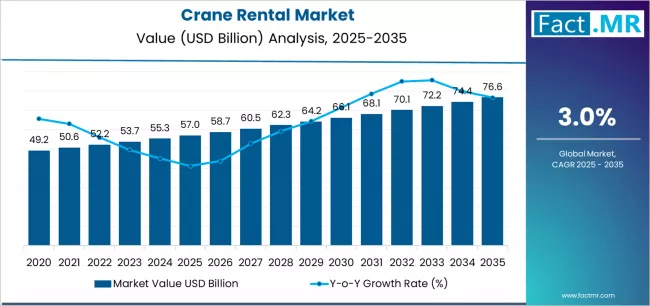

The global crane rental market is set for steady growth, fueled by rising demand from construction, industrial, and energy sectors. According to a recent Fact.MR report, the market is expected to expand from USD 57.0 billion in 2025 to USD 77.0 billion by 2035, reflecting a CAGR of 3.0% over the forecast period. The market’s growth is underpinned by the increasing need for advanced lifting solutions, cost-effective equipment access, and operational efficiency in large-scale projects.

Strategic Market Drivers:

Infrastructure and Construction Expansion: Ongoing urbanization and government-led infrastructure programs continue to propel demand for crane rental services. Mobile and tower cranes are widely used in construction, industrial assembly, and shipping operations due to their flexibility, lifting capacity, and operational reliability.

Industrial and Energy Sector Applications: Industrial modernization and energy sector growth are boosting the adoption of specialized crane solutions. Rentals allow companies to access advanced lifting equipment without large capital investments, improving project efficiency by 40–60% compared to ownership alternatives.

Technological Advancements and Operational Efficiency: Integration of advanced crane technologies, including automated lifting systems and mobile positioning solutions, is enhancing safety, reducing setup times, and enabling precise operations across complex construction and industrial projects.

Browse Full Report: https://www.factmr.com/report/crane-rental-market

Regional Growth Highlights:

Asia Pacific – Construction Hub: Asia Pacific leads market demand, driven by rapid infrastructure development, industrial growth, and urbanization. Countries like China, India, and Japan dominate consumption through large-scale projects and technological adoption in crane systems.

Europe – Regulatory and Innovation Focus: Europe sees consistent growth with emphasis on safety standards, construction innovation, and environmental compliance. Germany, France, and the U.K. are key markets where modern crane rental solutions support complex infrastructure and industrial projects.

North America – Efficiency and Sustainability: The U.S. and Canada are expanding rental adoption in construction, energy, and industrial sectors. Companies prioritize high-performance mobile cranes and safety-compliant operations to meet stringent project requirements.

Market Segmentation Insights:

By Type:

- Mobile Cranes – Leading with 50% market share, offering flexibility and high lifting performance.

- Tower Cranes – Account for 35% of the market, ideal for high-rise construction projects.

- Crawler Cranes – Represent 15%, suited for heavy-duty and specialized terrain applications.

By Application:

- Construction – Dominates with 60% share, driven by large-scale building and infrastructure projects.

- Industrial – Holds 25%, supporting manufacturing and facility operations.

- Shipping – Accounts for 15%, used in port and cargo handling.

Challenges and Market Considerations:

- Equipment availability and skilled operator shortages may limit access in developing regions.

- High maintenance costs and compliance with safety regulations pose operational challenges.

- Complex certification and technical requirements can impact rental affordability and efficiency.

Competitive Landscape:

The crane rental market is highly competitive, with companies focusing on fleet expansion, advanced lifting technologies, and strategic regional collaborations.

Key Players in the Crane Rental Market:

- Mammoet

- Sarens

- Maxim Crane

- All Erection

- ALE

- Lampson

- Bigge

- Tat Hong

- Loxam

- Ashtead

- Kanamoto

- United Rentals

- Nishio

- Buckner

- Schmidbauer

Future Outlook:

Over the next decade, the crane rental market will continue to evolve with technological innovations, strategic partnerships, and a focus on operational efficiency. Companies that leverage advanced equipment, digital solutions, and regional collaboration will capture market leadership, delivering reliable, safe, and cost-effective lifting solutions across construction, industrial, and energy applications. The market is set to reach USD 77.0 billion by 2035, reflecting the growing importance of flexible, efficient, and high-performance crane rental services worldwide.