The Global Protein Content Optimizing Cereal Fertility Program Market is projected to experience significant growth between 2026 and 2036, driven by rising demand for protein-enriched staple crops, climate-resilient agriculture, and adoption of precision nutrition strategies. As global food security pressures increase and consumers prioritize higher nutritional quality, programs aimed at optimizing protein content in cereals such as wheat, rice, maize, barley, and sorghum are gaining strategic importance across agricultural supply chains.

Market Overview and Growth Outlook

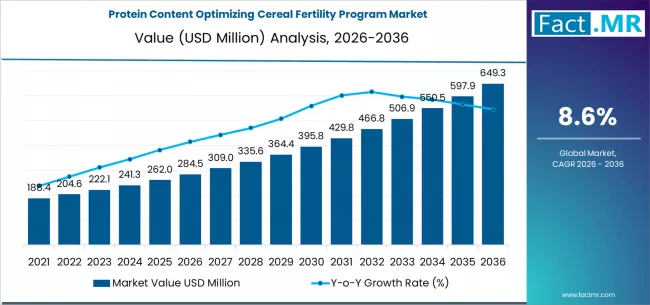

The market is expected to grow at a compound annual growth rate (CAGR) of 6.5–7.8% over the next decade, with total revenues potentially doubling by 2036. Expansion is fueled by investments in soil fertility management, nitrogen-use efficiency technologies, micronutrient supplementation, and data-driven agronomic advisory systems.

Protein optimization programs integrate nutrient management protocols, crop genetics, soil diagnostics, and digital decision-support tools to enhance protein accumulation in cereals without compromising yield. These programs are increasingly adopted as governments and agribusinesses shift focus from purely yield-based production to nutritional quality.

Key Market Drivers

-

Growing Global Protein Demand

Worldwide protein consumption is expected to increase by more than 30% by 2035, with cereals providing nearly 40% of dietary protein in emerging economies. Protein-enhanced cereals are recognized as cost-effective solutions to address malnutrition. -

Premium Pricing for High-Protein Crops

Farmers implementing protein optimization strategies can achieve price premiums ranging from 8% to 20%, particularly for wheat and barley intended for baking, malting, and functional foods. -

Government and Policy Support

Initiatives promoting nutrient-use efficiency, reduced fertilizer runoff, and climate-smart agriculture are accelerating adoption of fertility programs designed to optimize both yield and nutritional output. -

Technological Advancements

The integration of precision agriculture, AI-driven soil analytics, controlled-release fertilizers, and bio-stimulants has enhanced the scalability and predictability of protein optimization programs.

Market Segmentation Insights

By program type, integrated fertility management systems account for approximately 45% of market revenue, followed by targeted nitrogen optimization and micronutrient enhancement solutions. Demand for biological and low-emission fertilizers is rising faster than conventional inputs, reflecting sustainability-driven procurement trends.

By crop type, wheat leads the market due to its sensitivity to protein content and strong linkage to quality-based pricing. Rice and maize are projected to grow fastest, especially in regions where protein enhancement programs are linked to food security policies.

By end user, commercial farms and contract growers account for over 55% of demand, with adoption among smallholder farmers increasing through cooperative models and subsidized programs.

Supply Chain Dynamics

The supply chain for protein-optimizing cereal fertility programs is evolving into an integrated solution ecosystem, including:

-

Input manufacturers producing fertilizers, bio-stimulants, and soil amendments

-

Agri-tech providers offering soil testing, remote sensing, and predictive analytics

-

Advisory service firms providing crop nutrition consultation and digital agronomy support

-

Offtakers and processors requiring consistent protein quality

While localized production of fertilizers and digital service delivery have improved supply chain resilience, volatility in nitrogen-based input costs continues to pose a challenge.

Risk Assessment and Market Constraints

Despite promising growth, several risks could impact market expansion:

-

Input Cost Volatility

Fertilizer price fluctuations can increase program costs by 15–30%, affecting adoption among price-sensitive farmers. -

Climate Variability

Protein synthesis in cereals is sensitive to heat stress and water scarcity. Climate fluctuations introduce trade-offs between yield and protein content that require advanced risk modeling. -

Knowledge and Adoption Gaps

In low-income regions, limited access to agronomic training and digital tools can reduce program effectiveness and scalability. -

Regulatory Uncertainty

Changing regulations around nitrogen application limits and emission reporting could increase compliance costs in certain regions.

Regional Market Trends

-

Asia-Pacific dominates volume due to large cereal production bases and government-led nutritional enhancement initiatives.

-

North America leads in technology adoption and premium protein wheat production, driving high-value revenue.

-

Europe emphasizes sustainability and compliance, favoring low-input, high-efficiency fertility solutions.

-

Latin America and Africa offer high-growth potential as commercial farming expands and soil health initiatives gain traction.

Competitive Landscape and Innovation Trends

The market is characterized by partnerships between fertilizer manufacturers, agri-tech startups, and food processors. Leading players focus on field-level data integration, adaptive nutrient algorithms, and outcome-based pricing models tied to protein performance.

Key innovation areas include:

-

Real-time protein prediction analytics

-

Enhanced nitrogen-use efficiency formulations

-

Bio-based soil enhancers

-

Climate-adaptive fertility protocols

Browse Full Report: https://www.factmr.com/report/protein-content-optimizing-cereal-fertility-program-market

Market Trajectory Through 2036

By 2036, protein content optimization is expected to shift from a value-added feature to a baseline requirement in cereal supply chains. Programs that combine agronomic precision, sustainability compliance, and economic returns will define market leadership.

As global food systems increasingly prioritize nutritional density, traceability, and environmental sustainability, the Protein Content Optimizing Cereal Fertility Program Market will play a pivotal role in bridging productivity with purpose and profitability. High-protein cereals are set to become a central component of both food security strategies and value-driven agriculture worldwide.