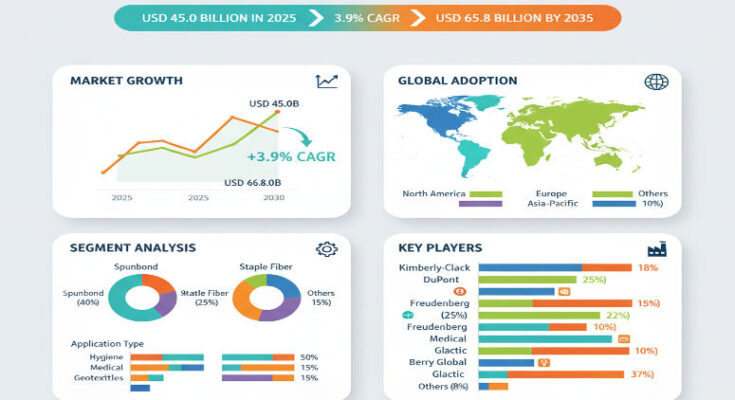

The global nonwoven fabric market is entering a phase of steady but substantial growth. In 2025, its value is estimated at roughly USD 45.0 billion, and over the next decade this market is expected to reach around USD 65.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 3.9%. This expansion underscores the evolving role of nonwoven fabrics—from simple textile substitutes to high-performance materials integral to hygiene, medical, industrial, and construction applications.

In broad terms, what once was an adjunct textile process is now central to innovations in absorbent hygiene products, medical disposables, filtration media, geotextiles, automotive interior components and other advanced manufacturing contexts. As manufacturers look for materials that combine low cost, high performance, ease of production and sustainability credentials, nonwovens increasingly become the material of choice.

Why the Market Is Expanding

Several trends drive the nonwoven fabric market forward:

-

Hygiene & medical demand: The hygiene end-use segment is projected to account for around 40% of market value in 2025. Nonwoven fabrics are critical in diapers, sanitary products, surgical gowns, masks, wipes and other high-use consumables. Their ability to provide functional performance (absorbency, fluid handling, barrier protection) at low cost is a key advantage.

-

Industrial & construction applications: Beyond hygiene, nonwovens are expanding in filtration, automotive (insulation, interior liners), geotextiles and protective materials. Lightweight, high-strength, and adaptable nonwovens help manufacturers meet performance and cost targets.

-

Polymer dominance & process efficiency: Polypropylene is forecast to account for around 60% of the nonwoven fabric market in 2025. Its favorable cost–performance balance makes it dominant among polymers. Meanwhile, processes such as spunbond (which may account for about 45% of production) combine efficiency with material performance, driving adoption.

-

Geographic manufacturing shift: Asia-Pacific, led by countries such as India and China, is among the fastest-growing regions (India projected around 5.0% CAGR, China around 4.5%). As domestic manufacturing, textile production and industrial capability expand, demand for nonwoven materials rises.

-

Quality standards & customization: As end-users demand better consistency, tailored material properties and supply-chain reliability, nonwoven producers are responding with specialized grades, advanced manufacturing lines and higher-performance materials—supporting premium pricing and deeper penetration.

Segmentation & Material Dynamics

-

By polymer: Polypropylene leads; polyester, cellulose/rayon and other specialty polymers hold smaller shares. The dominance of polypropylene is rooted in its cost efficiency and adaptability for large-volume applications.

-

By process: Spunbond remains the most widely used, followed by meltblown, needle-punched and other methods. Spunbond offers solid performance at lower cost and is preferred in many mature manufacturing contexts.

-

By end-use: Hygiene is the largest application, reflecting large volumes in disposable products; medical, industrial and construction follow. Each presents distinct requirements—medical uses call for cleanliness, barrier performance and regulatory compliance, while industrial uses emphasize strength, durability, cost-effectiveness.

-

By region: Key growth markets include Asia-Pacific, North America and Europe. Mature markets such as the U.S. and Germany show moderate growth (~3.3–3.4% CAGR through 2035) while emerging markets such as India (~5.0% CAGR) provide volume opportunity.

Regional Insight: U.S. & Asia-Pacific

United States: Mature manufacturing base, strong hygiene & medical sectors, and advanced industrial end-users mean the U.S. nonwoven fabric market is growing at a modest but steady rate—around 3.3% CAGR to 2035. Demand is broad-based, with particular attention to premium grades, regulatory-compliant materials and innovation in sustainable formats.

