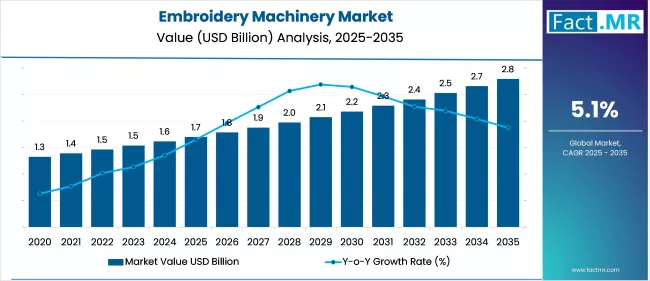

The global embroidery machinery market is poised for significant growth over the next decade, with the market projected to expand from US$ 1.7 billion in 2025 to US$ 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1%. This surge is being fueled by strong demand for customized apparel, rapid adoption of automation and smart technologies, and evolving digital fashion business models.

Rising Demand for Personalization and Custom Apparel

One of the key drivers of this growth is the increasing consumer appetite for personalized and bespoke clothing. Brands and small businesses alike are leveraging embroidery to offer unique designs, monograms, and custom logos. This trend is pushing embroidery businesses to invest in more advanced, efficient machines that can handle diverse designs and frequent changeovers.

At the same time, the explosion of e‑commerce and D2C (direct-to-consumer) fashion is empowering home-based embroiderers and small boutiques. These operators are gravitating toward compact and computerized embroidery machines that integrate easily with digital design workflows, enabling faster turnaround times and high-quality output at scale.

Smart & Automated Tech Accelerates Adoption

Technological innovation is playing a pivotal role in market expansion. Computerized embroidery machines currently dominate the market, representing approximately 66% of market share in 2025. These machines bring precision, repeatability, and integration with software-based design tools, reducing manual intervention and enabling intricate patterns.

Moreover, smart features such as cloud connectivity, IoT-enabled maintenance, and real-time performance monitoring are becoming common — facilitating predictive servicing, reducing downtime, and improving productivity. Automation is also helping manufacturers scale while maintaining quality, especially in high-volume or multi-head embroidery operations.

Regional Dynamics: Key Growth Markets

Asia Pacific, with its large textile manufacturing base, remains a critical region for machine adoption. Emerging garment-exporting hubs like India, Bangladesh, and Vietnam are fueling demand for high-speed, multi-head embroidery machines to meet both domestic and international custom-product needs.

In Europe, countries like Germany, Italy, and the U.K. continue to lead in precision embroidery, particularly for high-end fashion, technical textiles, and industrial embroidery applications. Their advanced manufacturing capabilities and strong fashion heritage boost demand for high-performance, computerized embroidery systems.

North America, especially the United States, is also a growth hotspot. The U.S. market is driven by small businesses, promotional-product firms, and fashion entrepreneurs. Custom logos, uniforms, and specialty apparel contribute significantly to demand for both industrial and smaller domestic embroidery machines.

Segment Insights: From Needles to Speed

-

Needle Type: While single-needle machines remain popular for their versatility and affordability, multi-needle machines are fast growing due to their high throughput and efficiency in large-scale operations.

-

Machine Working Area: Compact machines (working area below 20 square inches) dominate due to their suitability for logos, badges, and small-format embroidery. Meanwhile, the large-format machines are gaining traction for bulk production, such as jackets, blankets, and upholstery.

-

Speed (Stitches Per Minute): Lower-speed machines (< 400 SPM) are widely used in artisan, hobbyist, and small-business settings, while high-speed machines (> 1,200 SPM) are becoming more common in industrial embroidery production due to their productivity advantages.

-

End‑Use: Commercial applications (promotional goods, uniforms, merchandise) lead market share, but domestic embroidery is the fastest-growing segment, fueled by the boom in home-based creative businesses and DIY fashion.

Opportunities & Innovation for Stakeholders

-

Machine Manufacturers: There is a strong opportunity to invest in modular, IoT-enabled embroidered systems. Providing scalable solutions that support both small- and large-scale embroiderers will be key to capturing market share.

-

Apparel & Textile Firms: By integrating advanced embroidery machinery into production lines, brands can meet the growing demand for customization, collect digital design assets, and scale efficiently.

-

Small Businesses & Entrepreneurs: Compact, computerized machines allow entrepreneurs to start or scale a personalization business with lower capital outlay, while still delivering high-value products.

-

Investors: The forecast to reach US$ 2.8 billion by 2035 suggests a solid growth trajectory for machine makers investing in smart automation and servicing capabilities.

-

Policy Makers & Educators: As the market grows, training in operating, programming, and maintaining computerized embroidery machines will become important. Incentives for tech adoption in textiles could support SME modernization.

Challenges & Risk Factors

While the outlook is positive, several hurdles could slow adoption:

-

High Upfront Costs: Advanced, computerized, multi-head machines require significant capital investment, limiting adoption by smaller or cash-constrained operators.

-

Skilled Labor: Operating modern embroidery machines demands design software knowledge, maintenance skills, and embroidery expertise. A lack of trained personnel remains a bottleneck.

-

Maintenance & Support: In emerging markets, service networks and parts availability may be limited, increasing downtime and reducing the appeal of high-end machinery.

-

Market Cyclicality: The embroidery machinery market is closely tied to the textile and apparel industry, which is vulnerable to fashion trends, trade policies, and economic cycles.

Browse Full Report : https://www.factmr.com/report/2015/embroidery-machinery-market

Future Outlook

By 2035, the embroidery machinery market is expected to reach US$ 2.8 billion, driven by a 5.1% CAGR. Adoption of computerized systems, IoT and cloud-based features, and the rise of custom apparel and home-based businesses are expected to sustain this momentum.

As technology continues to evolve, manufacturers that emphasize automation, connectivity, durability, and modularity will likely lead. Meanwhile, small- and mid-sized apparel brands, promotional merchandise producers, and home-embroidery entrepreneurs are presented with expansive opportunities to leverage customization.