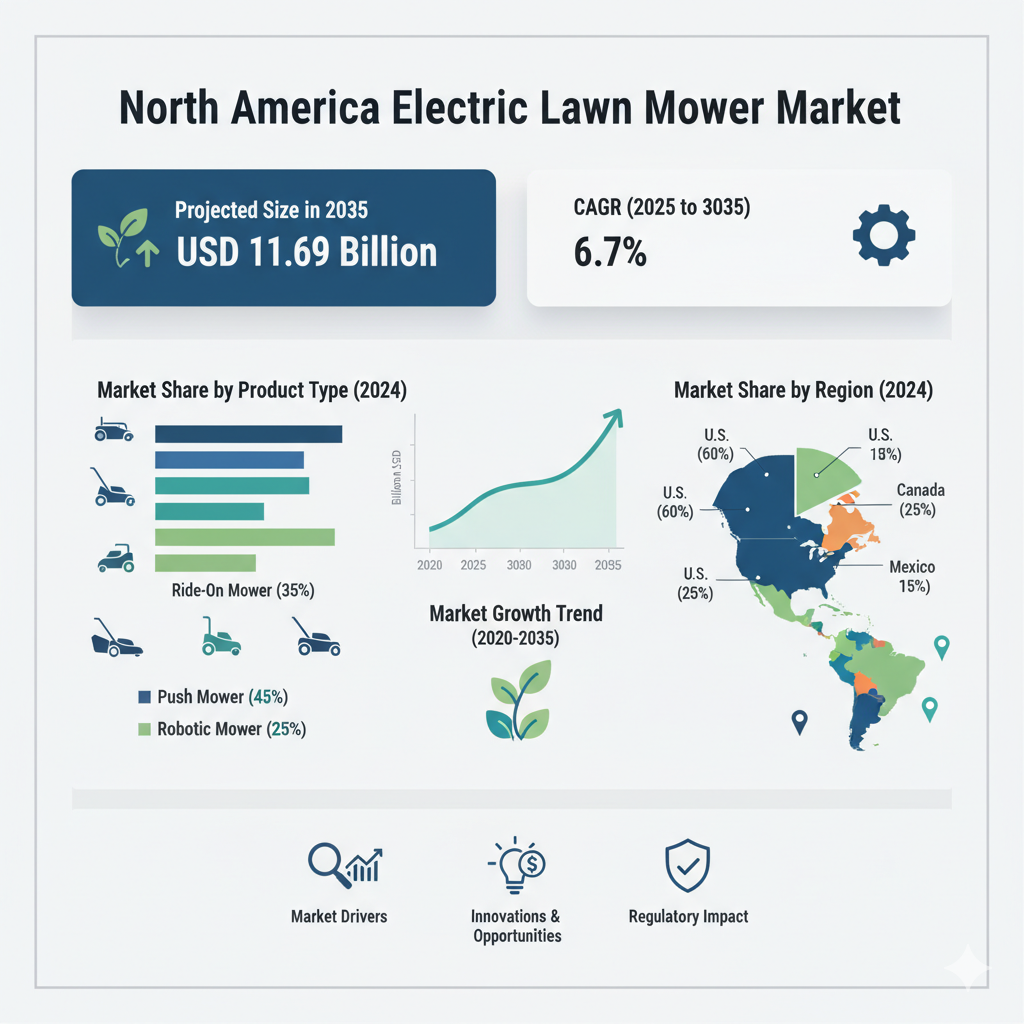

The North America electric lawn mower market is entering a period of robust growth and transformation. In 2025, the market is valued at USD 6.11 billion, and according to Fact.MR analysis, it is projected to grow at a compound annual growth rate (CAGR) of 6.7 %, reaching USD 11.69 billion by 2035. This forecast underscores the accelerating shift from traditional gasoline-powered mowers toward cleaner, quieter, and smarter electric alternatives.

