The marine scrubber systems market is gaining remarkable momentum as the global shipping industry accelerates efforts to reduce emissions and comply with evolving environmental regulations. Marine scrubbers, also known as exhaust gas cleaning systems, play a crucial role in helping vessels meet international sulfur emission standards while maintaining fuel efficiency and operational flexibility.

Driven by the growing emphasis on sustainability, shipowners are adopting scrubber technologies to meet environmental targets without compromising on performance. The market reflects the maritime sector’s strategic transition toward cleaner propulsion systems and greener ocean transportation practices.

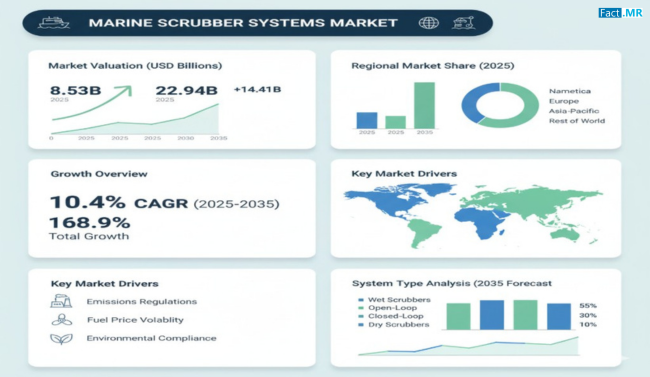

Market Overview

Marine scrubber systems are exhaust gas cleaning technologies installed on ships to remove sulfur oxides (SOx) and other pollutants generated from fuel combustion. These systems enable vessels to continue operating on conventional fuels while still complying with international maritime emission limits established by global regulatory bodies.

The market has evolved rapidly due to the International Maritime Organization’s (IMO) focus on reducing maritime pollution. Ship operators are increasingly turning to scrubbers as a cost-effective and reliable method of ensuring compliance, especially for large vessels engaged in international trade.

Manufacturers are innovating to deliver compact, energy-efficient, and maintenance-friendly systems that minimize downtime and optimize space utilization on ships. Hybrid and closed-loop systems, capable of operating in diverse marine environments, are witnessing growing adoption across commercial fleets. Additionally, research into advanced materials and digital monitoring solutions is enhancing system longevity, efficiency, and environmental performance.

Regional Insights

Europe remains at the forefront of marine scrubber system adoption, driven by the presence of stringent emission control regulations and proactive sustainability initiatives. European shipowners and operators are investing in retrofit and newbuild installations to meet environmental targets while maintaining competitive operational costs.

Asia-Pacific is emerging as a dominant region in the global market due to its extensive shipbuilding activities and growing fleet modernization programs. Countries such as China, Japan, and South Korea are leading in scrubber manufacturing and integration, benefiting from advanced shipyard capabilities and strong maritime trade growth.

North America is witnessing steady adoption of marine scrubber systems, particularly along coastal regions with emission control areas (ECAs). Ports in the U.S. and Canada are implementing strict environmental policies, prompting shipping companies to invest in compliant technologies that ensure uninterrupted operations.

In the Middle East and Africa, marine scrubber installations are increasing alongside expanding maritime trade routes and the region’s growing emphasis on sustainable port operations. Similarly, Latin America is expected to show progressive growth as shipping operators seek long-term compliance solutions that align with global decarbonization efforts.

Key Trends & Forecast

- Adoption of Hybrid and Closed-Loop Systems:

Shipowners are favoring hybrid systems that combine open and closed-loop functionalities, allowing vessels to switch between operational modes depending on water discharge regulations and environmental conditions. - Shift Toward Retrofitting Solutions:

A significant portion of demand arises from retrofitting existing vessels with scrubbers rather than building new ships. Retrofitting provides a cost-effective solution for compliance and extends the lifespan of existing fleets. - Advancements in Automation and Digital Monitoring:

The integration of real-time data analytics and automation into scrubber systems enhances performance monitoring, predictive maintenance, and operational safety. Smart control systems enable operators to track emissions, energy consumption, and system efficiency remotely. - Focus on Water Treatment and Waste Management:

Environmental authorities are tightening regulations on washwater discharge from scrubber operations. Manufacturers are responding with advanced filtration and water treatment systems that minimize marine pollution and ensure adherence to zero-discharge standards. - Integration with Alternative Fuels:

As the maritime industry explores alternative fuels such as LNG, methanol, and ammonia, hybrid scrubber systems are being developed to complement these fuels, supporting a smooth transition toward cleaner energy sources. - Growing Collaboration Across the Supply Chain:

Partnerships between shipbuilders, equipment suppliers, and maritime engineering firms are strengthening the development of standardized and efficient scrubber technologies. Joint ventures are helping accelerate innovation while ensuring compliance with evolving global regulations.

These trends underscore the market’s shift toward a future defined by cleaner, smarter, and more efficient marine propulsion solutions.

Applications & End-Use Outlook

Marine scrubber systems are used across a wide range of vessel types, including bulk carriers, container ships, tankers, cruise liners, and offshore support vessels. Their application is primarily aimed at reducing sulfur emissions and maintaining compliance with international environmental laws.

Commercial shipping represents the largest application segment, with operators prioritizing scrubber installations to sustain long-distance operations across regulated and non-regulated zones. By integrating these systems, shipping companies can continue using traditional fuels while ensuring compliance and cost savings.

The cruise industry has emerged as a major adopter of scrubber technologies, focusing on improving passenger experience and minimizing environmental impact. Cruise operators are installing advanced scrubber systems to meet port regulations and strengthen their sustainability credentials.

In the naval and offshore sectors, scrubber systems are gaining importance as governments and defense agencies aim to modernize fleets and align military operations with environmental policies. Offshore drilling and support vessels are also integrating compact scrubbers to manage emissions efficiently during extended marine operations.

Moreover, with the global emphasis on decarbonization, shipyards and equipment manufacturers are offering integrated solutions that combine scrubbers with exhaust gas recirculation and carbon capture technologies — paving the way for next-generation emission control systems.

Conclusion

The marine scrubber systems market represents a cornerstone of the shipping industry’s journey toward environmental responsibility and regulatory compliance. As maritime emissions face stricter global scrutiny, scrubber technologies offer a practical, transitional solution that bridges the gap between conventional fuels and future green alternatives.

Manufacturers are driving continuous innovation, focusing on efficiency, adaptability, and sustainability. The growing adoption of hybrid, closed-loop, and automated scrubbers highlights the industry’s commitment to sustainable operations and long-term viability.

In an era where environmental stewardship is redefining the maritime landscape, marine scrubber systems serve as a key enabler of responsible growth. Access to comprehensive market intelligence and technology insights empowers shipowners, operators, and policymakers to navigate the challenges of marine decarbonization and build a cleaner, more resilient global shipping ecosystem.

Browse Full Report – https://www.factmr.com/report/3055/marine-scrubber-systems-market