Global Perchloroethylene Market Deep‑Dive 2026–2036: Strategic Forecasts, Market Entry Insights & Emerging Opportunities

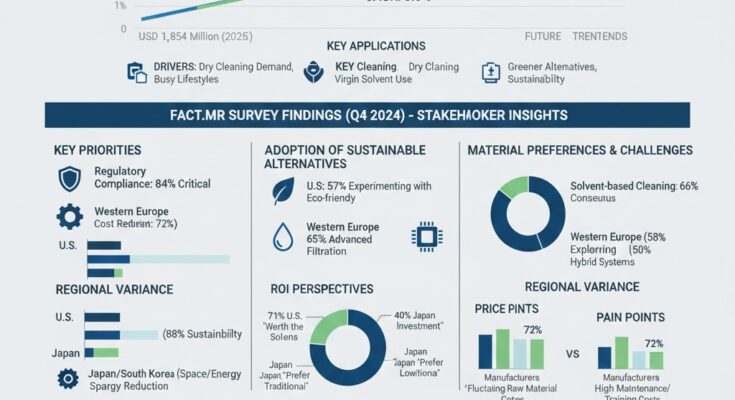

The Global Perchloroethylene (PCE) Market is poised for steady expansion between 2026 and 2036, driven by industrial growth, textile and dry-cleaning demand, and chemical feedstock applications. Valued at USD 1.85 billion in 2025, the market is projected to reach USD 2.62 billion by 2035, reflecting a CAGR of 3.5% over the forecast period.

Globally, demand is largely driven by the dry-cleaning sector (accounting for ~40% of total consumption in 2025), followed by industrial degreasing (25%) and chemical intermediates (20%), with remaining demand from specialty applications. The market demonstrates resilience despite increasing regulatory scrutiny due to its critical industrial applications and multifunctional use.

Market Segmentation and Regional Insights

By Application

-

Dry Cleaning & Textile Care: PCE dominates with ~40% market share, reflecting its superior oil and grease removal efficiency. Urbanization and disposable income growth in Asia Pacific have expanded organized dry-cleaning services, resulting in annual regional demand growth of 4.2%.

-

Industrial Degreasing: PCE accounts for 25% of global demand, with applications in automotive, aerospace, and electronics manufacturing. North America leads this segment, representing ~30% of global industrial PCE consumption, primarily for precision metal cleaning.

-

Chemical Feedstock: Serving as a precursor for fluorocarbons and specialty chemicals, PCE contributes ~20% of total consumption. Emerging chemical manufacturing hubs in Asia are driving feedstock demand at a CAGR of 3.8%, reflecting stable industrial expansion.

By Region

-

Asia Pacific: The largest market with ~45% share of global PCE consumption, projected to grow at 4% CAGR due to expanding textile production, electronics, and automotive industries in China, India, and Southeast Asia.

-

North America: Represents ~25% of global consumption, exhibiting steady growth of 2.5% CAGR, tempered by environmental regulations and adoption of sustainable alternatives.

-

Europe: Accounts for ~20% of the market, with growth at 2.2% CAGR, influenced by stringent chemical safety regulations and increasing green solvent adoption.

-

Rest of World: Remaining ~10%, driven by Latin America and Middle East industrial expansion, projected to grow at 3% CAGR.

Market Drivers

-

Growing Dry-Cleaning Industry: The professional dry-cleaning segment alone consumes ~740 kilotons of PCE annually, accounting for nearly 40% of global demand. Rising urban populations and higher disposable incomes in emerging economies are expanding service adoption.

-

Industrial Degreasing Needs: PCE’s high solvency is critical for cleaning metal surfaces in aerospace and automotive sectors. Industrial degreasing applications represent ~460 kilotons annually, with demand concentrated in North America (138 kt) and Asia Pacific (115 kt).

-

Chemical Feedstock Expansion: PCE use as a precursor in fluorocarbon and specialty chemical synthesis contributes ~368 kilotons annually, with growth driven by Asia Pacific manufacturing hubs.

Challenges

-

Regulatory Pressures: PCE is classified as a VOC and is subject to strict environmental controls. In the U.S., EPA limits emissions to ~0.02 ppm in occupational settings, while Europe’s REACH regulations encourage the adoption of greener alternatives.

-

Sustainability and Alternatives: The rise of biodegradable and non-toxic solvents is gradually reducing market share in mature markets. Approximately 10–15% of European dry-cleaning facilities have adopted PCE-free systems.

Competitive Landscape

The PCE market is moderately consolidated. Key players include:

-

Dow Chemical Company – Estimated 18% global market share

-

Solvay SA – 12%

-

Chemours Company – 10%

-

Regional specialty chemical producers collectively hold ~25–30%, catering to local textile and industrial markets.

Market strategy emphasizes:

-

Sustainability: Companies investing in solvent recycling systems have achieved ~20–25% reduction in VOC emissions, appealing to environmentally conscious buyers.

-

Localized Manufacturing: Establishing production facilities in Asia Pacific reduces logistics costs by up to 15–20%, supporting competitive pricing.

-

Strategic Partnerships: Collaborations with dry-cleaning networks and industrial clients increase market penetration.

Emerging Opportunities (2026–2036)

-

Sustainable Solvent Development: Demand for recyclable and environmentally friendly solvents is expected to grow at 5% CAGR, creating opportunities for innovation.

-

Expansion in Emerging Markets: Asia Pacific and Middle East dry-cleaning and industrial segments are expected to contribute ~60% of incremental global demand by 2035.

-

Advanced Manufacturing Applications: Aerospace, automotive electronics, and semiconductor precision cleaning demand is projected to grow at 4–5% CAGR, providing premium market opportunities.

-

Regulatory Compliance Solutions: Companies offering integrated solutions to meet environmental regulations could capture ~10–15% incremental market share in regulated regions.

Forecast Overview (2026–2036)

| Segment | 2025 Consumption (kt) | CAGR (%) | 2035 Forecast (kt) |

|---|---|---|---|

| Dry Cleaning & Textile Care | 740 | 4.2 | 1100 |

| Industrial Degreasing | 460 | 3.0 | 620 |

| Chemical Feedstock | 368 | 3.8 | 520 |

| Other Applications | 180 | 3.5 | 250 |

| Total | 1748 | 3.5 | 2490 |

Browse Full Report : https://www.factmr.com/report/5102/perchloroethylene-market

Conclusion

The Global Perchloroethylene Market (2026–2036) is set to grow steadily, driven by demand from dry-cleaning, industrial degreasing, and chemical feedstock applications. While environmental regulations and sustainability concerns pose challenges, they simultaneously present opportunities for innovation in greener solvents, recycling technologies, and regulatory compliance solutions. Companies that invest in sustainable technologies, expand in emerging markets, and optimize production strategies are positioned to capture significant long-term growth and maintain market leadership.