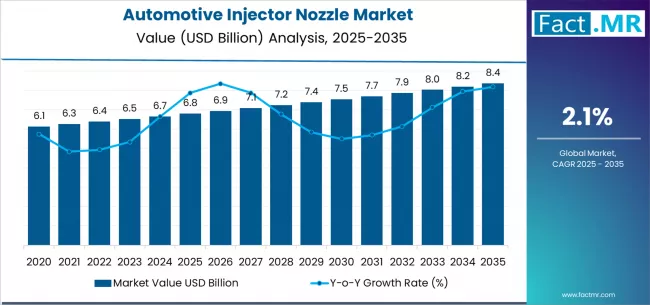

The global automotive injector nozzle market is set to witness steady and resilient growth over the coming decade, driven by continuous advancements in fuel injection technologies, tightening emission regulations, and the sustained evolution of gasoline direct injection (GDI) and advanced diesel systems. According to an analysis by Fact.MR, the market is projected to expand from USD 6.8 billion in 2025 to USD 8.4 billion by 2035, reflecting an absolute growth of USD 1.6 billion during the forecast period.

This progression corresponds to a compound annual growth rate (CAGR) of 2.1% from 2025 to 2035, demonstrating the ongoing innovation and refinement of fuel delivery systems across automotive OEMs, engine manufacturers, and aftermarket service providers worldwide.

The rising focus on engine efficiency, fuel economy, and lower emissions continues to underpin long-term demand for high-precision injector nozzles.

Strategic Market Drivers

Stringent Emission Regulations Fuel Technology Upgrades

Governments worldwide are enforcing stricter emission norms to curb vehicle-related pollution. These regulations are compelling automakers to adopt advanced injector nozzle designs that enable precise fuel atomization, improved combustion efficiency, and reduced particulate emissions.

Injector nozzles play a crucial role in meeting standards such as Euro 6/7, BS VI, and EPA regulations, making them indispensable components in modern engines.

Browse Full Report: https://www.factmr.com/report/38/automotive-injector-nozzle-market

Growth of Gasoline Direct Injection (GDI) Systems

The global shift toward GDI engines—especially in passenger vehicles—is a major contributor to injector nozzle demand. Compared to traditional port fuel injection systems, GDI engines rely on high-pressure, high-precision injector nozzles to optimize performance, power output, and fuel efficiency.

As automakers balance performance expectations with environmental compliance, injector nozzle technology continues to evolve in complexity and importance.

Continued Demand from Diesel Engines in Commercial Vehicles

Despite the electrification trend, diesel engines remain dominant in heavy-duty trucks, buses, construction equipment, and agricultural machinery. High-durability injector nozzles are critical for these applications, supporting consistent fuel delivery under extreme pressure and temperature conditions.

Growth in logistics, infrastructure development, and long-haul transportation sustains steady demand from this segment.

Expansion of the Automotive Aftermarket

Injector nozzles are subject to wear due to high operating pressures and fuel quality variations. This drives replacement demand in the global automotive aftermarket, particularly in regions with aging vehicle fleets.

The aftermarket segment provides stable revenue streams for manufacturers alongside OEM supply contracts.

Regional Growth Highlights

North America: Technology-Driven Engine Optimization

North America maintains a solid market position, supported by advanced engine development, strong aftermarket demand, and regulatory emphasis on fuel efficiency. The U.S. remains a key contributor due to ongoing upgrades in gasoline and diesel powertrains.

Europe: Emission Compliance and Precision Engineering

Europe leads innovation in injector nozzle design, driven by stringent emission mandates and the presence of major automotive OEMs. Germany, France, and Italy continue to invest in high-precision fuel injection systems for both passenger and commercial vehicles.

East Asia: High-Volume Automotive Manufacturing

China, Japan, and South Korea dominate injector nozzle production and consumption, backed by large-scale vehicle manufacturing and growing adoption of GDI technologies. Continuous investments in engine efficiency improvements are supporting regional growth.

Emerging Markets: Gradual Expansion in Vehicle Parcels

India, Southeast Asia, Latin America, and parts of Africa are witnessing rising demand due to:

- Growth in passenger and commercial vehicle sales

- Expanding automotive service and repair networks

- Increasing adoption of fuel-efficient engine platforms

Market Segmentation Insights

By Fuel Type

- Gasoline Injector Nozzles – Growing steadily due to GDI penetration.

- Diesel Injector Nozzles – Strong presence in commercial and off-highway vehicles.

By Vehicle Type

- Passenger Vehicles – Largest market share driven by global car parc expansion.

- Light Commercial Vehicles (LCVs) – Increasing use in urban logistics.

- Heavy Commercial Vehicles (HCVs) – Stable demand supported by infrastructure and freight movement.

By Sales Channel

- OEMs – Dominant share due to factory-installed systems.

- Aftermarket – Consistent growth driven by replacement cycles.

Challenges Impacting Market Growth

Gradual Shift Toward Electrification

The rise of electric vehicles (EVs) presents a long-term challenge, as fully electric powertrains eliminate the need for injector nozzles. However, hybrid vehicles and internal combustion engines (ICEs) are expected to coexist for the foreseeable future.

High Precision Manufacturing Requirements

Injector nozzles require advanced machining and materials to withstand extreme pressures, increasing production complexity and cost.

Fuel Quality Variability

Inconsistent fuel quality in some regions accelerates wear, affecting nozzle performance and increasing warranty and replacement concerns.

Competitive Landscape

The automotive injector nozzle market is moderately consolidated, with key players focusing on:

- Precision engineering

- Advanced materials and coatings

- High-pressure injection compatibility

- Long-life and low-emission designs

Key Companies Profiled

- Robert Bosch GmbH

- Denso Corporation

- Continental AG

- Delphi Technologies (BorgWarner)

- Stanadyne LLC

- Weifu High-Technology Group

- Hitachi Astemo

Manufacturers are investing in next-generation injector technologies tailored for hybrid engines and low-emission combustion systems.

Recent Developments

- 2024: Introduction of next-generation injector nozzles optimized for ultra-high-pressure GDI systems.

- 2023: Expansion of aftermarket injector nozzle portfolios for BS VI and Euro 6-compliant vehicles.

- 2022: Increased adoption of advanced coatings to improve durability and reduce carbon buildup.

Future Outlook: Sustained Evolution of Fuel Delivery Systems

While electrification is reshaping the automotive landscape, internal combustion and hybrid engines will remain integral to global mobility over the next decade. Continuous improvements in injector nozzle precision, durability, and emission performance will be essential to meet regulatory and efficiency goals.

With steady OEM demand, a robust aftermarket, and ongoing innovation in fuel injection technologies, the global automotive injector nozzle market is positioned for stable and sustained growth through 2035.