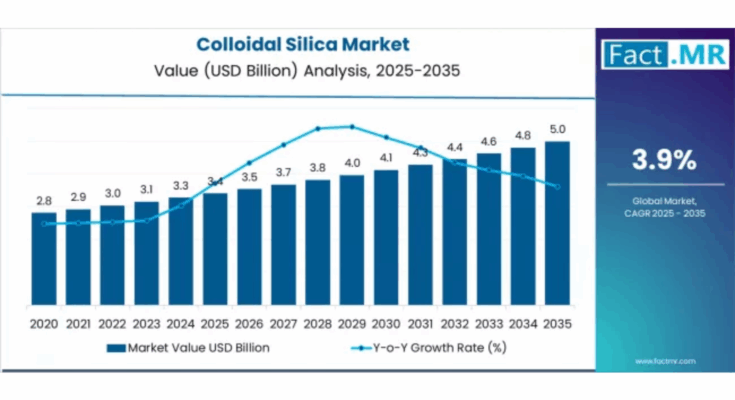

The global colloidal silica market stands at the threshold of a decade-long expansion trajectory that is set to redefine specialty chemicals technology and advanced material solutions. According to Fact.MR, the market is projected to grow from USD 3.4 billion in 2025 to USD 5.1 billion by 2035, reflecting a steady CAGR of 3.9% over the forecast period. This sustained growth highlights the accelerating adoption of colloidal silica across high-performance industrial, construction, and electronics applications.

Increasing demand for high-purity binders, polishing agents, coatings, and reinforcing additives is positioning colloidal silica as a critical material across multiple value chains worldwide.

Strategic Market Drivers

Expansion of Advanced Materials & Specialty Chemicals

Colloidal silica plays a vital role as a binder, stabilizer, and reinforcing agent in advanced materials. Its exceptional properties—such as controlled particle size, chemical stability, and high surface area—make it indispensable in precision-driven industries.

Rising use in ceramics, refractories, catalysts, and specialty coatings is significantly strengthening market demand.

Browse Full Report: https://www.factmr.com/report/3593/colloidal-silica-market

Construction Industry Growth Fuels Adoption

The global construction sector continues to be a major demand driver, with colloidal silica widely used in:

- Concrete densifiers

- Cementitious formulations

- Surface coatings and sealants

Its ability to enhance strength, durability, and chemical resistance aligns well with infrastructure development and sustainable construction trends.

Semiconductor & Electronics Industry Momentum

In the electronics sector, colloidal silica is a key material in chemical mechanical planarization (CMP) processes used in semiconductor wafer polishing. As demand for smaller, faster, and more efficient electronic devices increases, so does the need for high-purity colloidal silica.

Growth in semiconductors, displays, and precision optics is expected to remain a strong long-term catalyst.

Sustainability & Environment-Friendly Solutions

Colloidal silica-based formulations are increasingly favored as low-VOC, water-based, and environmentally friendly alternatives to conventional chemical binders, supporting global sustainability initiatives and regulatory compliance.

Regional Growth Highlights

North America: Technology & Industrial Innovation Hub

North America remains a prominent market, driven by strong demand from electronics, construction, and specialty chemicals industries. The U.S. continues to benefit from advanced R&D capabilities and high adoption of sustainable material solutions.

Europe: Sustainability and Advanced Manufacturing

Strict environmental regulations and a strong focus on green construction materials and advanced manufacturing are boosting colloidal silica demand across Germany, France, and the U.K.

East Asia: Electronics & Industrial Powerhouse

China, Japan, and South Korea dominate consumption due to their leadership in semiconductors, electronics manufacturing, and precision ceramics. Continued investments in high-tech industries are accelerating market expansion.

Emerging Markets: Infrastructure & Industrial Growth

India, Southeast Asia, Latin America, and the Middle East are witnessing rising adoption due to:

- Rapid infrastructure development

- Expanding manufacturing bases

- Growing construction and coatings industries

Market Segmentation Insights

By Product Type

- Alkaline Colloidal Silica – Widely used in construction and binders

- Acidic Colloidal Silica – Preferred for polishing and electronics

- Modified Colloidal Silica – High growth in specialty applications

By Application

- Construction & Building Materials – Largest segment

- Electronics & Semiconductors – Fastest-growing

- Paper & Pulp – Used for surface treatment and retention

- Paints & Coatings – Enhances durability and performance

- Catalysts & Chemical Processing – Specialized industrial use

Challenges Impacting Market Growth

Raw Material & Production Cost Pressures

Fluctuating raw material prices and energy costs can affect profit margins, especially for high-purity colloidal silica grades.

Technical Complexity in High-End Applications

Electronics and semiconductor applications require ultra-high purity and precise particle control, increasing manufacturing complexity and costs.

Competitive Landscape

The colloidal silica market is moderately consolidated, with companies focusing on product purity, particle size customization, and application-specific formulations.

Key Companies Profiled

- Nouryon

- Evonik Industries

- W.R. Grace & Co.

- Fuso Chemical

- Nissan Chemical

- Cabot Corporation

- Merck KGaA

- Tata Chemicals

Players are investing in process optimization, sustainable production methods, and advanced material innovations to strengthen their market position.

Recent Developments

- 2024: Increased investments in high-purity colloidal silica for semiconductor CMP applications

- 2023: Expansion of production capacities to meet construction sector demand

- 2022: Development of eco-friendly, water-based colloidal silica solutions

Future Outlook: A Decade of Steady, High-Value Growth

Over the next decade, the global colloidal silica market will continue to evolve, driven by:

- Growth in advanced electronics and semiconductors

- Expansion of sustainable construction materials

- Rising demand for high-performance coatings

- Technological innovation in specialty chemicals

As industries increasingly prioritize performance, sustainability, and material efficiency, colloidal silica is set to remain a cornerstone material supporting innovation and long-term growth through 2035.