 2026 to USD 155.77 million by 2036, registering a strong CAGR of 7.3% during the forecast period.

Rising consumer expectations for clean, scratch-resistant, and visually appealing surfaces, along with rapid innovation in nanocoating technologies, are accelerating adoption of anti-fingerprint IMD coatings worldwide.

Browse Full Report: https://www.factmr.com/report/anti-fingerprint-in-mold-decoration-imd-coatings-market

Strategic Market Drivers

Growing Demand for Premium Consumer Electronics

The widespread use of smartphones, tablets, wearables, laptops, and smart home devices has significantly boosted demand for anti-fingerprint IMD coatings. These coatings enhance product appearance by minimizing fingerprints, oil smudges, and stains, thereby improving user experience and product longevity.

Manufacturers are increasingly integrating IMD coatings to deliver high-gloss, matte, and textured finishes without compromising surface durability.

Automotive Interior Innovation Accelerates Adoption

Modern vehicles feature touch-based controls, infotainment panels, and decorative trims that require clean, fingerprint-resistant surfaces. Anti-fingerprint IMD coatings offer superior resistance to wear, chemicals, and UV exposure, making them ideal for automotive dashboards, center consoles, and control panels.

The shift toward luxury and electric vehicles further supports market growth.

Rise of Oleophobic and Hydrophobic Nanocoatings

Oleophobic and hydrophobic nanocoatings dominate the market, accounting for 45.00% share, due to their ability to repel oils, water, and contaminants. These coatings provide long-lasting protection while maintaining transparency and tactile smoothness.

Advancements in nano-engineered materials are enhancing coating durability and environmental compliance.

Manufacturing Efficiency Through IMD Technology

In-mold decoration eliminates secondary coating or printing processes, reducing production time and cost. Anti-fingerprint IMD coatings enable design flexibility, reduced waste, and consistent surface quality, making them highly attractive for mass manufacturing.

Regional Growth Highlights

East Asia: Electronics Manufacturing Hub

China, Japan, and South Korea lead the global market due to their strong presence in consumer electronics manufacturing, advanced material technologies, and large-scale adoption of IMD processes.

North America: Innovation and Premium Product Demand

The U.S. market is driven by rising demand for high-end electronics, automotive innovation, and smart appliances, supported by strong R&D investments in surface coating technologies.

Europe: Automotive and Sustainability Focus

Germany, France, and the U.K. are witnessing increased adoption driven by automotive interior innovation, premium consumer goods, and strict environmental regulations encouraging durable, low-VOC coatings.

Emerging Markets: Expanding Electronics Consumption

India, Southeast Asia, and Latin America are experiencing steady growth due to rising disposable income, increasing smartphone penetration, and expansion of local electronics manufacturing.

Market Segmentation Insights

By Film Type

- Polycarbonate IMD Films – Leading segment with 35% market share, favored for high impact resistance, transparency, and thermal stability.

By Coating Technology

- Oleophobic / Hydrophobic Nanocoatings – Dominant segment with 45.00% share, offering superior fingerprint resistance and easy-clean properties.

By End Use

- Consumer Electronics – Largest segment at 30.0%, driven by smartphones, tablets, wearables, and smart devices.

- Automotive Interiors – Growing adoption for dashboards and control panels.

- Home Appliances – Increasing use in washing machines, refrigerators, and control interfaces.

- Industrial & Medical Devices – Niche but expanding applications.

Challenges Impacting Market Growth

High Material and Development Costs

Advanced nanocoatings and specialty films increase production costs, limiting adoption in price-sensitive markets.

Technical Integration Complexity

Ensuring coating adhesion, durability, and performance during high-temperature molding requires precise process control.

Environmental Compliance Pressures

Manufacturers must comply with evolving regulations related to VOC emissions and sustainable materials, increasing R&D investment.

Competitive Landscape

The anti-fingerprint IMD coatings market is moderately fragmented, with players focusing on material innovation, sustainability, and customized solutions for electronics and automotive applications.

Key Industry Focus Areas

- Development of eco-friendly nanocoatings

- Enhanced scratch and abrasion resistance

- Improved coating lifespan and transparency

- Integration with smart and touch-enabled surfaces

Recent Developments

- 2024: Introduction of next-generation nanocoatings with enhanced oil-repellent performance and extended lifecycle.

- 2023: Consumer electronics manufacturers expand use of anti-fingerprint IMD coatings in premium smartphones and wearables.

- 2022: Automotive OEMs increase adoption of IMD-coated interior components to enhance cabin aesthetics.

Future Outlook: Smart Surfaces Define the Next Decade

The global anti-fingerprint IMD coatings market is poised for sustained growth through 2036, supported by:

- Rising demand for premium, smudge-free surfaces

- Expansion of smart consumer electronics

- Automotive interior digitization

- Advances in nanotechnology and sustainable coatings

- Increased adoption of integrated IMD manufacturing processes

As industries prioritize aesthetics, durability, and user experience, anti-fingerprint IMD coatings will play a critical role in shaping the future of high-performance surface solutions.