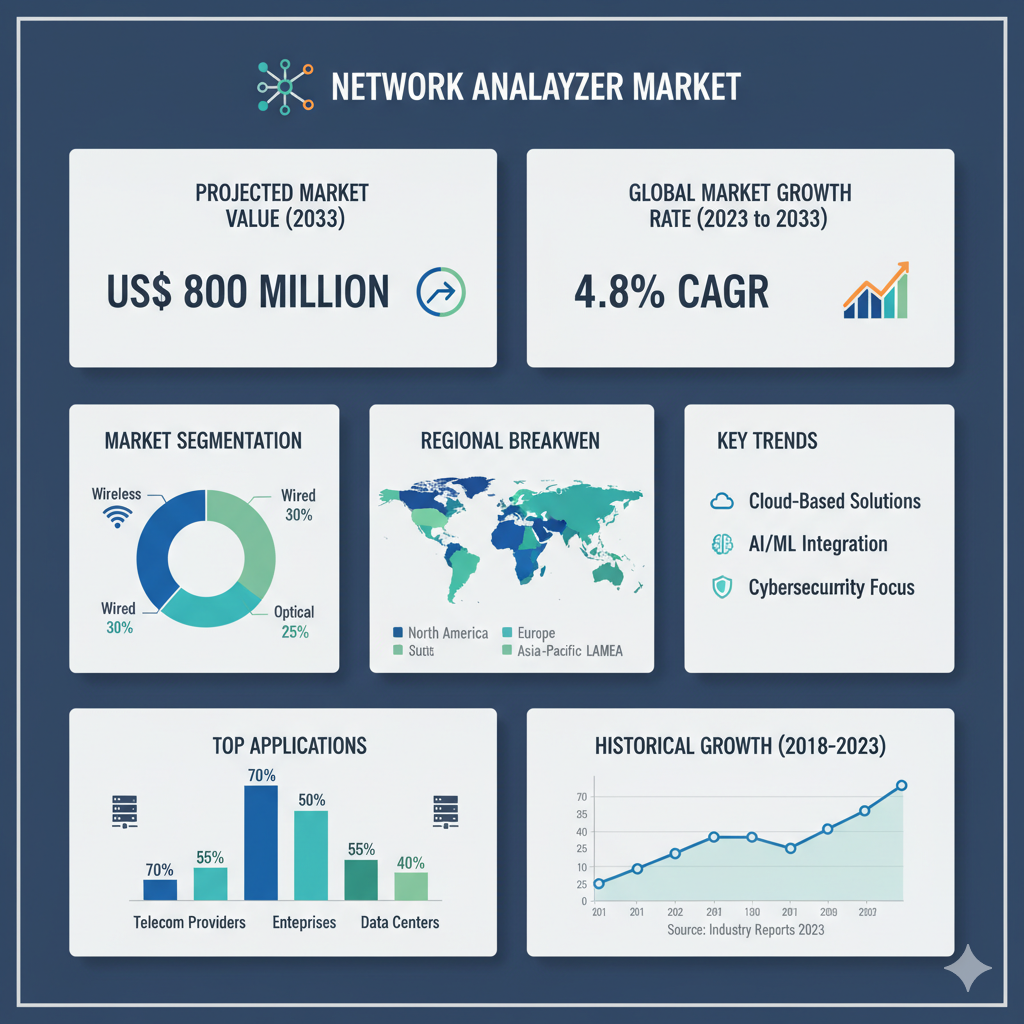

The global network analyzer market is valued at US $ 500 million in 2023 and is predicted to reach US $ 800 million by 2033, expanding at a CAGR of 4.8% from 2023 to 2033 (forecast period).

Frequency-Band and Application Segmentation

The network analyzer market is typically segmented by frequency range and end-use application. It is analyzed across four main frequency bands—Below 1.5 GHz, 1.5 to 4 GHz, 4 to 10 GHz, and Above 10 GHz—and serves several key industries, including Communications, Aerospace & Military/Defense, Electronics, and Automotive.

Network analyzers operating below 1.5 GHz are primarily used for testing low-frequency wireless systems such as IoT and short-range communication devices. They are essential in the communications sector for sub-GHz wireless links and machine-to-machine (M2M) systems. The 1.5 to 4 GHz range covers a large portion of modern wireless communications, including Wi-Fi and 4G LTE, and is a dominant frequency band in both communications and electronics applications.

In the 4 to 10 GHz band, network analyzers cater to high-performance RF systems such as radar front ends, satellite communications, and advanced defense systems. This range finds major use in aerospace, defense, and advanced electronics manufacturing. The above 10 GHz segment is becoming increasingly important for millimeter-wave applications, including 5G/6G wireless, automotive radar, and aerospace systems. In the automotive industry, demand for analyzers in this range is expected to rise rapidly with the integration of radar and vehicle-to-everything (V2X) communication technologies.

By application, communications remains the largest user segment, driven by the rapid evolution of wireless technologies and growing network complexity. Aerospace and military/defense applications demand the highest precision and frequency range, while electronics manufacturers utilize analyzers across all bands for component validation. The automotive industry, meanwhile, represents a fast-emerging segment as vehicles become increasingly connected and sensor-driven.

Over the forecast period, growth is expected to vary by band, with mid-range frequencies (1.5–10 GHz) maintaining the largest market share, while the above 10 GHz category is projected to witness the highest growth rate, fueled by mmWave and radar adoption.

Recent Developments and Competitive Dynamics

Recent years have seen significant innovation in network analyzer design and technology. Manufacturers are introducing modular and software-defined architectures that allow for greater flexibility, smaller form factors, and lower total cost of ownership. For instance, new multiport analyzers and PXI-based modular systems have become popular as they allow multiple tests to run simultaneously in a compact setup.

Industry leaders are also pursuing acquisitions and partnerships to expand their product portfolios and strengthen their technological capabilities. Strategic collaborations between test equipment manufacturers and semiconductor companies are enabling the development of faster, higher-frequency analyzers suitable for 5G and beyond. Additionally, software upgrades, cloud connectivity, and AI-driven test analytics are transforming how network analyzers are deployed and used in research, manufacturing, and field environments.

Smaller and emerging players are finding opportunities by focusing on cost-effective and portable solutions for education, research labs, and small production setups. The trend toward rental and subscription-based test services is also helping broaden access to high-end analyzers for customers with limited capital budgets.

The market is moderately concentrated, with a few leading companies capturing a significant portion of global revenue. Keysight Technologies, Rohde & Schwarz, and Anritsu Corporation are recognized as dominant players, offering extensive frequency coverage and advanced measurement capabilities. Viavi Solutions, Advantest Corporation, Teledyne LeCroy, National Instruments, and Yokogawa Electric are among other key participants, each with specialized strengths in modular testing, field equipment, or high-frequency systems.

Keysight Technologies remains the clear market leader, leveraging its broad product portfolio and deep R&D investments. Rohde & Schwarz continues to innovate in high-performance and portable instruments, while Anritsu excels in telecommunications testing and handheld solutions. Advantest and National Instruments are making strides in modular PXI-based platforms that provide flexibility and scalability.

The competitive environment is shaped by several strategic factors. Leading firms rely on strong brand reputation, global calibration networks, and integration with automated test systems. However, high production costs, long development cycles, and growing competition from lower-cost entrants present ongoing challenges. Opportunities exist for companies that can deliver scalable, software-driven solutions covering both mid-band and mmWave frequencies.