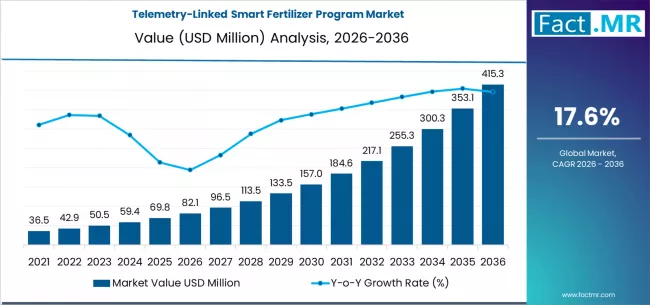

The global telemetry-linked smart fertilizer program market is set for transformational growth over the next decade, driven by rising demand for precision agriculture, sustainable farming practices, and real-time crop nutrient optimization. According to a new analysis by Fact.MR, the market is projected to expand from USD 82.09 million in 2026 to USD 415.28 million by 2036, registering an impressive CAGR of 17.6% during the forecast period.

This exponential expansion marks a fundamental shift from traditional, periodic, and map-based fertilization methods to dynamic, telemetry-driven, real-time nutrient management systems, enabling farmers to optimize yields while minimizing environmental impact.

Browse Full Report:

https://www.factmr.com/report/telemetry-linked-smart-fertilizer-program-market

Strategic Market Drivers

Precision Agriculture Revolution Accelerates Adoption

The global transition toward data-driven farming is accelerating demand for telemetry-linked fertilizer programs. These systems leverage real-time field data collected via sensors, satellite imagery, and IoT-enabled devices to deliver precise nutrient recommendations, reducing over-application and improving soil health.

Farmers are increasingly adopting telemetry-linked solutions to:

- Enhance crop productivity

- Reduce fertilizer waste

- Improve nutrient-use efficiency

- Support sustainable land management

Rising Demand for Sustainable & Climate-Smart Agriculture

Governments and agricultural bodies worldwide are promoting sustainable farming practices to combat soil degradation, water pollution, and greenhouse gas emissions. Telemetry-linked smart fertilizer programs align perfectly with these objectives by enabling:

- Controlled nutrient release

- Lower nitrogen runoff

- Reduced carbon footprint

This has made them a cornerstone of climate-smart agriculture initiatives.

Advancements in Agri-IoT & Sensor Technologies

Rapid advancements in soil sensors, weather stations, satellite monitoring, and cloud analytics are enhancing the accuracy and reliability of smart fertilizer programs. Integration with AI-driven decision-support platforms allows continuous optimization based on:

- Soil moisture

- Nutrient availability

- Crop growth stages

- Weather conditions

These technological improvements are significantly expanding commercial-scale adoption.

Rising Global Food Demand & Yield Optimization Needs

With global food demand rising due to population growth and shrinking arable land, farmers are under pressure to maximize yields per hectare. Telemetry-linked fertilizer programs enable precise nutrient timing and dosage, directly improving crop performance and profitability.

Regional Growth Highlights

North America: Precision Agriculture Leadership

North America remains a leading market due to high adoption of precision farming technologies, advanced farm mechanization, and strong support from agritech startups. The U.S. and Canada are witnessing increased integration of telemetry-based nutrient management across large-scale farms.

Europe: Sustainability-Driven Adoption

Strict EU regulations on fertilizer usage, nitrate emissions, and environmental protection are accelerating adoption of smart fertilizer programs. Countries such as Germany, France, the Netherlands, and the U.K. are investing heavily in digital agriculture solutions.

Asia-Pacific: High Growth Potential

Asia-Pacific is expected to witness the fastest growth, driven by:

- Rising food demand

- Government-backed smart farming initiatives

- Rapid digitalization of agriculture in China, India, Japan, and Southeast Asia

Smallholder-focused telemetry solutions are gaining traction across the region.

Emerging Markets: Expanding Smart Farming Infrastructure

Latin America, the Middle East, and Africa are showing increasing adoption due to:

- Expansion of commercial farming

- Water scarcity concerns

- Need for fertilizer efficiency in arid regions

Market Segmentation Insights

By Technology Type

- Soil Sensor-Based Telemetry – Dominant due to real-time nutrient and moisture monitoring

- Satellite & Remote Sensing – Growing adoption for large-area crop analytics

- Weather-Integrated Telemetry Systems – Enhancing nutrient timing accuracy

By Crop Type

- Cereals & Grains – Largest segment driven by staple food demand

- Fruits & Vegetables – High growth due to yield sensitivity to nutrient precision

- Oilseeds & Pulses – Increasing adoption for sustainability compliance

By Farm Size

- Large Commercial Farms – Leading adoption due to scalability benefits

- Medium Farms – Rapid growth with declining sensor and IoT costs

- Smallholder Farms – Emerging adoption supported by government subsidies

Challenges Impacting Market Growth

High Initial Investment Costs

The cost of sensors, telemetry infrastructure, and analytics platforms can limit adoption among small-scale farmers, particularly in developing regions.

Data Integration & Technical Complexity

Managing and interpreting large volumes of real-time field data requires technical expertise, posing adoption challenges for traditional farming operations.

Connectivity Constraints in Rural Areas

Limited internet and IoT connectivity in remote agricultural regions may restrict real-time telemetry implementation.

Competitive Landscape

The telemetry-linked smart fertilizer program market is moderately fragmented, with players focusing on AI-powered analytics, sensor innovation, and scalable subscription-based platforms.

Key Companies Profiled

- John Deere

- Trimble Inc.

- AGCO Corporation

- Yara International

- Nutrien Ltd.

- BASF Digital Farming

- Corteva Agriscience

- Climate LLC (Bayer)

- Topcon Positioning Systems

- Raven Industries

Companies are investing in AI-driven nutrient modeling, cloud-based dashboards, and integrated farm management ecosystems.

Recent Developments

- 2025: Launch of AI-powered nutrient telemetry platforms offering predictive fertilizer recommendations

- 2024: Expansion of smart fertilizer programs integrated with satellite and drone-based analytics

- 2023: Increased government-backed pilot projects promoting real-time nutrient management

Future Outlook: The Next Decade of Intelligent Nutrient Management

The telemetry-linked smart fertilizer program market is poised for rapid expansion through 2036, supported by:

- Growing precision agriculture adoption

- Climate-smart farming initiatives

- AI and IoT-driven agronomic intelligence

- Rising demand for fertilizer efficiency

- Digital transformation of global agriculture

As agriculture shifts toward real-time, data-driven decision-making, telemetry-linked smart fertilizer programs will play a critical role in enhancing productivity, sustainability, and long-term food security worldwide.