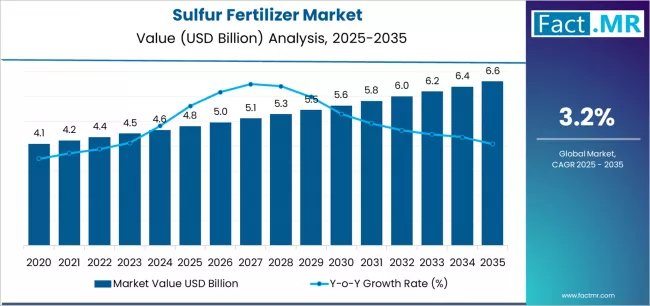

The global sulfur fertilizer market is positioned for healthy expansion as farmers and agribusinesses worldwide prioritize nutrient balance, soil regeneration, and higher crop productivity. According to a new analysis by Fact.MR, the market is valued at USD 4.8 billion in 2025 and is projected to reach USD 6.6 billion by 2035, reflecting an absolute increase of USD 1.8 billion. This represents a total growth of 37.5%, with demand set to rise at a CAGR of 3.2% during the forecast period.

As sulfur deficiencies expand across intensively cultivated farmlands, sulfur fertilizers are emerging as a critical tool for improving nitrogen efficiency, enhancing protein synthesis, and strengthening crop resilience.

Strategic Market Drivers

Growing Sulfur Deficiency in Agricultural Soils

Rising crop intensification, reduced atmospheric sulfur deposition, and long-term soil degradation are amplifying deficiency concerns worldwide. Sulfur fertilizers—especially sulfate, elemental sulfur, and ammonium sulfate-based products—are being widely adopted to restore soil balance and improve nutrient uptake.

High Demand from Oilseeds, Cereals, and Pulses

Crops such as canola, soybean, cotton, wheat, and maize require sulfur for optimal growth. Expanding consumption of high-protein food products and edible oils is boosting the use of sulfur fertilizers to increase yield and enhance crop quality parameters such as protein content, oil concentration, and grain uniformity.

Shift Toward Sustainable and Precision Farming

Farmers are increasingly embracing precision nutrient management systems, microgranular formulations, controlled-release sulfur, and blends compatible with modern application equipment. These solutions minimize nutrient loss, reduce environmental impact, and optimize yield output, strengthening market growth.

Expanding Use in Specialty Crops

Sulfur fertilizers are also gaining traction in fruits, vegetables, and plantation crops, where sulfur improves flavor development, crop coloring, and disease resistance. Rising export-oriented horticulture is creating new revenue opportunities across developing economies.

Browse Full Report: https://www.factmr.com/report/sulfur-fertilizer-market

Regional Growth Highlights

East Asia: Rising Food Production and Fertilizer Consumption

East Asia—led by China—is a major consumer of sulfur fertilizers due to intensive crop cycles, high population pressure, and government initiatives supporting balanced fertilization. Investments in sulfur-based fertilizers for rice, vegetables, and fruit crops are steadily increasing.

North America: Strong Focus on Crop Quality and Efficiency

The U.S. and Canada continue to invest in sulfur fertilizers to counter declining soil sulfur levels caused by cleaner air policies. Growing adoption of precision application technologies and liquid sulfur fertilizers further supports market expansion.

Europe: Sustainability-Driven Market Reforms

Strict environmental regulations and nutrient stewardship programs are accelerating the use of sulfur fertilizers in the EU. Sulfur-enriched NPK blends and eco-friendly formulations are gaining ground in Germany, France, and the U.K., driven by the need to enhance nitrogen-use efficiency.

Emerging Markets: Rapid Agricultural Modernization

South Asia, Latin America, and the Middle East are witnessing rising demand due to increased oilseed cultivation, government subsidies for fertilizer use, and expanding agribusiness supply chains. Countries such as India and Brazil stand out as high-potential markets.

Market Segmentation Insights

By Product Type

- Sulfate-Based Fertilizers – The most widely used category, offering immediate sulfur availability.

- Elemental Sulfur – Favored for long-term soil replenishment and cost-effectiveness.

- Ammonium Sulfate (AS) – Popular for simultaneous nitrogen and sulfur supplementation.

- Gypsum and Potash Sulfate – Used in specialty and chloride-sensitive crops.

By Crop Type

- Cereals & Grains – Largest consumer, driven by wheat, maize, and rice cultivation.

- Oilseeds & Pulses – Growing rapidly due to sulfur’s critical role in oil and protein formation.

- Fruits & Vegetables – Increasing adoption to enhance taste, firmness, and shelf life.

- Others – Including sugarcane, cotton, plantations, and fodder crops.

Challenges and Market Considerations

- Raw Material Price Instability: Volatility in sulfur and ammonia prices directly impacts production costs and farmer affordability.

- Stringent Environmental Regulations: Fertilizer application caps and emission rules require continuous innovation in controlled-release and low-impact solutions.

- Competition from Multi-Nutrient Blends: NPK and micronutrient blends with integrated sulfur are gaining traction, influencing demand for standalone sulfur fertilizers.

- Supply Chain Pressures: Trade policies, logistics disruptions, and fluctuating global sulfur supply can create regional shortages.

Competitive Landscape

The sulfur fertilizer market is characterized by active innovation, global expansion, and strong distribution networks. Manufacturers are investing in advanced sulfur formulations, fortified blends, and sustainable production technologies.

Key Players in the Sulfur Fertilizer Market

- Yara International ASA

- Nutrien Ltd.

- The Mosaic Company

- EuroChem Group AG

- ICL Group Ltd.

- OCI N.V.

- Helm AG

- Sinofert Holdings Limited

- CF Industries Holdings, Inc.

- Saudi Basic Industries Corporation (SABIC)

Industry leaders continue to scale capacity, integrate backward into sulfur sourcing, and collaborate with agritech developers to deliver next-generation nutrient solutions.

Future Outlook: Advancing Agronomic Efficiency and Soil Health

Over the next decade, the sulfur fertilizer market will be shaped by regenerative agriculture, high-efficiency nutrient technologies, and precision farming adoption. Manufacturers are expected to expand offerings in smart-coated sulfur granules, liquid sulfur blends, and bio-based fertilizer hybrids.

As farmers and food companies push for higher yields, better crop quality, and sustainable nutrient practices, sulfur fertilizers will remain central to global agricultural productivity. Companies that innovate and strengthen regional supply capabilities will be best positioned to lead the market’s next phase of growth.