Asia-Pacific: A major growth engine. India’s projected 5.0% CAGR to 2035 reflects rising manufacturing capacity, increased demand for hygiene products, expanding textile and industrial sectors and government efforts to modernize infrastructure. China’s 4.5% CAGR stems from large manufacturing base, strong domestic demand and export opportunities. The region offers both scale and scope for nonwoven fabric suppliers.

Key Players & Competitive Landscape

Leading companies shaping the market include:

-

Berry Global Inc.

-

Freudenberg Group

-

Ahlstrom-Munksjö Oyj

-

Kimberly-Clark Corporation

-

DuPont de Nemours, Inc.

-

Johns Manville Corporation

-

Lydall, Inc.

-

Toray Industries, Inc.

-

Fitesa S.A.

-

PFNonwovens

These players compete on material innovation (e.g., antimicrobial, filtration grade, high-loft nonwovens), production efficiency, geographic footprint, supply-chain integration and sustainability credentials. For example, companies are investing in lower basis-weight nonwovens that deliver the same function with less material, in recycled content and bio-based polymers, and in digital manufacturing to improve consistency and traceability.

Innovation is particularly strong in hygiene/nonwoven hybrids, high-performance filtration nonwovens, geotextiles with enhanced strength-to-weight, and automotive interior nonwovens that combine acoustic dampening with lightweighting.

Challenges & Restraints

The market’s growth is steady rather than explosive, reflecting certain constraints:

-

Raw material and energy cost volatility: Nonwoven production is sensitive to polypropylene, polyester and energy prices. Margins may be squeezed when input costs rise.

-

Quality consistency & supply-chain complexity: As nonwoven applications become more demanding (medical, filtration, industrial), manufacturers face tight tolerances, regulatory compliance and complex process controls.

-

Competitive pressure from other materials: Traditional textiles, woven fabrics, and emerging composites remain alternatives in many applications—nonwovens must continuously demonstrate cost-benefit and performance.

-

Sustainability demands: Pressure for recyclability, lower carbon footprint and circular-economy credentials is increasing. Nonwovens, often disposable or bonded for single-use applications, face scrutiny. Meeting these demands may require investment in new materials or recycling pathways.

-

Growth moderation in mature markets: In North America and Europe, procedural and regulatory burdens, high cost of manufacturing, and slower end-use growth result in moderate expansion rates.

Future Outlook & Strategic Implications

Looking ahead to 2035, the nonwoven fabric market will nearly one-and-a-half-times its size in 2025, going from about USD 45 billion to USD 65.8 billion. While overall CAGR is moderate (3.9%), the real story lies in pockets of value: hygiene premium segments, advanced filtration applications, geotextile and construction nonwovens, and high-growth emerging economies.

For companies and investors, strategic priorities should include:

-

Material innovation: Developing lighter, higher-performance, multi-functional nonwovens (e.g., antimicrobial hygiene, high-efficiency filtration, automotive lightweighting).

-

Geographic expansion: Establishing capacities closer to growth markets in Asia-Pacific and Latin America, reducing logistics cost and improving local service.

-

Sustainability positioning: Offering nonwoven fabrics with recycled input, bio-based polymers or design for recycling will increasingly differentiate suppliers.

-

Process efficiency: Investing in spunbond, meltblown and automated systems to reduce cost per square-meter, improve consistency, and support volume growth.

-

End-use partnerships: Collaborating with hygiene, medical, filtration, construction and automotive OEMs to co-develop tailored solutions and lock in supply relationships.

Browse Full Report: https://www.factmr.com/report/nonwoven-fabric-market

Editorial Perspective

The nonwoven fabric market might not command headlines like high-tech fields do, but it is quietly essential—anchoring hygiene, healthcare, filtration, construction and industrial materials. Growth is solid rather than spectacular, but it is meaningful: manufacturers, health-care providers, infrastructure sectors and consumers increasingly rely on nonwovens because of their unique blend of cost, performance and adaptability. For suppliers who can move beyond commodity grades into higher-value nonwoven systems—lightweight, functional, sustainable—the coming decade offers deserved reward.