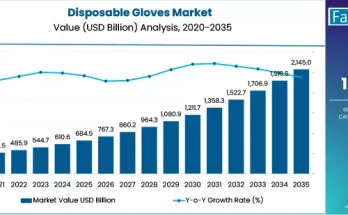

Disposable Gloves market experienced noteworthy growth, growing at a value CAGR of 5.8% from 2017 to 2021. Disposable gloves, being an integral part of personal safety and hygiene, have gained fast traction in the past years. Rising awareness regarding personal hygiene and protection against infectious diseases has become the key driving factor driving demand for disposable gloves since the outbreak of the pandemic.

The rising inpatient population and medical tourism across the globe are the key factors for driving the sales of the global Disposable Gloves Market. The pandemic has given a major blow to the industry. The market which was earlier restricted to medical and food processing purposes or was termed as mere a hygienic precaution now has become a necessity to be used by everyone. From shopkeepers to a student, everyone now has a stock of the gloves packed up back in their home, skyrocketing the sales. The government measures and regulations to mandate the use of gloves have also played a major role in booming the market.

Key Takeaways from the Market Study

- According to Fact.MR, a CAGR of 8% was recorded for the Disposable Gloves market from 2017-2021

- From 2022 to 2032, the industry is poised to flourish at a 1% CAGR

- By 2032, the Disposable Gloves landscape is slated to reach a valuation of US$ 1,579.11 Million

- By Material, the Natural Rubber Segment is expected to grow the fastest, at a CAGR of 11.8%

- By End-User, the Medical Segment is expected to dominate the market, documenting a 11.9% value CAGR

- As per Fact.MR’s projections, the market for Disposable Gloves in the US will likely expand at a 8% CAGR

“Governments and regulatory bodies across the globe are adopting stricter industrial safety regulations, thus creating new opportunities for the disposable gloves market growth,” comments an analyst at Fact.MR.

Competitive Landscape

Prominent players in the Disposable Gloves Industry are taking advantage of the rapidly increasing demand for the Disposable Gloves in various applications. To further their outreach, players are relying on collaborations, partnerships and acquisitions with existing small, medium and large-scale vendors. Some prominent market developments are as follows:

- In January 2021, Ansell Limited, completed the acquisition of the Primus brand and related assets that consist of the Life Science business belonging to Primus Gloves and Sanrea Healthcare Products (“Primus”). In addition, Ansell and Primus have entered into a long-term supply partnership. Primus is an Indian manufacturer and marketer of gloves sold in the Life Science and Specialty Medical sectors and is one of the few global producers of long cuff gloves with strong brand recognition. This acquisition increases the company’s presence in this important Indian market and provides them with the opportunity to further speed up the growth of their Life Sciences business.

- In May 2021, Honeywell and Premier Inc. established a new business partnership aimed at increasing nitrile exam glove production in the U.S. In the first year alone, this new alliance is estimated to create at least 750 million nitrile test gloves. The partnership is anticipated to provide access to domestically produced exam gloves for hospitals, clinics, and other healthcare professionals in the U.S.