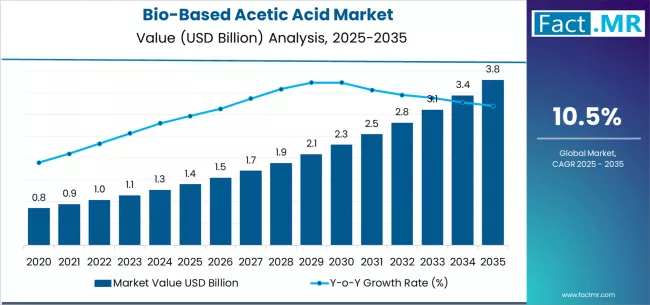

The global bio‑based acetic acid market is poised for a transformative decadal growth, expanding from an estimated US$ 1.4 billion in 2025 to a projected US$ 3.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 10.5 %. This significant increase is being driven by mounting regulatory pressure, corporate sustainability mandates and the escalating demand for greener chemical feedstocks.

Sustainability and regulatory shift fueling demand

Bio‑based acetic acid, produced via fermentation from renewable biomass feedstocks rather than conventional petrochemical routes, aligns with global efforts to reduce carbon footprints and transition toward circular economy models. As end‑users in chemical processing, food & beverage, and other sectors place greater emphasis on “bio‑based” credentials, companies are adopting bio‑acetic acid to meet consumer demand and regulatory compliance. The shift toward renewable feedstocks is accelerating, underpinning the robust market outlook.

Production and feedstock dynamics

By 2025, biomass fermentation is estimated to account for the majority of the bio‑based acetic acid production share, driven by its scalability, feedstock flexibility and established industrial fermenters. This mode of production provides a competitive advantage compared to newer synthetic biology or waste‑gas routes, and its dominance reinforces the growth trajectory. As manufacturers expand capacity and optimize fermentation pathways, cost parity with petrochemical acetic acid is expected to improve significantly.

Application sectors driving adoption

Several end‑use domains are bolstering demand:

-

The chemical manufacturing segment—particularly intermediates such as vinyl acetate monomer (VAM)—is set to command a sizeable share, as bio‑acetic acid offers a renewable alternative to conventional acetic acid in adhesives, coatings, films and polymers.

-

The food & beverage end‑use remains highly relevant, with bio‑acetic acid being used as an acidity regulator, preservative and functional ingredient. As clean‑label, organic and natural products continue to gain market share, this segment is expected to deliver steady growth.

-

Additionally, emerging niches such as pharmaceuticals and personal care are witnessing elevated interest: usage in pharma is projected to increase by approximately 1.5× over the forecast period, while personal care applications are expected to grow by around 1.4×.

Regional outlook and expansion hotspots

Geographically, North America—including the United States—is forecast to be one of the strongest growth markets, with the U.S. segment projected to expand from approximately US$ 0.43 billion in 2025 to around US$ 1.2 billion by 2035, translating into a CAGR of roughly 10.8 %. Within the U.S., the Western region leads at an estimated 11.2 % CAGR, followed by the Northeast (10.8 %).

Elsewhere, regions such as Europe and Asia Pacific are expected to contribute significantly, supported by stringent environmental policies and rising industrial adoption of sustainable chemicals.

Competitive landscape and strategic initiatives

Key players across the bio‑based acetic acid value chain are investing in capacity expansion, feedstock optimization and strategic alliances to leverage the growth cycle. Leading firms include producers active in fermentation technology, waste‑to‑chemical conversion and green chemical manufacturing. Companies are differentiating through integrated biomass sourcing, advanced bioprocessing and certifications to meet sustainability targets of downstream users.

Challenges and market‑entry barriers

Despite the favourable outlook, several challenges remain. The production cost differential between bio‑based and petrochemical acetic acid remains a constraint in price‑sensitive applications. Scaling fermentation processes to large commercial scale, securing consistent biomass feedstock supply and maintaining robust quality standards are critical hurdles. Moreover, achieving industry‑wide acceptance of bio‑based credentials and certifications will be key to unlocking broader adoption.

Outlook and strategic implications for stakeholders

For chemical manufacturers and compounders, the shift toward bio‑acetic acid presents a strategic opportunity to access value‑added, high‑growth feedstocks aligned with sustainability commitments. For investors, the projected market expansion from US$ 1.4 billion to US$ 3.8 billion presents compelling growth visibility—with early movers in fermentation and renewable feedstock logistics likely to capture disproportionate value.

Regulators and policymakers should consider supportive incentives for bio‑based chemical production, such as tax credits, feedstock subsidies and certification frameworks, to accelerate transition away from fossil‑derived inputs.

Browse Full report : https://www.factmr.com/report/1189/bio-based-acetic-acid-market

Conclusion

The bio‑based acetic acid market is entering a phase of significant expansion, underpinned by sustainability drivers, industrial decarbonization efforts and increasing preference for renewable chemical alternatives. With a forecasted market size of US$ 3.8 billion by 2035 and robust double‑digit growth ahead, bio‑acetic acid is set to play a pivotal role in the green chemistry landscape. Manufacturers, investors and policy makers that align with this momentum stand to benefit from the next generation of sustainable chemical solutions.