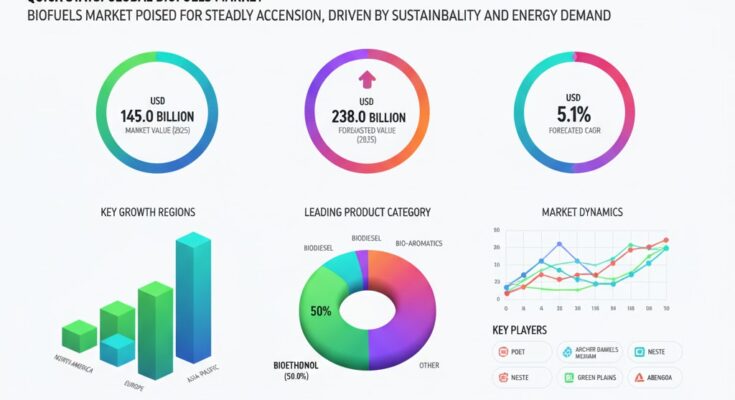

The global biofuels market is set to witness strong expansion over the next decade, driven by a surge in renewable energy adoption, sustainability initiatives, and the need to decarbonize transportation and industrial sectors. According to recent market analysis, the biofuels industry — currently valued at USD 145 billion in 2025 — is forecast to grow to USD 238 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 5.1%.

Market Snapshot & Growth Drivers

The biofuels market is entering a transformative phase, catalyzed by growing environmental consciousness, tight regulations on greenhouse gas emissions, and the push for cleaner energy sources. Biofuels, such as bioethanol, biodiesel, and biogas, are increasingly viewed as key components of the energy transition, offering a lower-carbon alternative to fossil fuels in transport, energy generation, and specialty fuel applications.

Leading Segments & Feedstock Trends

-

By Fuel Type: Bioethanol is projected to dominate the market, accounting for 50% of total biofuel consumption. Its established infrastructure and compatibility with existing fuel systems make it a preferred choice for blending and standalone applications.

-

By Feedstock: Among feedstocks, sugarcane is expected to hold a 40% share, emphasizing its importance in high-yield, low-cost bioethanol production. Other significant feedstocks include corn and oilseeds, which support biodiesel and biogas production.

Regional Dynamics

The biofuels market’s growth will be strongly influenced by developments in key regions:

-

North America and Europe are expected to continue leading due to supportive regulatory frameworks, renewable fuel mandates, and infrastructure readiness.

-

Asia-Pacific is emerging as a high-growth region, driven by increasing energy demand, expanding bio-refinery capacity, and government incentives for biofuel production.

What’s Fueling the Surge?

-

Stringent Emission Policies: Governments worldwide are pushing for reduced carbon footprints. Biofuels are being promoted as essential to meeting national and corporate net-zero goals.

-

Energy Security: Biofuels provide an alternative to volatile fossil fuel markets, supporting energy diversification and resilience.

-

Technological Progress: Advances in biofuel production — including more efficient fermentation and conversion technologies — are improving yield, reducing costs, and broadening the range of viable feedstocks.

-

Sustainability Initiatives: Consumers and companies alike are demanding greener energy sources. Biofuels produced from waste biomass and second-generation feedstocks are gaining traction.

-

Infrastructure Integration: Biofuels are increasingly compatible with existing fuel distribution and vehicle infrastructure, making adoption more seamless.

Market Challenges

Despite the positive outlook, the biofuels market faces several hurdles:

-

Feedstock Price Volatility: Fluctuations in feedstock costs (like sugarcane, corn, and oilseeds) can impact production economics.

-

Competition from Electric & Hydrogen Alternatives: As EV adoption grows and hydrogen technology matures, biofuels must prove their long-term competitiveness.

-

Land Use & Sustainability Concerns: Scaling biofuel production raises questions about land use, food security, and environmental impact.

-

Capital Intensity: Building bio-refineries and securing consistent feedstock supply requires substantial capital investment.

Competitive Landscape

The biofuels market is highly competitive, with both legacy energy firms and specialist companies investing in production capacity, technology, and sustainability:

-

POET LLC and Archer Daniels Midland (ADM) are among the leading companies driving bioethanol production and infrastructure integration.

-

Green Plains, Neste, and Abengoa are focusing on advanced biofuel technologies, including renewable diesel and sustainable aviation fuels (SAF).

These players are not only expanding capacity but also investing in R&D to improve conversion efficiencies, reduce emissions, and scale up second-generation biofuels.

Future Outlook & Innovation Trends

Over the next decade, several key trends will shape the biofuels market:

-

Advanced Biofuels: There will be increasing investment in second- and third-generation biofuels made from non-food biomass, algae, and waste to address feedstock sustainability.

-

Sustainable Aviation Fuel (SAF): As aviation seeks to cut its carbon footprint, bio-based SAF will be a major growth opportunity.

-

Circular Bioeconomy Models: Bio-refineries will increasingly integrate with waste management and agricultural systems to produce fuel from residual biomass.

-

Carbon Capture Integration: Future biofuel production plants may combine biofuel production with carbon capture to further reduce net emissions.

-

Policy & Incentives: Enhanced blending mandates, carbon credits, and financial incentives will continue to drive adoption globally.

Browse Full Report :

https://www.factmr.com/report/biofuels-market

“Biofuels are emerging as a cornerstone of the renewable energy landscape — not just because of their environmental benefits, but because they can plug directly into current energy systems,” said a senior market analyst. “Innovation in feedstock, conversion, and policy will be critical to unlocking the next wave of growth.”