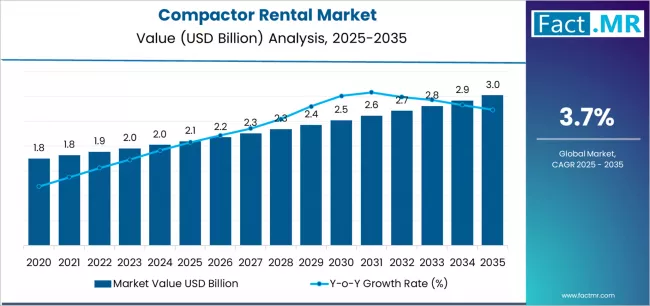

The global compactor rental market is poised for steady growth over the next decade, fueled by increasing demand from construction, infrastructure, and landscaping projects. According to a recent Fact.MR report, the market is projected to expand from USD 2,100.0 million in 2025 to USD 3,000.0 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.7% during the forecast period.

As construction firms seek cost-efficient and flexible solutions for high-performance compaction, rental services are emerging as the preferred choice for specialized equipment, enabling project optimization without substantial upfront investment.

Strategic Market Drivers:

Infrastructure Expansion and Road Construction Boom: Rapid urbanization and government-led infrastructure initiatives are driving the demand for compactor rental services. High-performance plate and roller compactors are increasingly deployed in road construction, building foundations, and landscaping projects. The plate segment alone is expected to capture a dominant 40% market share, while road construction accounts for 50% of total applications.

Cost-Efficiency and Flexibility for Construction Firms: Rental services allow contractors to access specialized compaction equipment without large capital expenditure. Advanced rental fleets enhance operational efficiency, reduce maintenance complexity, and ensure reliable performance across diverse project sites.

Technological Advancements in Equipment Management: Innovations in compactor technology, including vibratory systems and automated fleet management, are boosting adoption. These advancements ensure consistent compaction quality and project compliance, further supporting market expansion.

Browse Full Report: https://www.factmr.com/report/compactor-rental-market

Regional Growth Highlights:

Asia Pacific: Manufacturing and Infrastructure Hub

Countries like China, India, and Japan are driving the compactor rental market with large-scale infrastructure investments, urban development projects, and growing demand for road construction equipment.

Europe: Sustainability and Efficiency Focus

European markets emphasize advanced construction methods and equipment efficiency. Germany, France, and the U.K. are major contributors, integrating specialized compaction solutions into infrastructure modernization programs.

North America: Innovation and Fleet Expansion

The U.S. and Canada are witnessing growth through investments in high-performance rental fleets and advanced equipment management technologies, supporting road construction and commercial development projects.

Emerging Markets: Latin America, the Middle East, and South Asia are experiencing increasing demand due to urbanization, industrial development, and government infrastructure programs.

Market Segmentation Insights:

By Type:

- Plate: Dominant segment with 40% share, widely used in road construction and building foundations.

- Roller: 35% share, preferred for heavy-duty and large-scale projects.

- Rammer: 25% share, suited for specialized compaction tasks.

By Application:

- Road Construction: Largest segment at 50%, driven by infrastructure development.

- Building Foundations: 30%, with focus on structural integrity and project compliance.

- Landscaping: 20%, serving site preparation and environmental construction projects.

Challenges and Market Considerations:

- Limited rental fleet capacity and complex equipment maintenance requirements may constrain growth.

- High upfront costs of advanced compaction technology can limit adoption in developing regions.

Competitive Landscape:

The compactor rental market is highly competitive, with key players focusing on fleet expansion, technological integration, and specialized rental solutions.

Key Companies Profiled:

- Wacker Neuson

- BOMAG

- JCB

- Caterpillar

- Volvo CE

- Dynapac

- Ammann

- United Rentals

- Ashtead

- Loxam

- Boels

- Sunbelt

- Kubota

- Hamm

- Mikasa

Recent Developments:

- Companies are investing in advanced rental fleets and automated equipment management technologies.

- Strategic collaborations between rental providers and construction firms are increasing to deliver project-specific solutions.

Future Outlook: Toward Efficient and Specialized Compaction Solutions

Over the next decade, the compactor rental market will continue to benefit from infrastructure expansion, technological innovation, and increasing preference for flexible rental models. Companies prioritizing advanced equipment, smart fleet management, and regional collaboration are expected to lead market growth, delivering specialized compaction solutions that enhance operational efficiency and project performance globally.