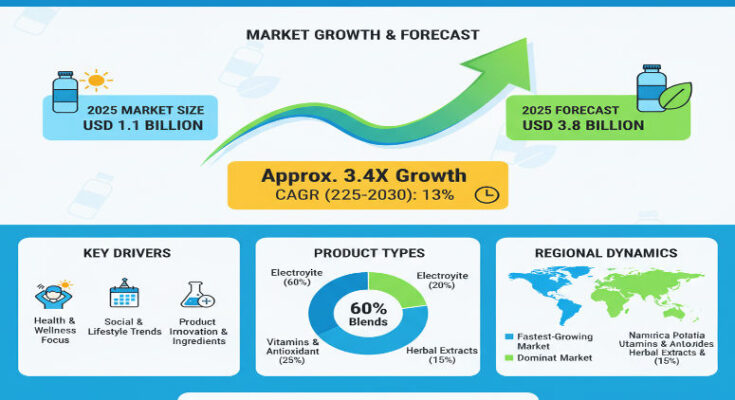

Recent studies estimate the global Hangover Rehydration Supplements Market at around USD 1.1 billion in 2025, with forecasts projecting growth to roughly USD 3.8 billion by 2035, at a compound annual growth rate (CAGR) of about 13%.

What’s Fueling the Surge

Several converging forces are pushing this category beyond niche status into mainstream wellness:

-

Preventive wellness mindset: Instead of just recovering, more consumers want to preempt the effects of alcohol—rehydrate, replenish, and support liver function and recovery.

-

Natural & functional ingredients gaining credibility: Botanical extracts (milk thistle, prickly pear), compounds like dihydromyricetin (DHM), activated B-vitamins, and clean-label, plant-based actives are increasingly popular. They’re bolstered by influencer marketing and growing clinical interest.

-

Format innovation & convenience: Liquid solutions, effervescent tablets, on-the-go powders or stick packs, nano-emulsified liquid shots—all offer faster absorption or more convenient dosing. These formats appeal heavily to younger, urban consumers in North America and Asia-Pacific.

-

Channel shifts: E-commerce and direct-to-consumer (DTC) models are growing fast—often backed by personalization, subscription, and strong social media or influencer presence. Yet, traditional retail (pharmacies, convenience stores, offline stores) still contributes a large share, especially in markets where consumers prefer to purchase in person.

Segments & Product Trends

By product type, solutions (liquid or effervescent forms) dominate—thanks to faster rehydration and visible, near-immediate relief. In 2025, solutions are estimated to hold over 70% of market share in most reports. Tablets and capsules lag in absorption speed but maintain relevance for portability and preference in less liquid-friendly usage.

Distribution is split roughly between online (≈ 40-45%) and offline channels (≈ 55-60%), with online growing faster due to convenience, subscription models, and influencer traction.

Regional Insights: U.S. & Europe

-

United States: The U.S. is a leading market—high awareness of wellness and nutraceuticals, broad e-commerce penetration, established supplement regulation infrastructure, and consumers willing to pay for premium, clean-label formulations. In many U.S. reports, expect a CAGR around 7-8% for the market over several years, with strong growth in online + DTC channels.

-

Europe: Europe is also growing, though with more emphasis on regulatory compliance, ingredient transparency, and clean or vegan labeling. Countries like Germany, the UK, Sweden are key; consumers often demand clinically tested products, low sugar, natural ingredients. Growth is steadier but quality expectations are high.

Asia-Pacific is frequently identified as the fastest growing region, due to rising disposable incomes, urban nightlife culture, and increasing health awareness among younger generations.

Key Players & Competitive Landscape

Leading brands are carving out distinct positioning:

-

Cheers Health, Inc. emerges as a frontrunner with formulas combining DHM, milk thistle, electrolytes, and strong clinical or research backing.

-

Liquid I.V. (now part of Unilever) uses its broad distribution, strong branding, and trusted hydration science to reach mainstream audience.

-

Other players like Flyby Ventures, More Labs, Blowfish, Rally Labs, Drinkwel, DOTSHOT, etc., are competing on nuances: flavor profiles, form factor, added extras (sleep aids, anti-nausea, immunity support), or sustainable & clean formulations.

Competition is shifting from “just alleviating hangovers” toward holistic after-party recovery: rehydration, detoxification, supporting liver recovery, helping with fatigue.

Challenges & Barriers to Uptake

-

Regulatory scrutiny & clinical evidence: Some markets demand higher validation of claims around hangover relief, dehydration, etc. Brands lacking rigorous science or making exaggerated claims risk regulatory pushback.

-

Ingredient sourcing & quality: Natural plants or botanical extracts may vary in quality. Ensuring consistent potency, clean-label, non-contaminated ingredients is critical.

-

Consumer trust & claims fatigue: With many supplements in the space, consumers are increasingly skeptical. Branding without proof or high perceived value may struggle.

-

Price sensitivity & product efficacy: Premium formulations may hit price ceilings. Consumers will compare efficacy (onset, relief strength) vs. cost.

Market Outlook & Strategic Implications

Looking ahead, the hangover rehydration supplements market is likely to evolve in several ways:

-

Personalization (tailoring based on drinking habits, body weight, diet) could drive higher value.

-

Multi-symptom formulations (hydration + liver support + sleep + immunity) will likely outperform single-benefit products.

-

Sustainable and clean label credentials will strongly influence purchase decisions—packaging, ingredient source, ethical practices.

-

Marketing partnerships with nightlife venues, festivals, hospitality chains may offer high-impact touchpoints.

-

Increasing adoption of subscription models and bundles (e.g. recovery kits) will strengthen recurring revenue and customer loyalty.

Browse Full Report: https://www.factmr.com/report/hangover-rehydration-supplements-market

Editorial Take: Is Hangover Recovery the Next Big Wellness Frontier?

From where I observe the market, the notion of “hangover supplements” is shifting—from a convenience for party-goers to part of a broader preventive health and wellness toolkit. Consumers are no longer waiting to feel bad; they want to avoid it, mitigate it, bounce back quicker.

For brands, the winners will be those that combine science, clean/natural credentials, customer trust, format innovation, and visibility (online + offline). The U.S. and Europe will set standards around regulation and ingredient transparency; Asia-Pacific will likely set pace in volume growth.

This is more than just helping with headaches—it’s about building responsible wellness categories, backed by efficacy, convenience, and credibility.