The global dry powder flavors market is poised for robust growth over the next decade, rising from USD 4,500.0 million in 2025 to USD 6,800.0 million by 2035, representing an absolute increase of USD 2,300.0 million. According to a new study by Fact.MR, this trajectory reflects a 4.2% CAGR from 2025 to 2035, driven by mounting demand for convenience foods, premium taste experiences, and advanced encapsulated flavor technologies across food and beverage manufacturing.

The report, “Dry Powder Flavors Market Forecast and Outlook, 2025–2035,” reveals that the market will expand 1.5x in size over the decade, powered by enhanced food processing infrastructure, regulatory quality advancements, and growing consumer expectations for authentic flavor intensity in packaged and ready-to-eat products.

Innovation Anchored in Food Manufacturing Modernization

Global flavor system manufacturers are prioritizing performance-grade powder flavor solutions offering stability, taste precision, and moisture resistance during complex food processing cycles. As food processors optimize production efficiency and cost control, encapsulated powder flavors have emerged as a key enabler of flavor stability, oxidation control, and shelf-life extension.

“Powder flavor systems are increasingly central to modern food design,” said a senior analyst at Fact.MR. “Their performance in processing environments—balancing stability, safety, and taste—is redefining industrial flavor standards.”

To access the complete data tables and in-depth insights, request Discount : https://www.factmr.com/connectus/sample?flag=S&rep_id=8682

Key Market Insights at a Glance

| Metric | Global Estimate |

|---|---|

| Market Value (2025) | USD 4,500.0 million |

| Forecast Value (2035) | USD 6,800.0 million |

| CAGR (2025–2035) | 4.2% |

| Top Flavor Type (2025) | Fruit (35% share) |

| Top Application (2025) | Beverages (30% share) |

| Top Formulation (2025) | Encapsulated (60% share) |

| Key Regions | Asia Pacific, North America, Europe |

| Leading Companies | Givaudan, Symrise, Firmenich |

Segment Overview: Encapsulated Formulations Dominate

By Formulation:

Encapsulated powder flavors capture 60.0% of global revenue, driven by superior protection from moisture, oxidation, and high-temperature processing environments. Their demand continues to rise across premium bakery, snack, and beverage applications requiring extended shelf stability.

“Encapsulation technologies will remain the benchmark for quality and functionality in high-performance food manufacturing,” added Fact.MR.

By Type:

-

Fruit flavors (35%) dominate due to broad application across beverages, snacks, and bakery products.

-

Savory (25%) and dairy (20%) segments show strong traction in processed and plant-based foods.

By Application:

-

Beverages (30%) lead, fueled by convenience and instant drink applications.

-

Snacks and bakery each contribute roughly 25% of market value, supported by flavor innovation and functional ingredient integration.

View Full Report → [View Full Report]

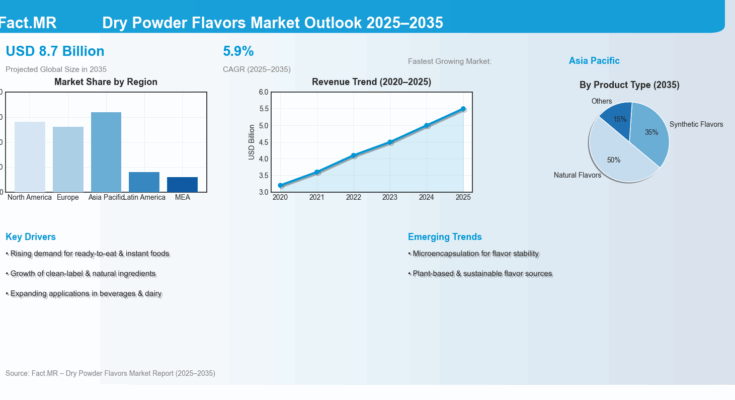

Regional Outlook: Asia Pacific Leads Global Expansion

The Asia Pacific region represents the fastest-growing hub for dry powder flavor innovation, driven by industrial-scale food processing expansion in India, China, and South Korea.

-

India: Forecast to grow at 5.0% CAGR, supported by food manufacturing modernization, flavor processing infrastructure, and government-led Make in India initiatives.

-

China: Expanding at 4.6% CAGR, propelled by large-scale food production and cost-effective powder flavor systems.

-

Japan: Emphasizes high-precision flavor manufacturing with stringent quality standards and supplier qualification protocols.

-

Europe: Home to premium-grade powder flavor manufacturing, led by Germany and the UK, which together represent over USD 1.6 billion in market value by 2035.

Buy Full Report → [Buy Full Report]

Competitive Landscape: Industry Consolidation and Quality Leadership

The global market is led by major flavor and fragrance giants, including:

Givaudan, Symrise, Firmenich, ADM, Takasago, Sensient, Kerry, Mane, Tate & Lyle, IFF, Robertet, Döhler, and Flavorchem.

Top players are advancing R&D investments in microencapsulation, controlled-release flavor technologies, and clean-label formulations. The market is shifting toward value-added powder flavor systems that combine performance consistency with strict compliance to international food safety standards.

Fact.MR notes consolidation across the supply chain, as leading manufacturers vertically integrate to control quality and maintain supply reliability amid raw material price volatility.

Market Outlook: Flavor Innovation at the Core of Future Food Manufacturing

Over the next decade, digitalization, encapsulation precision, and sensory optimization will define competitive advantage in the dry powder flavors market.

Emerging technologies—such as microencapsulation, AI-guided flavor formulation, and advanced spray-drying systems—will enable food manufacturers to achieve superior flavor stability and consumer satisfaction.

“As global food systems evolve, powder flavors are no longer additives—they are strategic enablers of food innovation,” added Fact.MR’s senior analyst.

About Fact.MR

Fact.MR is a leading market research and consulting organization providing actionable intelligence across 30+ industries and over 1,200 global markets. With operations across the U.S., UK, India, and the Middle East, the company supports its clients with data-driven insights, growth strategies, and customized consulting solutions tailored to evolving market needs.