The global forging lubricants industry is entering a decade of steady, innovation-led growth as manufacturers across automotive, aerospace, energy, and heavy engineering accelerate production of high-performance forged components. Forging lubricants—critical for reducing friction, extending die life, improving surface finish, and enabling complex metal forming—are increasingly viewed not as consumables, but as strategic enablers of productivity, sustainability, and cost control.

Market Size and Growth Trajectory

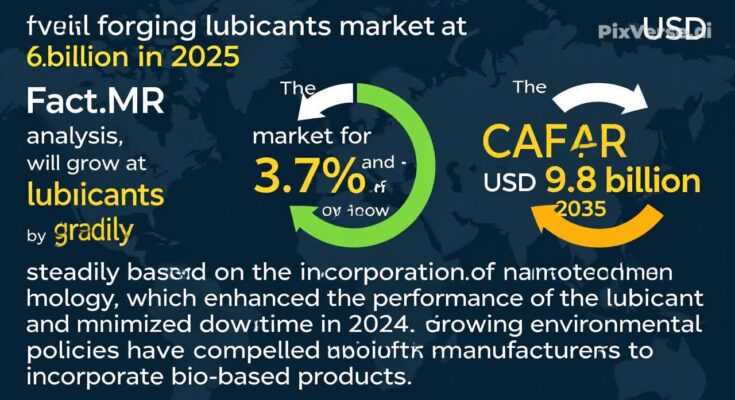

The global forging lubricants market was valued at approximately USD 6.7 billion in 2025 and is projected to reach USD 9.8 billion by 2035, expanding at a compound annual growth rate (CAGR) of about 3.7% over the decade. This growth outpaces several traditional lubricant subsegments and reflects the rising intensity of metal forming operations worldwide.

By 2036, demand is expected to be further reinforced by increasing forging output in Asia-Pacific, the electrification of mobility, and the aerospace sector’s shift toward lightweight alloys and precision-engineered components. While forging lubricants represent a fraction of the broader lubricants market—projected to exceed USD 200 billion globally by the early 2030s—their value density and technical complexity are significantly higher.

Key Demand Drivers

The automotive industry remains the single largest demand center for forging lubricants. Global automotive forging sales are projected to reach USD 86 billion by 2027, driven by lightweighting, safety requirements, and powertrain evolution. Electric vehicles (EVs), while reducing some traditional engine components, are increasing demand for forged aluminum and high-strength steel parts in chassis, suspension, and battery housings—applications that require advanced lubrication solutions.

The aerospace sector is another high-growth vertical. Rising air travel, defense modernization, and space exploration programs are accelerating demand for forged titanium, aluminum, and nickel-based superalloy components. These materials impose extreme thermal and mechanical loads during forging, pushing lubricant suppliers toward high-performance, residue-free, and thermally stable formulations.

Additionally, energy, construction, and heavy machinery industries continue to support baseline demand, particularly in emerging economies undergoing infrastructure expansion. Continuous investments in industrialization across China, India, and Southeast Asia have positioned Asia-Pacific as the largest and fastest-growing regional market.

R&D Priorities: Performance Meets Sustainability

Research and development has become the primary competitive lever in the forging lubricants industry. Manufacturers are investing heavily in next-generation formulations, including water-based, synthetic, and bio-derived lubricants, to balance performance with regulatory compliance. The incorporation of nanotechnology—such as solid lubricant nanoparticles—has already demonstrated improvements in wear resistance, heat transfer, and lubricant film stability, while reducing consumption rates and downtime.

Environmental regulations are accelerating the shift away from graphite-heavy and oil-intensive systems toward low-VOC, biodegradable, and operator-safe products. This aligns with broader industrial sustainability goals and mirrors trends seen across the synthetic lubricants market, which is projected to grow at a CAGR of over 4% through 2036.

For R&D leaders, the opportunity lies in developing application-specific lubricants—tailored for hot, warm, or cold forging; compatible with advanced alloys; and optimized for automated, high-speed forging lines. Digital simulation and in-process monitoring are increasingly used to co-develop lubricants alongside forging equipment and dies, reducing trial-and-error costs for end users.

Expansion Strategies and Regional Dynamics

From an expansion standpoint, Asia-Pacific will remain the focal point through 2036, supported by manufacturing scale, cost advantages, and growing domestic consumption. Localized production, technical service centers, and partnerships with regional forgers are becoming essential for global suppliers seeking to protect margins and respond quickly to customer needs.

Meanwhile, Europe and North America are evolving into innovation-centric markets. Growth here is driven less by volume and more by high-value applications in aerospace, defense, and advanced automotive manufacturing. In these regions, customers increasingly demand co-engineering support, lifecycle cost analysis, and sustainability reporting—creating opportunities for lubricant suppliers to move up the value chain.

Market Development and Competitive Outlook

The forging lubricants market remains moderately consolidated, with global chemical and specialty lubricant companies competing alongside regional specialists. Competitive differentiation is shifting from price toward technical performance, regulatory readiness, and service integration. Suppliers that can demonstrate measurable improvements—such as extended die life, reduced scrap rates, or lower lubricant consumption—are better positioned to secure long-term supply agreements.

Digitalization will also shape market development. Data-driven process optimization, predictive maintenance, and smart lubrication systems are expected to gain traction as forgers seek higher throughput and consistent quality. Lubricant suppliers that invest in digital tools and application engineering capabilities are likely to capture disproportionate value from these trends.

Browse Full Report : https://www.factmr.com/report/1078/forging-lubricants-market

Outlook to 2036

Looking ahead, the global forging lubricants industry is set for resilient, quality-driven growth rather than rapid commoditization. With the market approaching USD 10 billion in value by the mid-2030s, success will depend on strategic R&D investment, regional expansion aligned with manufacturing growth, and proactive market development focused on sustainability and performance.

For stakeholders across the value chain—chemical producers, forging companies, OEMs, and investors—the coming decade presents a clear message: forging lubricants are no longer ancillary inputs, but critical technologies shaping the efficiency, competitiveness, and environmental footprint of global metal forming industries.