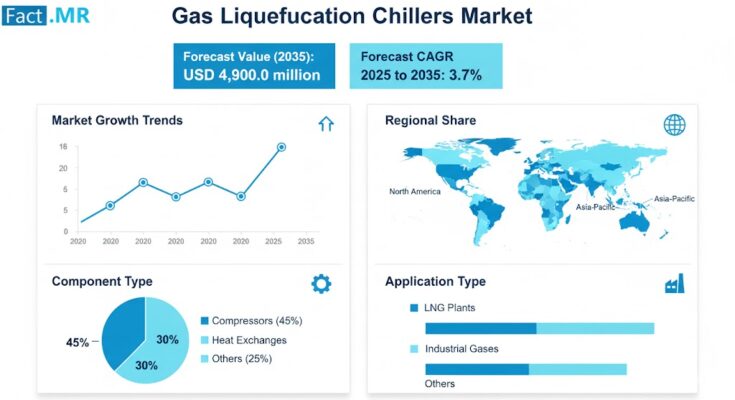

The global gas liquefaction chillers market is poised for a period of stable expansion, driven by increasing energy infrastructure investments, rising demand for liquefied natural gas (LNG), and advancements in cryogenic technology. According to a recent report by Fact.MR, the market is projected to grow from USD 3,400.0 million in 2025 to USD 4,900.0 million by 2035, marking an absolute increase of USD 1,500.0 million and registering a CAGR of 3.7% during the forecast period.

As industries worldwide accelerate efforts toward cleaner and more efficient energy systems, gas liquefaction chillers have become indispensable for optimizing cryogenic processes and ensuring safe, reliable gas handling across diverse end-use sectors.

Strategic Market Drivers

Energy Transition and LNG Demand Surge

The ongoing global transition toward low-carbon energy is fueling the demand for liquefied natural gas (LNG) and other cryogenic gases. Gas liquefaction chillers are essential components in LNG terminals, natural gas processing plants, and peak-shaving facilities.

Rising investments in LNG infrastructure, especially across Asia-Pacific, the Middle East, and North America, are creating lucrative opportunities for chiller manufacturers. These systems are also vital for carbon capture, storage, and hydrogen liquefaction processes, aligning with global decarbonization goals.

Industrial Gases and Chemical Processing Growth

Expanding industrial gas production for medical, chemical, and manufacturing applications is boosting the need for high-performance liquefaction chillers.

From oxygen and nitrogen separation units to hydrogen storage systems, these chillers ensure precise temperature control and energy efficiency. The chemical industry’s emphasis on process reliability and cost optimization continues to drive adoption across both established and emerging economies.

Technological Innovations in Cryogenic Engineering

Manufacturers are focusing on integrating advanced materials, heat exchanger designs, and AI-enabled monitoring systems to enhance chiller efficiency and reduce energy consumption. The development of modular, compact, and low-maintenance systems is reshaping competitiveness, particularly for mid-scale LNG and distributed gas networks.

Browse Full Report: https://www.factmr.com/report/gas-liquefaction-chillers-market

Regional Growth Highlights

East Asia: LNG and Hydrogen Powerhouses

East Asia leads the global market, propelled by China, Japan, and South Korea’s large-scale LNG import facilities and hydrogen economy initiatives. The region’s focus on clean energy, coupled with strong government policies promoting decarbonization, is spurring demand for efficient liquefaction chillers.

North America: Technological Innovation Hub

North America’s dominance in natural gas production, coupled with ongoing LNG export terminal expansions in the U.S. and Canada, positions it as a key regional market. Advanced cryogenic engineering, automation, and energy recovery solutions are central to maintaining competitiveness in this region.

Europe: Sustainability and Energy Security in Focus

Europe’s energy diversification strategy and emphasis on renewable gas storage are accelerating the adoption of liquefaction chillers. Countries like Germany, France, and the Netherlands are investing heavily in LNG import terminals, bio-LNG facilities, and green hydrogen projects—creating consistent demand for next-generation cooling systems.

Emerging Markets: Infrastructure and Industrialization Boom

The Middle East, Africa, and South Asia are witnessing significant infrastructure growth, with governments investing in energy diversification and gas distribution networks. The development of regional gas liquefaction hubs and cryogenic industrial gas plants will underpin robust market expansion through 2035.

Market Segmentation Insights

By Gas Type

- Natural Gas (LNG) – Dominant segment, driven by global LNG trade and clean energy transition.

- Hydrogen – Rapidly growing, supported by global hydrogen economy initiatives.

- Oxygen, Nitrogen & Argon – Expanding use across healthcare and electronics manufacturing.

By Application

- LNG Plants & Terminals

- Hydrogen Liquefaction Systems

- Industrial Gas Processing

- Cryogenic Storage Facilities

By End-Use Industry

- Energy & Power

- Chemical & Petrochemical

- Industrial Manufacturing

- Healthcare & Biotechnology

Challenges and Market Considerations

Despite strong long-term potential, the gas liquefaction chillers market faces notable challenges:

- High Initial Capital Costs: Large-scale liquefaction facilities demand substantial upfront investments in cryogenic infrastructure.

- Operational Complexity: Maintenance and system optimization require specialized expertise and advanced control systems.

- Energy Efficiency Concerns: Rising energy prices and emissions regulations are prompting innovation in low-power chiller technologies.

- Supply Chain Constraints: Global disruptions in compressor and heat exchanger supply chains can delay project timelines.

Competitive Landscape

The gas liquefaction chillers market is moderately consolidated, with global and regional players focusing on technological innovation, strategic partnerships, and capacity expansion to strengthen market positions.

Key Players in the Gas Liquefaction Chillers Market:

- Linde

- Air Liquide

- Chart Industries

- GEA Group

- Atlas Copco

- Siemens

- Cryostar

- Mayekawa

- Ebara Corporation

- Mitsubishi Heavy Industries (MHI)

- Howden

- Cryomech

- AL Khaimah Cryo

These players are emphasizing R&D investments in energy-efficient systems, expanding aftermarket services, and pursuing collaborations for LNG and hydrogen infrastructure projects.

Recent Developments

- February 2024 – Chart Industries announced new high-capacity cryogenic chiller systems tailored for small-scale LNG facilities, aimed at enhancing modularity and energy efficiency.

- September 2023 – Linde unveiled a next-generation hydrogen liquefaction plant in Germany featuring low-carbon, high-efficiency chillers with AI-integrated monitoring.

- June 2023 – Siemens Energy introduced a new digital twin platform to optimize operational performance and predictive maintenance for liquefaction chillers.

Future Outlook: Toward a Low-Carbon, High-Efficiency Future

The decade ahead will redefine the gas liquefaction chillers market through innovation, sustainability, and integration with digital technologies. As the global focus intensifies on hydrogen liquefaction, carbon capture, and LNG energy security, demand for high-efficiency chillers will continue to expand.

Manufacturers prioritizing sustainable engineering, energy optimization, and collaborative innovation will lead the next wave of growth — enabling a resilient, cleaner, and more connected energy ecosystem.