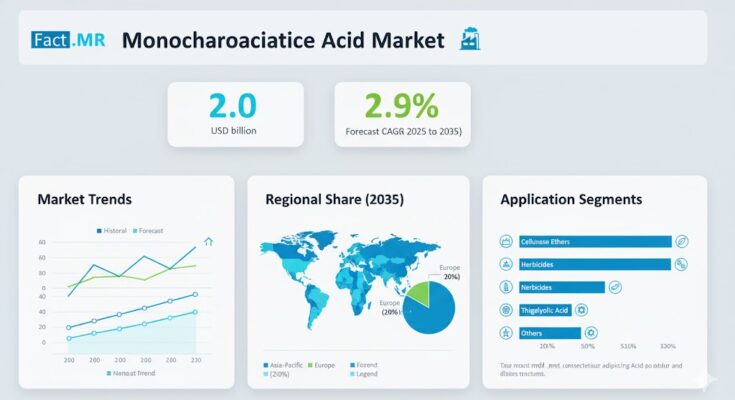

The global monochloroacetic acid market is poised for steady growth, with revenues projected to rise from USD 1.5 billion in 2025 to USD 2.0 billion by 2035, reflecting a CAGR of 2.9% over the forecast period. This growth trajectory underscores the increasing adoption of specialty chemical technologies and heightened investments across carboxymethyl cellulose (CMC), surfactant, and agrochemical manufacturing industries worldwide.

As industries emphasize efficiency, sustainability, and performance optimization, monochloroacetic acid continues to serve as a critical intermediate in diverse chemical syntheses — enabling advanced formulations for pharmaceuticals, personal care, textiles, and industrial production.

Strategic Market Drivers

- Rising Demand from Carboxymethyl Cellulose (CMC) Manufacturers

MCAA is a key feedstock for CMC, a high-value additive used extensively in food, cosmetics, oil drilling fluids, and pharmaceuticals. The expansion of the processed food and personal care industries is creating steady demand for high-purity MCAA, particularly in Asia Pacific and North America, where downstream processing capacities are expanding rapidly.

- Agrochemical Industry Transformation

The global shift toward sustainable agriculture and improved crop yields is fueling demand for MCAA in the production of herbicides such as 2,4-D and glyphosate intermediates. India, China, and Brazil are emerging as major consumers as local production and export-oriented agrochemical manufacturing gain momentum.

- Surfactant and Polymer Segment Growth

The use of MCAA in surfactant production — particularly in biodegradable surfactants and amphoteric compounds — is expanding alongside demand from home care and industrial cleaning sectors. Meanwhile, the polymer and plastics industries are integrating MCAA derivatives into performance-enhancing chemical formulations, driving new opportunities for material innovation.

Browse Full Report: https://www.factmr.com/report/monochloroacetic-acid-market

Market Segmentation Insights

By Application

- Carboxymethyl Cellulose (CMC): Dominant application area driven by the food, cosmetics, and pharmaceutical sectors.

- Agrochemicals: Increasing adoption for herbicide and pesticide production.

- Surfactants: Rising use in household and industrial cleaning agents.

- Dyes & Intermediates: Growing relevance in textiles and specialty manufacturing.

By Form

- Crystalline MCAA – Widely used due to ease of handling and storage.

- Liquid MCAA – Preferred for continuous processing and industrial blending applications.

Challenges and Market Considerations

- Raw Material Sensitivity: Dependence on acetic acid and chlorine markets leads to cost volatility.

- Environmental Compliance: Tightening VOC and emissions standards demand cleaner production technologies.

- Health & Safety Regulations: Strict handling and disposal norms increase operational costs for smaller manufacturers.

- Global Supply Chain Complexity: Logistics disruptions and import-export restrictions could impact supply stability.

Competitive Landscape

The monochloroacetic acid market is moderately consolidated, with key manufacturers investing in capacity expansion, sustainability initiatives, and process innovation to strengthen their market positions.

Key Players in the Monochloroacetic Acid Market:

- Solvay S.A.

- Nouryon

- OQ Chemicals GmbH

- LANXESS AG

- Shandong Dahua Chemical Co., Ltd.

- Oriental Chemical Industries

- Zhejiang CCP Chemical Co., Ltd.

- Lonza Group AG

- Galaxy Surfactants Ltd.

- Croda International Plc

These players are emphasizing eco-friendly production techniques, automation-driven process efficiency, and regional distribution network enhancement to capture emerging opportunities.

Future Outlook: Smart Growth through Specialty Integration

The next decade will mark a transition toward greener chemistry, digital process optimization, and advanced formulation design in the MCAA market. Manufacturers are expected to leverage AI-assisted process monitoring, circular economy practices, and regional production hubs to ensure cost efficiency and sustainability.

With strong demand from industrial chemicals, polymers, and agro-based industries, the monochloroacetic acid market is set to maintain a resilient upward path. Companies that balance innovation, compliance, and cost competitiveness will be best positioned to lead the next phase of global growth driving sustainable industrial chemistry for a more efficient and responsible future.