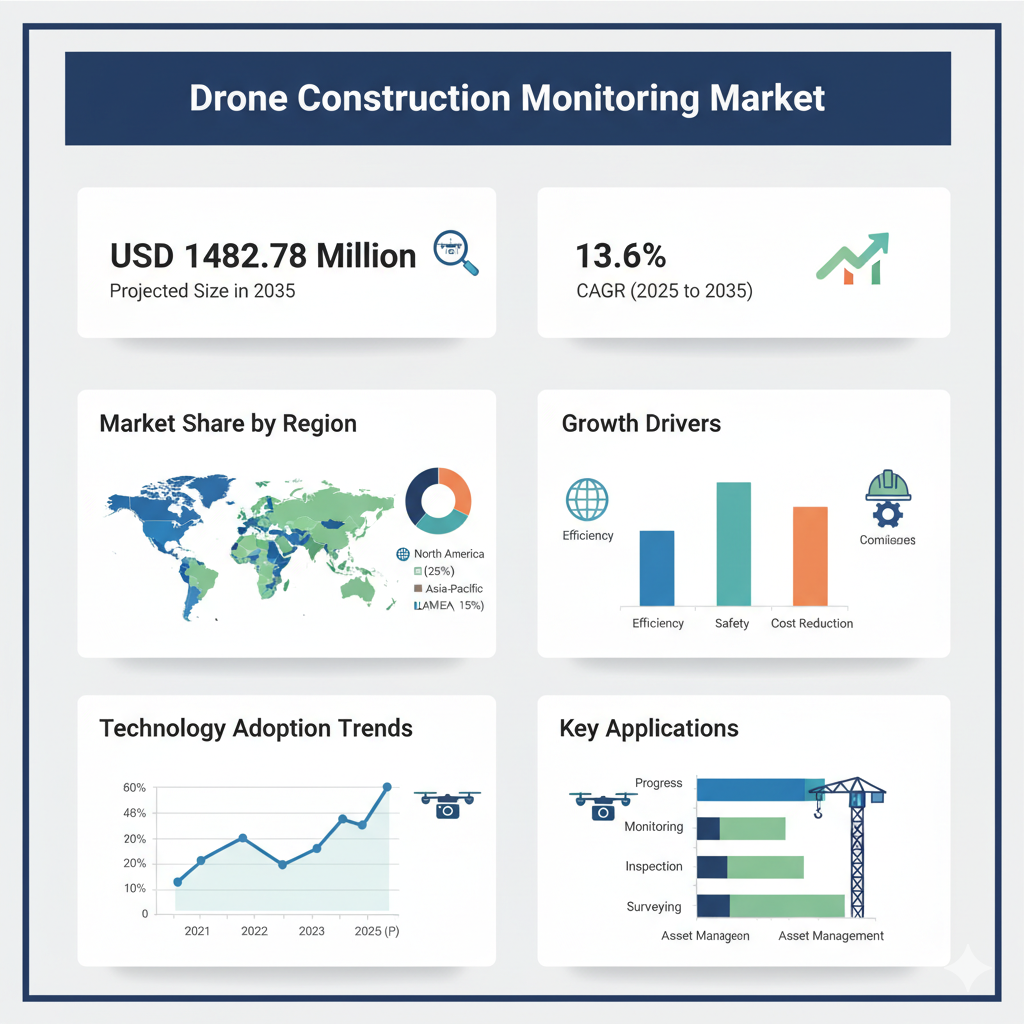

The drone construction monitoring market is witnessing remarkable growth, transforming how construction projects are planned, executed, and monitored. Valued at USD 414.28 million in 2025, the market is projected to expand at a CAGR of 13.6%, reaching USD 1,482.78 million by 2035. This surge reflects a rising demand for precision, safety, and real-time insights across construction sectors worldwide.

Market Segmentation: Drone Type, End Use, Application, and Region

A closer look at the market reveals diverse applications and specializations based on drone type, industry verticals, and regional developments.

By Drone Type

The market is broadly categorized into fixed-wing and rotary-wing drones. Fixed-wing drones are preferred for large-scale projects requiring wide-area coverage, such as highways, rail networks, and large infrastructure developments. Their longer flight endurance and efficiency make them suitable for topographic surveys and mapping. In contrast, rotary-wing drones dominate in compact or complex construction sites. Their ability to take off and land vertically, coupled with superior maneuverability, makes them ideal for close-up monitoring, site inspections, and progress documentation.

By End Use

Drone construction monitoring is gaining traction across residential, commercial, industrial, and infrastructure projects. In residential construction, drones enable developers to track progress efficiently and identify deviations early. Commercial construction firms employ drone monitoring to improve productivity and integrate data with Building Information Modeling (BIM) systems. Industrial construction, which often involves hazardous environments, benefits from drones that reduce human exposure and enhance inspection safety. Meanwhile, infrastructure projects such as bridges, roads, and smart city developments have become major users of drone technology, as these projects span vast areas requiring precise and consistent monitoring.

By Application

The applications of drones in construction monitoring are wide-ranging. Site surveying and mapping represent one of the most essential uses, replacing manual survey teams with high-resolution aerial data. Drones are also vital for progress monitoring, allowing stakeholders to document project milestones and detect potential delays. Safety inspections are another critical area, with drones accessing hard-to-reach or dangerous areas to ensure compliance and prevent accidents. Equipment tracking, post-construction audits, and other specialized tasks—such as volumetric analysis and environmental monitoring—further illustrate the technology’s versatility and value across the project lifecycle.

By Region

Regionally, the market spans North America, Latin America, Europe, East Asia, South Asia & Oceania, and the Middle East & Africa. Each region displays distinct adoption trends influenced by regulatory frameworks, infrastructure investment levels, and technological readiness. North America and Europe lead in terms of regulatory clarity and advanced drone integration, while Asia-Pacific and the Middle East show strong growth potential driven by large-scale infrastructure initiatives and increasing acceptance of drone technologies in construction.

Browse Full Report: https://www.factmr.com/report/drone-construction-monitoring-market

Recent Developments and Competitive Dynamics

Recent years have marked a pivotal shift from pilot testing to large-scale drone integration in construction workflows. In many regions, drones are now part of standard operational procedures. Construction firms use them for visual documentation, progress tracking, and safety audits, significantly improving project transparency and reducing rework.

Technological advancements continue to reshape the landscape. Features such as real-time data transmission, automated flight planning, photogrammetry analytics, and AI-based defect detection are becoming standard. The focus is moving from simply capturing aerial footage to generating actionable intelligence that enhances decision-making and project efficiency.

The competitive environment of the drone construction monitoring market is defined by a mix of established global leaders and emerging innovators. Major players such as DJI Innovations, Skydio Inc., DroneDeploy, Trimble Inc., Parrot SA, and Kespry are setting industry benchmarks in hardware reliability, data analytics, and software integration. DJI, with its strong presence and technological prowess, continues to dominate with advanced drone models designed for professional use. Skydio’s autonomous flight systems and AI-driven navigation are gaining popularity among construction firms handling complex environments. DroneDeploy excels in cloud-based analytics and integration with project management platforms, while Trimble leverages its strong geospatial expertise to offer comprehensive drone solutions.

These companies compete not only on product innovation but also on ecosystem partnerships, software compatibility, and compliance with evolving aviation regulations. Integration with existing construction management systems and adherence to safety and airspace laws have become key competitive differentiators.