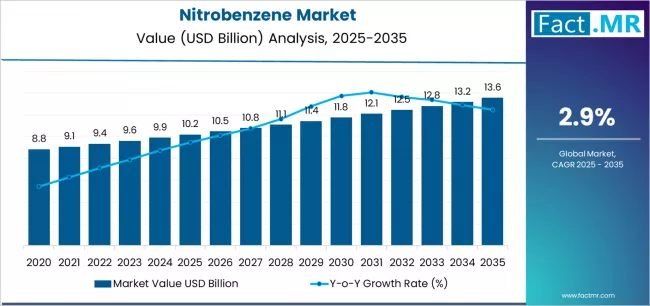

The global nitrobenzene market is poised for consistent long-term growth, driven by expanding aniline production, rising polyurethane output, and increasing demand across construction, automotive, and chemical manufacturing sectors. According to the latest analysis by Fact.MR, the market is projected to grow from USD 10.2 billion in 2025 to USD 13.6 billion by 2035, registering a CAGR of 2.9% during the forecast period.

As industries accelerate the shift toward high-performance intermediates, nitrobenzene remains indispensable for producing aniline, MDI, pesticides, dyes, and various specialty chemicals.

Strategic Market Drivers

Surging Aniline and MDI Production

Aniline remains the dominant application for nitrobenzene. The rising global demand for methylene diphenyl diisocyanate (MDI)—a core ingredient in polyurethane foams—continues to propel nitrobenzene consumption.

Polyurethanes are gaining rapid traction in:

- Building insulation

• Automotive seating and interior components

• Refrigeration systems

• Furniture and bedding

The global transition toward energy-efficient insulation materials further strengthens the long-term demand curve.

Growing Role in Agriculture and Specialty Chemicals

Nitrobenzene’s use in producing fertilizers, agrochemicals, dyes, and lubricating oil additives is expanding as agriculture-focused economies modernize their crop protection and nutrient-management systems.

Increasing demand for high-value specialty chemicals—particularly in coatings, rubber processing, and electronics—is also boosting the material’s importance across industrial ecosystems.

Industrialization and Capacity Expansion in Asia

China and India continue to lead global nitrobenzene and aniline production, supported by large-scale chemical manufacturing bases, continuous capacity expansion, and strong downstream demand from polyurethane and dye industries.

Browse Full Report: https://www.factmr.com/report/4733/nitrobenzene-market

Regional Growth Highlights

East Asia: Global Production Hub

East Asia accounts for a major share of global nitrobenzene output. China’s robust polyurethane manufacturing sector, extensive chemical value chain, and steady construction demand reinforce the region’s dominance.

Japan and South Korea continue to adopt advanced technologies for high-purity chemical intermediates, strengthening regional supply capabilities.

North America: Polyurethane Demand Remains a Key Catalyst

The U.S. is witnessing stable nitrobenzene consumption due to the growing use of rigid and flexible polyurethane foams in construction, automotive, and consumer goods.

Chemical producers are investing in high-efficiency production lines to reduce emissions and comply with tightening environmental norms.

Europe: Regulation-Led Innovation

Europe’s stringent industrial chemical safety and sustainability guidelines are pushing manufacturers to innovate low-emission and energy-efficient production technologies.

Germany, Belgium, and the Netherlands continue to act as strategic hubs for regional polyurethane and chemical exports.

Emerging Markets: Industrialization on the Rise

Countries across South Asia, the Middle East, and Latin America are expanding their chemical production infrastructure. Increasing investments in furniture manufacturing, automotive assembly, and agrochemical production are boosting nitrobenzene adoption in these markets.

Market Segmentation Insights

By Application

- Aniline Production – Dominant application, driven by MDI and polyurethane demand

• Agriculture (Pesticides & Fertilizers) – Growing adoption in crop yield enhancement chemicals

• Pharmaceuticals – Increasing use in chemical synthesis

• Dyes & Pigments – Strong demand from textiles and specialty coatings

• Others – Rubber chemicals, lubricants, and specialty intermediates

By End Use Industry

- Construction & Insulation Materials – Rapid shift to energy-efficient building solutions

• Automotive – Rising use of polyurethane for interiors and noise reduction

• Chemical Manufacturing – Core raw material for downstream chemical synthesis

• Furniture & Bedding – Growth driven by consumer comfort and lifestyle trends

Challenges and Industry Considerations

- Feedstock Volatility: Fluctuations in benzene prices impact nitrobenzene production costs.

• Environmental & Safety Regulations: Strict limits on emissions and hazardous intermediates require continuous process upgrades.

• High Energy Utilization: Production involves energy-intensive nitration processes, raising operational expenses.

• Competitive Alternatives: Modifications in polyurethane formulations and competing insulation materials may pressure long-term margins.

Competitive Landscape

The nitrobenzene market is characterized by capacity expansion, technology upgrades, and strategic regional partnerships. Key players are investing in efficient nitration processes, sustainability frameworks, and optimized downstream integration.

Key Players in the Nitrobenzene Market

- Covestro

• BASF

• Wanhua Chemical

• Huntsman

• GNFC

• Atul

• Dow

• China National Chemical

• Mitsui Chemicals

• Kumho Mitsui Chemical

These companies are focused on:

- Increasing production capacity

• Advancing nitration technology for lower emissions

• Strengthening global supply chains

• Expanding polyurethane and aniline downstream businesses

Future Outlook: Toward High-Efficiency and Sustainable Chemical Intermediates

The coming decade will reshape the nitrobenzene industry with deeper emphasis on sustainability, cleaner chemical synthesis, and integrated production ecosystems. Manufacturers are adopting digital monitoring systems, energy-optimized processes, and circular chemical strategies to reduce their environmental footprint.

With steady demand growth across polyurethanes, agrochemicals, and specialty chemicals, the global nitrobenzene market is set for durable expansion through 2035. Companies that invest in innovation, capacity modernization, and regional collaboration will lead the next phase of growth—powering the evolution of global chemical manufacturing.