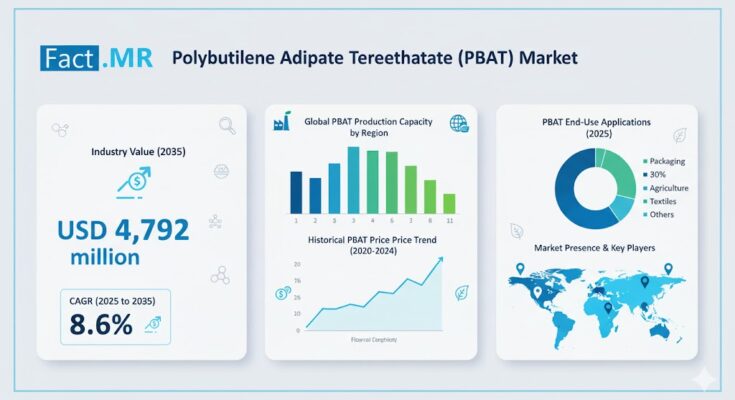

The global Polybutylene Adipate Terephthalate (PBAT) market is set for robust expansion as industries worldwide accelerate the transition toward biodegradable and compostable plastic alternatives. According to a recent report by Fact.MR, the market is projected to rise from USD 1,928 million in 2024 to USD 4,792 million by 2035, registering a strong CAGR of 8.6% during the forecast period.

PBAT, a flexible and fully biodegradable thermoplastic polymer, has gained prominence as an eco-friendly alternative to conventional plastics like polyethylene. With its excellent mechanical properties and compostability, PBAT is increasingly used in packaging films, agricultural mulch films, disposable products, and coating applications.

Strategic Market Drivers

- Rising Demand for Sustainable Packaging Solutions

The packaging industry is undergoing a significant transformation as consumer brands and regulators push for circular economy models. PBAT’s biodegradability and compatibility with other biopolymers, such as polylactic acid (PLA) and starch blends, make it a preferred material for single-use and flexible packaging.

Manufacturers are increasingly using PBAT for compostable shopping bags, food packaging, and agricultural films—driven by bans on non-degradable plastics and rising consumer awareness. Additionally, the growing emphasis on reducing microplastic pollution is reinforcing PBAT’s market position as a sustainable alternative.

- Regulatory Push and Environmental Mandates

Global sustainability frameworks and government regulations are playing a pivotal role in propelling the PBAT market forward. Europe and parts of Asia have introduced stringent regulations restricting single-use plastics, encouraging the adoption of biodegradable materials.

Policies promoting bio-based and compostable packaging—such as the EU Plastics Strategy and India’s Plastic Waste Management Rules—are compelling packaging producers and converters to invest in PBAT-based solutions.

- Technological Advancements and Material Innovation

Continuous innovation in biopolymer chemistry is expanding PBAT’s application scope.

In June 2024, BASF expanded its biopolymers portfolio by launching ecoflex® F Blend C1200 BMB, a biomass-balanced PBAT with a 60% lower product carbon footprint compared to standard grades. This advancement enables the packaging sector to enhance renewable feedstock utilization while maintaining high-performance and compostability certifications.

Such innovations highlight the industry’s commitment to balancing functionality with environmental responsibility.

- Expanding Applications Across Multiple Sectors

Beyond packaging, PBAT is witnessing increased adoption in agriculture, consumer goods, and textiles. In agriculture, PBAT-based mulch films decompose naturally in soil, reducing plastic waste and labor costs associated with film collection. In consumer goods, it is being utilized for biodegradable cutlery, trash bags, and hygiene products.

The growing use of PBAT in 3D printing and medical disposables also underscores its versatility and alignment with circular economy goals.

Browse Full Report: https://www.factmr.com/report/3218/pbat-market

Regional Growth Highlights

Europe: Regulatory Leadership in Bioplastics

Europe continues to dominate global PBAT consumption, backed by strong environmental policies, industrial composting infrastructure, and active research in bio-based materials. Germany, Italy, and France are key markets, driven by the EU’s ambitious sustainability targets and investments in green polymer production.

European producers are also focusing on expanding PBAT capacity to meet the surging demand for compostable packaging films and eco-friendly consumer products.

East Asia: Fastest-Growing Regional Market

East Asia is emerging as a significant growth hub, led by China, Japan, and South Korea. Rapid industrialization, government-led sustainability initiatives, and increasing investments in domestic biopolymer manufacturing are fueling market growth. China’s efforts to reduce plastic pollution through “green material” policies are fostering new opportunities for PBAT producers.

North America: Rising Demand for Compostable Packaging

The U.S. and Canada are witnessing growing interest in PBAT as consumer goods companies adopt compostable packaging to align with corporate sustainability goals. Collaborations between biopolymer manufacturers and major retail chains are driving large-scale commercialization. Increased consumer awareness and state-level bans on plastic bags are further supporting market expansion.

South Asia & Latin America: Emerging Opportunities

Countries like India, Brazil, and Mexico are witnessing rising adoption of PBAT due to government support for biodegradable plastic production and surging demand from food packaging and agriculture sectors. Investments in composting facilities and local polymer compounding capabilities are expected to accelerate market penetration in these regions.

Competitive Landscape

The global PBAT market is characterized by strategic collaborations, capacity expansions, and technological innovation. Leading companies are focusing on lowering carbon footprints, improving biodegradation performance, and enhancing polymer blend compatibility.

Key Companies Profiled:

- BASF SE

- Novamont S.p.A.

- Mitsubishi Chemical Corporation

- SK Geo Centric Co., Ltd.

- Jinhui Zhaolong High Technology Co., Ltd.

- Kingfa Sci. & Tech. Co., Ltd.

- Eastman Chemical Company

- NatureWorks LLC

- Coseco Inc.

- Chang Chun Plastics Co., Ltd.

Future Outlook: Toward a Circular and Carbon-Neutral Polymer Economy

Over the next decade, the PBAT market will evolve as a cornerstone of the global biodegradable plastics ecosystem. The integration of bio-based feedstocks, AI-driven production optimization, and chemical recycling technologies will redefine material performance and cost efficiency.

As brands, consumers, and governments align on sustainability targets, PBAT is positioned to play a central role in reducing plastic waste and advancing circular material design.

Manufacturers that embrace innovation, scalability, and renewable sourcing will lead the next phase of growth—delivering biopolymers that bridge performance with planet-positive impact.