Market Overview & Outlook

The push toward electrification in lawn care is being driven by stricter environmental regulations, growing consumer and municipal demand for low-emission equipment, and advances in battery and smart technologies. In 2024, the market closed at USD 5.73 billion, marking a turning point as policy pressures and consumer preferences combined to accelerate adoption of battery-powered models. Key tailwinds include improved lithium-ion battery performance, expanded runtimes, and declining costs.

Beyond 2025, manufacturers are expected to invest heavily in automation and connectivity—integrating AI, IoT, and remote control features into their offerings. Over the 2025–2035 period, electric mowers are anticipated to evolve from a sustainable alternative to the mainstream standard for turf care in North America.

Segment Analysis

By Mower Blade Type

Mulching blades are projected to grow at a CAGR of about 5.6 % through 2035. Their ability to finely chop and recycle grass clippings aligns well with eco-friendly and low-maintenance lawn practices. Cylinder, standard, and lifting blades will continue to be used but are expected to experience slower growth as mulching becomes the preferred choice for both residential and commercial users.

By Cord Type

Cordless models are expected to dominate the market, expanding at roughly 6.9 % CAGR through 2035. Their operational freedom, improved battery life, lower maintenance needs, and suitability for larger lawns make them increasingly preferred over corded variants. Corded electric mowers will remain relevant for smaller residential lawns but will likely see slower adoption rates compared to cordless models.

By Product Type

Robotic mowers are poised to lead growth, with a forecast CAGR of around 6.7 % over 2025–2035. Their autonomy, obstacle detection, and smart app-based control appeal to both residential and commercial buyers. Walk-behind and ride-on mowers will continue to hold significant market share, particularly in smaller applications, though growth will be slower compared to the robotic segment.

By End User

Professional landscaping services are expected to grow at around 6.8 % CAGR and remain the largest and most profitable end-user category. Electric mowers help these businesses reduce long-term operational costs, comply with emission standards, and simplify maintenance. Residential users also drive major demand, especially in suburban areas where consumers favor quiet, low-maintenance options. Meanwhile, golf courses and municipal green spaces are beginning to adopt electric models as battery power and durability continue to improve.

By Region

The United States remains the largest market, driven by suburban lawn culture and regulatory encouragement for zero-emission tools. Canadian demand leans toward lightweight and automated designs, particularly among homeowners and landscaping professionals. In Mexico, demand is growing for affordable electric options that balance efficiency and price.

Recent Developments & Competitive Landscape

Recent Market Developments

Recent years have seen major advances in lithium-ion battery technology, resulting in longer runtimes, faster charging, and higher power output. These improvements have significantly reduced barriers to adoption. Environmental and noise regulations in several U.S. states are also encouraging both consumers and landscaping firms to switch to electric models. Additionally, demand for robotic and self-propelled mowers is increasing rapidly, particularly in premium residential markets. To ensure supply chain resilience, several manufacturers are investing in local assembly and service infrastructure across North America.

Key Players & Competitive Positioning

Leading companies in the market include Husqvarna, EGO Power+, Greenworks, Deere & Company, Toro, and Ryobi. Husqvarna holds a strong position in robotic and professional-grade electric mowers, supported by investments in AI and navigation technology. EGO Power+ continues to expand its range of commercial zero-turn models and high-capacity battery systems. Greenworks benefits from strong retail partnerships and competitive pricing strategies. Deere & Company is leveraging its heritage in commercial landscaping to develop advanced electric ride-on and autonomous models, while Toro is strengthening its electric portfolio and fleet management solutions. Ryobi, known for affordability and wide retail distribution, continues to appeal to entry-level and mid-tier residential consumers.

Competitive Dynamics and Market Trends

Innovation remains the core competitive driver in the North American electric lawn mower market. Companies that successfully integrate smart controls, connectivity, and predictive maintenance capabilities are likely to capture larger shares. Robust after-sales service, warranty support, and dealer networks will also be essential for long-term success, especially in commercial applications. However, manufacturers are facing margin pressures from battery material costs and logistics challenges, prompting price adjustments across major product lines. Regional market differentiation will play a key role, as preferences vary by climate, lawn size, and user profile across the U.S., Canada, and Mexico.