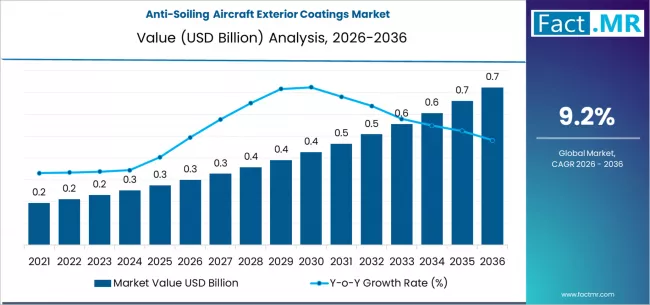

The global anti-soiling aircraft exterior coatings market is transitioning from a niche surface-protection segment into a strategic enabler of airline efficiency, sustainability, and lifecycle cost optimization. Driven by rising global aircraft fleets, mounting fuel-efficiency pressures, and advances in coating chemistry, the market is projected to grow at a high single-digit to low double-digit compound annual growth rate through the mid-2030s. By the end of the forecast period, total market value is expected to more than double from current levels, supported by both original equipment manufacturer (OEM) installations and retrofit demand in the maintenance, repair, and overhaul (MRO) ecosystem.

Anti-soiling coatings are increasingly positioned not merely as protective layers, but as performance-enhancing systems that reduce aerodynamic drag, limit contaminant accumulation, and extend repainting intervals. This shift is redefining procurement decisions across airlines, lessors, and aircraft manufacturers.

Market Size and Structure

The global market for anti-soiling aircraft exterior coatings is estimated to be in the low hundreds of millions of US dollars today and is projected to exceed half a billion dollars within the next decade. Narrow-body aircraft account for the largest share of demand, reflecting their dominance in global commercial fleets and high utilization rates. Wide-body aircraft represent a smaller but higher-value segment due to larger surface areas and longer repaint cycles.

From a value perspective, commercial aviation contributes more than 70% of total demand, followed by business aviation and military aircraft. While military fleets adopt advanced coatings selectively, commercial operators increasingly prioritize coatings that deliver measurable operational savings.

The market is segmented by coating type into anti-soiling topcoats, easy-to-clean clearcoats, and multifunctional coatings that integrate hydrophobic, anti-corrosion, and UV-resistant properties. Multifunctional coatings are the fastest-growing category, reflecting airline demand for consolidated performance benefits.

Core Growth Drivers

Operational Cost Reduction

Aircraft exterior contamination increases surface roughness, leading to higher drag and incremental fuel burn. Even marginal increases in drag can translate into millions of dollars in annual fuel costs across large fleets. Anti-soiling coatings help maintain smoother aerodynamic surfaces by repelling dust, oil residues, insect debris, and atmospheric pollutants. Airlines adopting these coatings report extended cleaning intervals and reduced labor, water, and chemical usage, contributing to lower direct operating costs.

Fuel Efficiency and Emissions Pressure

Fuel expenses typically represent 20–30% of airline operating costs. As fuel price volatility persists and emissions regulations tighten, airlines are increasingly focused on technologies that deliver incremental efficiency gains without requiring major capital investment. Anti-soiling coatings offer a relatively low-risk, high-return solution that aligns with fuel-burn reduction strategies and sustainability commitments.

Global Fleet Expansion

The global commercial aircraft fleet is expected to grow steadily over the next two decades, driven by rising passenger traffic, especially in Asia-Pacific, the Middle East, and parts of Latin America. Each new aircraft delivery represents a long-term opportunity for coating suppliers, not only at entry into service but throughout the aircraft’s lifecycle via repainting and refurbishment.

OEM and Lessors’ Influence

Aircraft lessors, who control a growing share of the global fleet, increasingly favor coatings that preserve asset value and minimize downtime between lease transitions. OEM endorsement of advanced anti-soiling coatings at the line-fit stage further accelerates adoption by reducing certification hurdles and demonstrating long-term performance reliability.

Technology and Innovation Trends

Advances in nanotechnology and polymer science are driving the next generation of anti-soiling coatings. Modern formulations use nano-structured surfaces that reduce adhesion of contaminants at the molecular level, improving durability under extreme temperature variation, UV exposure, and high-altitude operating conditions.

There is a clear shift toward coatings that combine multiple functions into a single layer, reducing overall coating weight and application complexity. Weight reduction, even at marginal levels, is increasingly valued as airlines pursue comprehensive efficiency optimization.

Another emerging trend is the alignment of coating performance with digital maintenance strategies. As aircraft health monitoring systems evolve, surface condition data may be integrated into predictive maintenance models, allowing airlines to optimize cleaning and recoating schedules based on actual performance degradation rather than fixed intervals.

Disruption Signals

Sustainability-Driven Reformulation

Environmental regulations are pushing the industry toward lower-VOC, fluorine-free, and more sustainable coating chemistries. While traditional fluoropolymer-based coatings offer excellent performance, regulatory scrutiny is accelerating investment in alternative materials that balance durability with environmental compliance.

Smart and Adaptive Coatings

Early-stage development of self-healing and adaptive coatings represents a potential long-term disruption. These systems aim to restore surface integrity after minor damage, extending coating lifespan and reducing maintenance frequency. While commercialization remains limited, progress in this area could materially alter competitive dynamics.

Cost Sensitivity in Retrofit Markets

Despite strong value propositions, adoption in retrofit markets can be constrained by upfront costs and application downtime. Innovations that shorten curing times, reduce application complexity, or allow partial surface treatments could unlock faster adoption among cost-sensitive operators.

Regional Dynamics

North America and Europe currently lead the market in terms of technology adoption, driven by mature airline fleets, strong OEM presence, and regulatory pressure to improve efficiency and environmental performance. Asia-Pacific, however, represents the fastest-growing region due to rapid fleet expansion and increasing focus on operational optimization among emerging carriers.

The Middle East also presents a strategic growth opportunity, with high-utilization fleets operating in harsh environmental conditions where anti-soiling performance delivers clear operational benefits.

Competitive Landscape

The market is moderately consolidated, with major global coatings manufacturers competing alongside specialized aerospace coating suppliers. Competitive advantage is defined by certification breadth, long-term performance data, global MRO partnerships, and the ability to support airlines across multiple regions. Increasing collaboration between coating manufacturers, OEMs, and airlines is shaping product development priorities.

Industry Scenarios

Baseline Scenario

Under current adoption trends, the market grows steadily at a high single-digit CAGR, driven by fleet expansion, incremental efficiency gains, and gradual sustainability-driven upgrades.

Accelerated Adoption Scenario

Stronger regulatory pressure on emissions, combined with proven fuel-efficiency data, accelerates adoption across both OEM and retrofit channels. Multifunctional and smart coatings gain rapid traction, pushing growth into double-digit territory.

Conservative Scenario

Economic downturns or airline financial stress delay discretionary maintenance upgrades, slowing retrofit demand. OEM installations remain stable, but overall growth moderates.

Browse Full Report : https://www.factmr.com/report/anti-soiling-aircraft-exterior-coatings-market

Conclusion

The anti-soiling aircraft exterior coatings market is evolving into a strategically important segment of the aerospace value chain. Its ability to deliver measurable cost savings, support sustainability objectives, and enhance asset longevity positions it as a critical technology for the next generation of aircraft operations. Companies that combine material innovation, regulatory foresight, and strong OEM and MRO partnerships are best positioned to capture long-term value as the market scales.