Air suspension line couplings are essential components in automotive pneumatic systems, connecting air suspension lines to valves, compressors, and other suspension modules. They control airflow within the suspension system to enhance ride comfort, load handling, and vehicle stability, particularly in commercial and heavy-duty vehicles. The increasing demand for advanced vehicle performance is driving the adoption of these components in modern pneumatic systems.

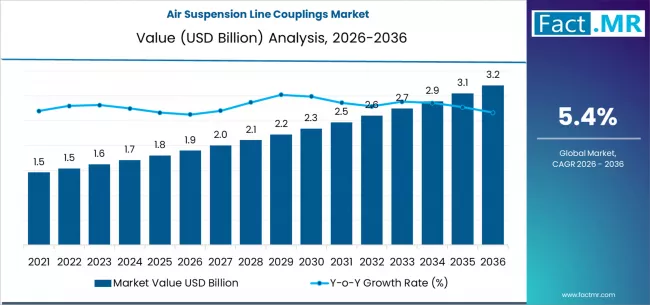

The global air suspension line couplings market is projected to grow from USD 1.9 billion in 2026 to USD 3.2 billion by 2036, representing a CAGR of 5.4% over the forecast period.

Technology Evolution: Driving Innovation & Performance

1. Push-to-Connect Couplings Lead the Market

Push-to-Connect (PTC) couplings are expected to dominate the market with a 56% share in 2026.

-

Ease of Use: PTC couplings require no special tools and reduce assembly time, making them highly attractive for OEMs focused on assembly efficiency.

-

Reliability: They provide robust sealing performance and minimize air leakage, critical for maintaining pneumatic system integrity.

-

Performance Consistency: PTC systems maintain stable pressure handling under various ambient conditions and operational stresses.

The adoption of PTC technology reflects an industry trend toward connectivity, automation, and modular design, enabling faster vehicle assembly and precise pneumatic control.

2. Shift Toward Automated Pneumatic Control Systems

Modern air suspension systems emphasize automation and integrated vehicle control. Coupling systems are evolving to support:

-

Smart diagnostics, enabling real-time monitoring of air pressure and line integrity.

-

Multi-parameter compatibility with advanced suspension modules and electronic control units.

-

Lower maintenance requirements, through improved seal materials and designs.

These innovations improve fuel efficiency, ride stability, and integration with semi-autonomous and autonomous driving technologies.

3. Material Innovations

Couplings are being manufactured with advanced materials such as:

-

Nylon air lines

-

Reinforced rubber

-

Composite materials

Composite materials are increasingly adopted due to their superior strength-to-weight ratio and thermal stability, ideal for heavy-duty and harsh environment applications.

Segmental Insights: Vehicle Type & Sales Channel

1. Vehicle Type: Heavy-Duty Trucks Dominate

Heavy-duty trucks account for a 54% share of the market in 2026.

-

Commercial fleets increasingly rely on air suspension systems for heavy load management and enhanced driver comfort.

-

Reliable pneumatic couplings reduce downtime and maintenance costs, supporting operational efficiency.

-

Regulatory safety standards encourage the use of advanced suspension components.

Buses and trailers also contribute significantly to market growth, driven by similar performance and safety requirements.

2. Sales Channels: OEM & Aftermarket Dynamics

Market sales channels include:

-

OEM line-fit — direct supply to vehicle manufacturers

-

Aftermarket — replacement components and retrofits

-

Dealer/OES systems

OEM demand reflects factory-installed advanced pneumatic systems, while aftermarket growth is driven by retrofits and replacement cycles.

Regional Demand Dynamics

1. Asia Pacific: Fastest Growth

Asia Pacific is projected to be the fastest-growing region, led by China and India.

-

China: Expected CAGR of 7.0%, driven by automotive infrastructure expansion and rising adoption of premium pneumatic technologies.

-

India and ASEAN markets: Growth supported by increasing commercial vehicle deployment and expanding fleet investments.

Rising industrialization and transportation network expansion fuel demand for air suspension couplings.

2. North America & Europe: Mature but Stable Growth

-

United States: CAGR of approximately 5.1%, with growth fueled by fleet modernization and strong aftermarket networks.

-

Europe: Demand supported by strict safety and emissions regulations and high adoption of advanced vehicle technologies.

Both regions benefit from mature automotive ecosystems and well-established supplier networks.

3. Latin America & Middle East/Africa: Emerging Opportunities

-

Brazil: CAGR of 6.8%, driven by commercial fleet modernization.

-

Middle East & Africa: Gradual adoption in logistics and commercial transport hubs is expected to grow over the forecast period.

Forecast Scenarios Through 2036

Likely Scenario

-

Market grows at 5.4% CAGR, reaching USD 3.2 billion by 2036.

-

Heavy-duty truck applications and push-to-connect technology continue to anchor demand.

Optimistic Scenario

-

Rapid adoption of automated pneumatic control systems and favorable regulatory frameworks could accelerate growth.

-

Vehicle electrification and semi-autonomous technologies may further expand market opportunities.

Conservative Scenario

-

Supply chain constraints or slower vehicle production could moderate growth.

-

Aftermarket and retrofit channels may partially offset slower OEM adoption.

Competitive Landscape

Major players in the market include Parker Hannifin, Eaton, WABCO, Knorr-Bremse, Continental, Haldex, NORMA Group, Gates, Cooper Standard, and Schaeffler. These companies focus on:

-

Expanding product portfolios

-

Enhancing technological capabilities

-

Strengthening distribution and service networks

Strategic partnerships with OEMs and continuous R&D are critical to maintaining market leadership.

Key Market Drivers & Challenges

Drivers

-

Rising demand for improved pneumatic performance in commercial vehicles

-

Growth in logistics and fleet modernization

-

Focus on ride comfort and operational efficiency

Challenges

-

High costs and integration complexity

-

Need for specialized maintenance and service infrastructure in emerging markets

Browse Full Report : https://www.factmr.com/report/air-suspension-line-couplings-market

Conclusion

The global air suspension line couplings market is set for steady growth through 2036, driven by push-to-connect technology, heavy-duty truck applications, and rising demand in Asia Pacific, North America, and Europe. Regulatory pressures, combined with material and automation innovations, will continue shaping market dynamics, making this a pivotal segment in the automotive systems industry.