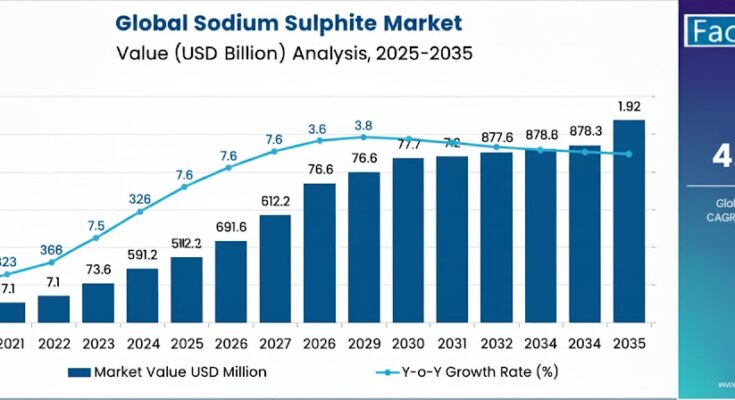

The global sodium sulphite market is poised for steady expansion over the next decade, driven by increasing industrial applications, regulatory focus on water treatment, and rising demand from pulp & paper and textile industries. According to Future Market Insights (FMI), the market is valued at USD 1.15 billion in 2025 and is projected to reach USD 1.92 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.8%.

The FMI report, “Sodium Sulphite Market Size, Share, and Forecast 2025–2035”, highlights the market’s steady growth trajectory, fueled by industrial modernization, environmental compliance requirements, and rising awareness of sodium sulphite’s role in water treatment, food preservation, and chemical processing applications.

Industrial Applications Propel Market Expansion

Sodium sulphite’s demand in pulp & paper production remains a major growth driver. As global paper consumption rises, the need for bleaching agents and anti-oxidants sustains sodium sulphite consumption. Between 2025 and 2030, the pulp & paper application is expected to account for 38% of global market growth, with a market value increase of USD 0.19 billion. From 2030 to 2035, the chemical processing and water treatment segments are projected to drive an additional USD 0.23 billion growth, reflecting stringent wastewater regulations and expanding industrial water treatment infrastructure.

“Industries are increasingly recognizing sodium sulphite not just as a chemical additive but as a critical component for regulatory compliance in water treatment and bleaching processes,” said an FMI market analyst. “Its stability, cost-effectiveness, and versatility across multiple applications underscore its enduring relevance.”

Key Market Insights at a Glance

| Metric | Global Estimate |

|---|---|

| Market Value (2025) | USD 1.15 billion |

| Forecast Value (2035) | USD 1.92 billion |

| CAGR (2025–2035) | 4.8% |

| Top Application | Pulp & Paper (38% share) |

| Fastest-Growing Application | Water Treatment (6.1% CAGR) |

| Dominant Form | Granular Sodium Sulphite (52% share) |

Regional Growth Outlook

Asia-Pacific is set to remain the largest and fastest-growing market, driven by industrial expansion in China, India, and Southeast Asia. China alone is projected to grow at a CAGR of 5.2%, fueled by pulp & paper modernization, textile industry adoption, and increasing water treatment infrastructure. India follows closely at 5.0% CAGR, supported by expanding textile manufacturing and chemical processing sectors.

North America and Europe will exhibit moderate growth, with CAGRs of 4.0% and 3.9%, respectively, due to regulatory mandates for wastewater treatment and steady pulp & paper consumption. Latin America and the Middle East & Africa are expected to experience incremental growth, driven by emerging industrial hubs and water treatment initiatives.

Segment Overview

By Application:

-

Pulp & Paper: Largest application segment; continues to dominate due to bleaching needs and anti-chlorination processes.

-

Textiles: Rapid adoption in dyeing and finishing operations, especially in sustainable and eco-friendly fabric treatments.

-

Water Treatment: Fastest-growing segment, driven by industrial wastewater standards and municipal water purification initiatives.

-

Chemical Processing & Others: Increasing utilization in sulfite-based chemical intermediates and antioxidant processes.

By Form:

-

Granular Sodium Sulphite: 52% share; preferred for ease of handling, storage, and uniform dissolution.

-

Powder & Liquid Forms: Gaining traction in specialized industrial and water treatment applications.

By End User:

-

Pulp & paper manufacturers remain the largest consumers, accounting for nearly 38% of total demand.

-

Textile manufacturers follow closely at 26%, driven by eco-friendly fabric finishing trends.

-

Water treatment operators and chemical processors are emerging as key demand centers, contributing 21% collectively.

Five Forces Driving Market Growth

-

Industrial Modernization: Expansion of pulp & paper mills, textile manufacturing, and chemical plants globally.

-

Water Treatment Regulations: Stringent wastewater and effluent standards requiring oxidizing and dechlorination agents.

-

Sustainable Practices: Eco-conscious adoption in textiles and pulp & paper industries.

-

Raw Material Availability: Steady access to sodium hydroxide and sulfur dioxide supports consistent production.

-

Global Trade & Distribution: Strategic partnerships and regional supply networks enhance accessibility and market penetration.

Competitive Landscape

Leading players dominating the global sodium sulphite market include:

-

BASF SE

-

Solvay SA

-

Kemira Oyj

-

Ningxia Tianyuan Chemicals Co., Ltd.

-

Shandong Haihua Group

-

Lanxess AG

-

OCI Company Ltd.

Browse Full Report : https://www.factmr.com/report/1365/sodium-sulphite-market

Top manufacturers leverage product innovation, eco-friendly formulations, and global distribution networks to maintain competitive advantage. BASF SE and Solvay SA collectively hold over 30% of global market share, reflecting dominance in specialty and industrial-grade sodium sulphite solutions.

Market Outlook: Driving Sustainability and Industrial Efficiency

Over the next decade, the sodium sulphite market is expected to evolve beyond traditional bleaching and chemical processing applications, with increasing adoption in water treatment, environmental compliance, and specialty chemical production. Emerging trends such as high-purity grades for sensitive industrial processes, water-soluble blends for energy-efficient textile operations, and integration in circular economy models will redefine market dynamics.