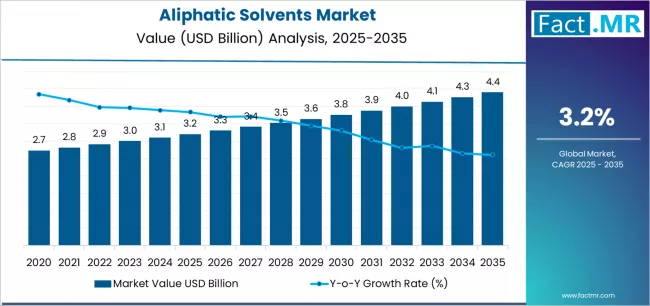

The global aliphatic solvents market is on a stable upward curve, supported by growing consumption across paints and coatings, agrochemicals, automotive maintenance, and industrial cleaning. According to a new analysis by Fact.MR, the market is valued at USD 3.2 billion in 2025 and is projected to reach USD 4.4 billion by 2035. This reflects an absolute increase of USD 1.2 billion over the decade, translating into total growth of 37.5% and a CAGR of 3.2% from 2025 to 2035.

Aliphatic solvents continue to play an essential role in dissolving, thinning, and extracting across industries that require high-purity, low-aromatic content formulations. Their lower toxicity, excellent solvency power, and compatibility with a wide range of chemical processes reinforce their position in modern industrial workflows.

Strategic Market Drivers

Surging Demand in Paints, Coatings, and Adhesives

The paints and coatings sector remains the powerhouse of aliphatic solvent consumption. Increasing residential and commercial construction, renovation activities, and the rapid adoption of protective coatings in industrial infrastructure are driving requirements for mineral spirits, hexane, heptane, and varnish makers.

Manufacturers are also responding to sustainability goals by shifting to low-VOC, cleaner-burning aliphatic formulations that support regulatory compliance without compromising performance.

Agrochemicals Sector Expands Solvent Utilization

Aliphatic solvents are gaining prominence in agrochemical formulations, especially as carriers and diluents in pesticides and herbicides. Rising global food demand and the expansion of mechanized farming have increased the consumption of solutions where aliphatic solvents enhance dispersion, stability, and delivery efficiency.

Growth in Automotive and Industrial Maintenance

Automotive workshops and manufacturing units rely on aliphatic solvents for degreasing, engine cleaning, and parts maintenance. Their quick evaporation rates, reduced odor profiles, and favorable safety characteristics make them consistent choices for routine maintenance work.

With automotive production increasing across Asia-Pacific and the Middle East, demand for high-purity aliphatic solvents is expected to see sustained momentum.

Rising Use in Polymerization and Chemical Processing

Chemical manufacturers use aliphatic solvents in polymerization reactions, extraction processes, and resin production. Their selective solvency and high flash points are particularly valued in producing synthetic rubber, adhesives, and specialty chemicals.

Browse Full Report: https://www.factmr.com/report/aliphatic-solvents-market

Regional Growth Landscape

East Asia Leads with Industrial Dominance

China, South Korea, and Japan anchor global demand thanks to large-scale manufacturing, booming construction industries, and the concentration of petrochemical plants. The region’s expanding coatings, adhesives, and electronics markets provide strong consumption pipelines for aliphatic solvents.

North America Advances with Eco-Friendly Solutions

The U.S. and Canada continue to adopt low-VOC solvent formulations driven by EPA regulations and the push for greener industrial chemistry. Strong automotive, energy, and coatings industries ensure steady market expansion while suppliers invest in bio-based solvent development.

Europe Driven by Compliance and Modernization

Strict environmental policies across Germany, France, and the U.K. encourage producers to innovate with low-aromatic, high-purity solvent blends. Europe’s advanced industrial cleaning, chemical processing, and construction sectors maintain consistent demand for specialty aliphatic solvents.

Emerging Markets Fuel High-Potential Opportunities

Rising industrialization in South Asia, Latin America, and the Middle East is creating new opportunities for solvents used in coatings, agriculture, and general manufacturing. Government-led infrastructure projects and growing automotive assembly capacities accelerate market adoption.

Market Segmentation Insights

By Product Type

- Mineral Spirits – Widely used in coatings, cleaning, and degreasing.

- Hexane – Essential in extraction, adhesives, and industrial formulations.

- Heptane – Popular for polymerization and specialty chemical reactions.

- Varnish Makers & Other Solvents – Used in paints, cleaning chemicals, and surface treatments.

By End-Use Industry

- Paints & Coatings – Largest application segment due to extensive usage in thinning, dissolution, and consistency control.

- Agrochemicals – Increasing role in pesticide and herbicide formulations.

- Automotive & Industrial – Growing adoption in degreasing and equipment maintenance.

- Chemical Processing – Expanding applications in polymerization, resin production, and extractions.

Challenges Impacting Market Dynamics

- Fluctuating Crude Oil Prices: Input cost volatility directly affects solvent pricing and margins.

- Stringent VOC Regulations: Environmental compliance pressures force continuous product reformulation.

- Shift Toward Water-Based Systems: Growing preference for eco-friendly coatings challenges solvent-based market share.

- Supply Chain Risks: Petrochemical feedstock disruptions due to geopolitical and logistical pressures can impact production continuity.

Competitive Landscape

The global aliphatic solvents market is moderately consolidated, with leading companies focusing on product innovation, cleaner formulations, and capacity expansions.

Key Players in the Aliphatic Solvents Market

- Exxon Mobil Corporation

- Royal Dutch Shell plc (Shell)

- TotalEnergies SE

- Chevron Phillips Chemical Company LLC

- Idemitsu Kosan Co., Ltd.

- Bharat Petroleum Corporation Limited (BPCL)

- LyondellBasell Industries N.V.

- SK Geo Centric Co., Ltd.

- Neste Oyj

- Compañía Española de Petróleos, S.A. (CEPSA)

These companies are strengthening global supply chains, investing in high-purity solvent technologies, and expanding into emerging regions to capture new opportunities.

Future Outlook: Toward Cleaner, Safer, and High-Purity Solvent Solutions

Between 2025 and 2035, the aliphatic solvents market will evolve with a focus on environmental compatibility, purity enhancement, and application-specific performance. The rise of bio-based solvents, digital production monitoring, and sustainable petrochemical refining will define the next decade.

With continued growth in coatings, agrochemicals, and industrial applications, the aliphatic solvents market is set for resilient, demand-driven expansion. Companies that prioritize green chemistry, supply stability, and regulatory alignment will lead the next chapter of solvent innovation.