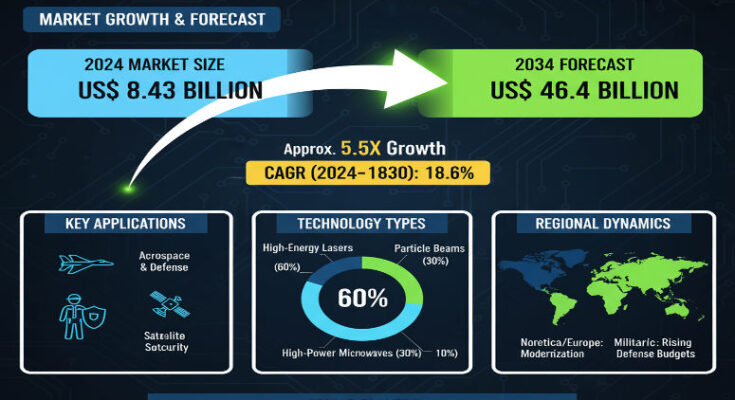

As modern warfare evolves, nations are increasingly investing in next-generation weaponry that offers speed, accuracy, and reduced reliance on traditional ammunition. Direct Energy Weapons (DEWs)—lasers, high-power microwave, particle beam and related technologies—are stepping into that role. These systems promise precision, lower logistical burden, and capability to counter unmanned aerial threats, missiles, and other asymmetric threats. In 2024, the global Direct Energy Weapon Market is estimated to be worth approximately US$ 8.43 billion, with projections to reach nearly US$ 46.4 billion by 2034, growing at a compound annual growth rate (CAGR) of around 18.6%.

Market Size & Forecast

The DEW market’s strong growth is fueled by rising defense modernization, geopolitical tension, and the need for cost-efficient, rapid response capabilities. Regions such as North America hold a large share today, while East Asia, especially China, is expected to grow at one of the highest CAGRs. By 2034, DEWs deployed on ground platforms (armored vehicles, static defenses) are expected to account for over half of the total market value. Other platforms—ships, aircraft, unmanned systems—are also growing rapidly, especially as technologies improve in power, range, and integration.

Recent Developments & Innovation

Recent years have seen several milestone advances. High-energy lasers have moved from experimental to demonstration phases in many militaries. Companies have developed systems with scalable power, better beam control, improvements in cooling and power supply, making DEWs more practical for deployment. There is a rising focus on counter-drone applications: DEWs offer an attractive option to neutralize small unmanned aerial vehicles (UAVs) at lower operating cost than missiles. Governments are funding research into both lethal and non-lethal DEWs, exploring handheld and mobile systems, and integrating AI and sensor systems for faster target acquisition and reaction. Some key prototypes and contracts are advancing, showing operational feasibility in controlled settings.

Key Players & Competitive Landscape

Major defense contractors lead the DEW market. Companies such as Lockheed Martin, Raytheon Technologies, BAE Systems, Thales Group, Elbit Systems, Honeywell, Moog, Rheinmetall, Boeing, and similar firms are heavily involved in developing and supplying systems or subsystems. These firms compete on power output, precision, range, integration into platforms (land, naval, airborne, unmanned), durability, and cost per engagement. Partnerships between governments, research institutions, and private vendors are common, and many players are investing in R&D to reduce weight, improve targeting, and ensure reliability under harsh environmental conditions.

Regional Insights: United States & East Asia

The United States remains the biggest market for DEWs, both in terms of spending and capability. U.S. military modernization plans prioritize laser and microwave systems, especially for counter-UAS and border security or missile defense applications. Domestic manufacturers benefit from strong defense budgets, regulatory support, and large procurement programs.

In East Asia, China is forecasted to be one of the fastest-growing markets. Growth there is driven by regional security dynamics, increased military spending, and ambitions to match or exceed peers in advanced defense technologies. Other East Asian nations are also investing in DEW development, especially for naval and border/air defense systems.

Challenges & Restraints

The DEW market faces several hurdles. High initial costs of development (power supplies, cooling, beam control, optics) remain a barrier. Integration onto mobile platforms demands ensuring ruggedization, power efficiency, and heat management. Environmental factors—weather, atmospheric interference—can degrade performance of laser and beam systems. Regulatory, ethical, and legal frameworks are still catching up with these technologies, particularly regarding lethal vs non-lethal use and international arms control. Finally, supply chains for certain specialized materials (e.g., optics, special semiconductors, laser fibers) may be constrained.

Browse Full Report: https://www.factmr.com/report/direct-energy-weapon-market

Outlook & Strategic Takeaways

Looking ahead to 2034, the DEW market offers significant opportunity for stakeholders who can deliver reliability, cost-effectiveness, and platform-agnostic solutions. Vendors that optimize for power output, efficient energy use, and rapid deployment will lead. Governments that invest in demonstrators and field validation program will shape adoption. Counter-drone systems and non-lethal DEWs may emerge as high volume segments in the near term.

For those in the industry, strategic priorities include advancing component technology (optics, power, cooling), modular designs that fit multiple platforms, certification and combat testing, and ensuring affordability—not just performance. Markets in North America and East Asia will dictate many of the technological standards and procurement trends; collaboration between public and private sectors will be key.