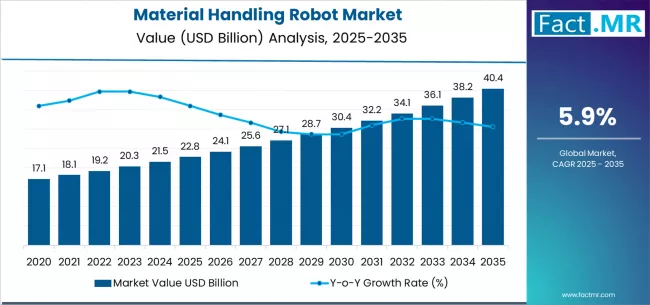

The global material handling robot market is poised for significant expansion, reflecting the accelerating pace of automation in industrial and logistics environments. According to a new report by Fact.MR, the market is projected to grow from USD 22.8 billion in 2025 to USD 40.6 billion by 2035, representing a CAGR of 5.9% over the forecast period. This rapid rise underscores the transformative role of robotics in enhancing operational efficiency, workplace safety, and manufacturing productivity worldwide.

As industries continue to digitalize, material handling robots are becoming indispensable in smart factories, warehouses, and fulfillment centers — offering precision, flexibility, and scalability across diverse applications.

Strategic Market Drivers

- Surge in Industrial Automation and Smart Manufacturing

The ongoing shift toward Industry 4.0 and smart manufacturing ecosystems is a primary catalyst for the material handling robot market. Automation of repetitive and hazardous material movement tasks has become a strategic necessity for improving throughput and reducing operational costs.

Manufacturers are deploying advanced robots for palletizing, packaging, and pick-and-place operations to meet the rising demand for customized, high-mix, low-volume production environments. - E-commerce Boom and Logistics Modernization

With the e-commerce sector expanding at an unprecedented rate, logistics and warehousing operators are increasingly relying on robotic systems to optimize order fulfillment and inventory management.

Automated Guided Vehicles (AGVs) and collaborative robots (cobots) are being deployed to handle goods more efficiently, minimize errors, and shorten delivery cycles — driving adoption across fulfillment centers and distribution hubs. - Workforce Safety and Operational Efficiency

Material handling robots are reducing the dependence on manual labor in high-risk environments, promoting worker safety, and ensuring consistent operational output. The growing emphasis on ergonomics, labor shortages, and productivity optimization is pushing organizations toward robotic integration as a long-term solution. - Technological Advancements in AI and Sensor Systems

AI-powered machine vision, IoT connectivity, and advanced sensors have enhanced the intelligence and adaptability of material handling robots. These innovations enable real-time decision-making, predictive maintenance, and seamless human-robot collaboration — marking a new era of autonomous industrial operations.

Browse Full Report: https://www.factmr.com/report/material-handling-robot-market

Regional Growth Highlights

East Asia: The Global Automation Powerhouse

East Asia leads the material handling robot market, with China, Japan, and South Korea at the forefront of robotics innovation. Strong government initiatives, large-scale manufacturing facilities, and robust investments in industrial automation have solidified the region’s dominance.

China’s “Made in China 2025” initiative and Japan’s advanced robotics ecosystem continue to propel the market’s technological evolution.

North America: Accelerating Smart Factory Adoption

The U.S. and Canada are witnessing rapid adoption of material handling robots in automotive, electronics, and logistics sectors. Growing emphasis on reshoring manufacturing and integrating AI-driven robotic solutions is fueling regional market expansion.

Europe: Sustainability and Efficiency at the Core

European nations such as Germany, Italy, and France are investing heavily in robotics to enhance productivity and sustainability. Integration of robots in modular and energy-efficient production systems aligns with the European Union’s green transition goals.

Emerging Markets: Industrialization and Infrastructure Growth

Countries across South Asia, the Middle East, and Latin America are increasingly deploying robots to modernize their manufacturing and logistics sectors. Expanding industrial infrastructure, coupled with favorable government incentives, positions these regions as high-potential growth frontiers.

Market Segmentation Insights

By Robot Type

- Articulated Robots – Widely adopted for high-speed palletizing and heavy-load handling.

- SCARA Robots – Ideal for precision assembly and pick-and-place applications.

- Cartesian Robots – Used for packaging and stacking with high repeatability.

- Collaborative Robots (Cobots) – Rapidly gaining traction for flexible human-robot collaboration.

By End-Use Industry

- Automotive & Transportation – For component assembly, welding, and part handling.

- Food & Beverage – For packaging, sorting, and palletizing in high-speed lines.

- E-commerce & Logistics – Revolutionizing inventory management and fulfillment centers.

- Electronics & Semiconductor – For precise handling of delicate components.

- Manufacturing & Heavy Industry – Enabling automation of repetitive material movement tasks.

Challenges and Market Considerations

Despite robust growth potential, the material handling robot market faces several operational and structural challenges:

- High Initial Investment Costs: Small and medium enterprises face financial barriers to adoption.

- Integration Complexity: Compatibility issues with legacy systems can slow deployment.

- Workforce Reskilling Needs: Growing automation necessitates technical training and skill adaptation.

- Cybersecurity Risks: Increasing connectivity introduces potential data vulnerabilities in smart factories.

Competitive Landscape

The global material handling robot market is characterized by high innovation intensity, with leading players focusing on AI integration, system interoperability, and service-based robotic models.

Key Players in the Material Handling Robot Market:

- KUKA AG

- ABB Ltd.

- FANUC Corporation

- Yaskawa Electric Corporation

- Dematic

- Honeywell International Inc.

- Toyota Industries Corporation

- Mitsubishi Electric Corporation

- Staubli International AG

- Daifuku Co., Ltd.

These companies are expanding production capacities, enhancing software capabilities, and strengthening partnerships with automation integrators to address rising global demand.

Recent Developments

- May 2024: ABB launched a new generation of cobots designed for flexible material handling in confined spaces, enhancing productivity in mid-size manufacturing setups.

- March 2024: FANUC introduced its M-410iC/110 robot optimized for high-speed palletizing, capable of handling payloads up to 110 kg with reduced energy consumption.

- January 2024: KUKA collaborated with major logistics firms to deploy intelligent AGVs for autonomous warehouse operations across Europe and North America

Future Outlook: Toward Autonomous and Sustainable Handling Solutions

The next decade will redefine the material handling landscape as robotics, AI, and data analytics converge to create fully autonomous and connected systems.

Manufacturers are prioritizing eco-efficient robots, predictive intelligence, and cloud-connected operations to achieve maximum productivity and sustainability.

With rising global investment in automation technologies, the material handling robot market is set to become a cornerstone of next-generation industrial ecosystems — driving efficiency, resilience, and competitiveness across all sectors.