Global Barge Transportation Market Projected to Surpass $149 Billion by 2026 as Sustainability and Multimodal Logistics Redefine Freight

The global barge transportation market is entering a transformative era, with its valuation projected to reach $149.21 billion by the end of 2026. Driven by a systemic shift toward low-emission logistics and significant infrastructure investments across the Mississippi, Rhine, and Yangtze river corridors, the industry is moving beyond its traditional role as a bulk commodity carrier to become a cornerstone of the modern, green supply chain.

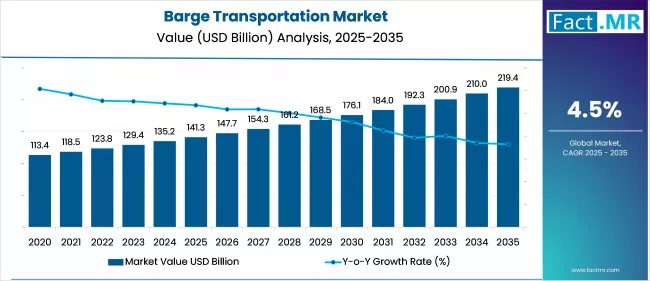

According to latest industry data, the market is expanding at a compound annual growth rate (CAGR) of approximately 5.2%. This steady climb is fueled by an urgent corporate mandate to reduce Scope 3 emissions, where barge transport offers a clear advantage, moving significantly more tonnage per gallon of fuel than either rail or road.

The Strategic Shift: Why Waterways are Winning

As global trade lanes face increasing volatility and overland congestion, the “”who”” and “”why”” of barge transportation have evolved. No longer just the domain of coal and grain, the market is seeing a surge in demand from the petrochemical, renewable energy, and e-commerce sectors.

- Cost-Efficiency: A single 15-barge tow can displace over 1,000 semi-trucks, reducing freight costs by as much as 20% for bulk shippers.

- Environmental Mandates: With international climate policies tightening, the inland waterway system has emerged as the most carbon-efficient mode of surface transport.

- Infrastructure Modernization: Significant federal funding, such as the U.S. Infrastructure Investment and Jobs Act and China’s waterway upgrades, is currently being deployed to modernize aging lock and dam systems, ensuring greater reliability.

Market Segmentation and Regional Dominance

The Dry Cargo segment continues to lead the market, accounting for nearly 48% of the total volume in 2025. However, the Liquid Cargo and Specialty Barge segments—particularly those designed for LNG bunkering and biofuels—are forecasted to witness the fastest growth through 2030, with a CAGR exceeding 9%.

North America remains the largest regional market, holding a 41.6% revenue share, bolstered by the extensive Mississippi River System. Meanwhile, the Asia-Pacific region is identified as the fastest-growing market. Led by China and India, the region is investing billions in “”Blue Economy”” initiatives to link inland industrial hubs directly to deep-water ports.

Browse Full report : https://www.factmr.com/report/2485/barge-transportation-market

Technological Innovation: AI and Green Propulsion

The industry is currently undergoing a digital overhaul. Forward-thinking operators like Kirby Corporation, Ingram Marine Group, and American Commercial Barge Line (ACBL) are integrating AI-driven route optimization and IoT-enabled asset tracking to mitigate risks associated with water-level variability and weather disruptions.

Furthermore, the “”how”” of barge operations is shifting toward electrification. Trials of hydrogen fuel cell propulsion and diesel-electric hybrid barges are moving from pilot programs to fleet-wide implementation, effectively future-proofing the industry against tightening maritime emission standards.

Future Outlook: Navigating 2026 and Beyond

While the market faces headwinds from climate-driven water level fluctuations and high capital costs for fleet renewal, the long-term outlook remains bullish. Analysts expect the integration of intermodal logistics networks—where barges work in seamless tandem with rail and autonomous trucking—to create a more resilient global trade infrastructure.

“”The barge industry is no longer the ‘invisible’ link in the supply chain,”” says a leading market analyst. “”In a world where efficiency and sustainability are non-negotiable, the ability to move massive volumes with a minimal carbon footprint makes inland waterways the ultimate strategic asset.””

About the Barge Transportation Market

The barge transportation market encompasses the movement of cargo via flat-bottomed vessels on inland waterways and intracoastal routes. Key participants include ship owners, logistics providers, and terminal operators focused on the delivery of dry, liquid, and gaseous commodities essential to global industry and agriculture.