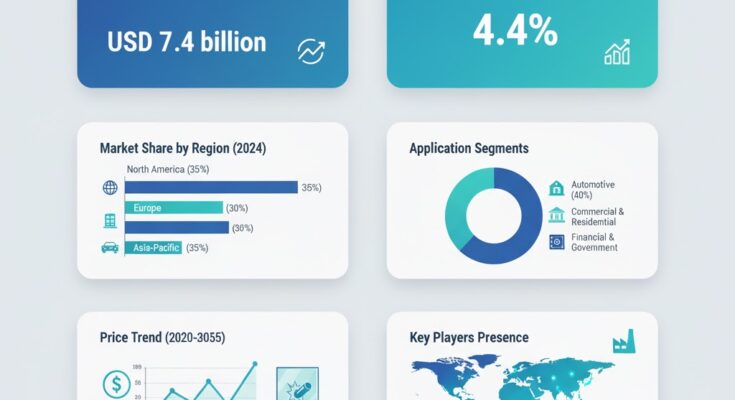

The global bulletproof security glass market is poised for steady expansion amid rising concerns over physical security, infrastructure protection, and the need for high-performance architectural materials. Valued at USD 4.8 billion in 2025, the market is projected to reach USD 7.4 billion by 2035, recording an absolute increase of USD 2.6 billion and growing at a CAGR of 4.4% during the forecast period.

As global urbanization intensifies and threats to physical safety increase, bulletproof glass is emerging as an essential component in commercial, defense, automotive, and banking applications. Its ability to combine transparency with impact resistance and energy efficiency positions it as a critical material in modern construction and vehicle manufacturing.

Market Drivers: Security Concerns, Infrastructure Investment, and Technological Advancements

Rising Global Security Threats and Demand for Reinforced Protection

Increasing incidents of armed assaults, riots, and thefts are compelling governments, financial institutions, and corporations to invest in enhanced security solutions. Bulletproof glass—used extensively in banks, embassies, VIP vehicles, and high-security buildings—provides effective protection against ballistic and blast threats while maintaining clear visibility and aesthetic appeal.

Advancements in Glass Interlayers and Lamination Technology

Innovations in glass lamination, polymer interlayers, and resin technologies have enhanced impact resistance while reducing weight and thickness. Multi-layered composites and thermoplastic interlayers now offer superior optical quality, UV resistance, and thermal insulation, making bulletproof glass both safer and more energy-efficient.

Infrastructure Modernization and Smart Building Integration

Government-led infrastructure modernization and smart city projects are fueling demand for advanced architectural glass. Bulletproof glass is increasingly used in control rooms, airports, data centers, and luxury residential buildings where safety and design aesthetics intersect. Integration with smart sensors and coatings further extends its application in next-generation buildings.

Competitive Landscape

The bulletproof security glass market is moderately consolidated, with global players investing in R&D, production capacity expansion, and partnerships with defense and construction sectors to strengthen their market presence.

Key Players in the Bulletproof Security Glass Market:

- Saint-Gobain

- AGP

- Asahi Glass

- Guardian Glass

- NSG Group

- Schott

- PPG

- Armortex

- TSS

- OSG

- Sisecam

- Romag

- Smartglass

- Everlam

- Jiangsu Yongxiang

These companies are focusing on product innovation, lightweight ballistic composites, and sustainable glass manufacturing to meet evolving market demands. Strategic collaborations and mergers are also reshaping the competitive landscape, especially in Asia-Pacific and the Middle East.

Recent Developments

- August 2025 – Saint-Gobain introduced a next-generation ballistic glass series with advanced polycarbonate interlayers, offering enhanced resistance to multi-caliber impacts and superior optical clarity.

- March 2024 – AGP launched “Armor ONE,” a transparent armor solution for electric and luxury vehicles, reducing weight by 25% while maintaining ballistic protection.

- November 2023 – Schott partnered with defense agencies in Europe to supply customized bulletproof glass for armored military vehicles and embassy facilities.

Segmentation of the Bulletproof Security Glass Market

The market is segmented to reflect product types, applications, end-use industries, and regional dynamics:

- By Type: Polycarbonate, Acrylic, Glass-Clad Polycarbonate, and Others

- By Application: Defense & Military, Banking & Finance, Automotive, Residential & Commercial Buildings, and Others

- By End-Use Industry: Automotive, Construction, Defense, and Marine

- By Sales Channel: Direct Sales, Distributors, and Online Channels

- By Region: North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa

Regional Outlook

North America – Leading in Security Infrastructure

With strong defense budgets and high adoption of armored vehicles, North America dominates the market. The U.S. continues to be a key hub for innovation and large-scale installations in public infrastructure.

Europe – Focused on Safety Standards and Sustainability

Countries such as Germany, France, and the U.K. are advancing safety glass applications through stringent building codes, energy efficiency mandates, and green building certifications.

Asia-Pacific – Fastest Growing Market

Rising crime rates, rapid urbanization, and defense modernization in China, India, and Japan are boosting regional demand. Expanding construction and automotive industries are key contributors to growth.

Future Outlook: Advanced Materials and Integrated Protection Systems

The next decade will witness the emergence of smart bulletproof glass systems equipped with advanced materials and digital integration features:

- Self-Healing Coatings – Nano-based coatings that restore surface integrity after impact.

- Lightweight Composites – Improved polymer-glass hybrids offering ballistic resistance with minimal weight.

- Smart Sensor Integration – Embedded sensors for structural health monitoring and intrusion detection.

- Sustainable Production – Adoption of eco-friendly laminates and recyclable interlayers.

By 2035, the bulletproof security glass market will play a pivotal role in shaping the future of urban security, automotive protection, and smart building design—offering strength, transparency, and innovation in one material.