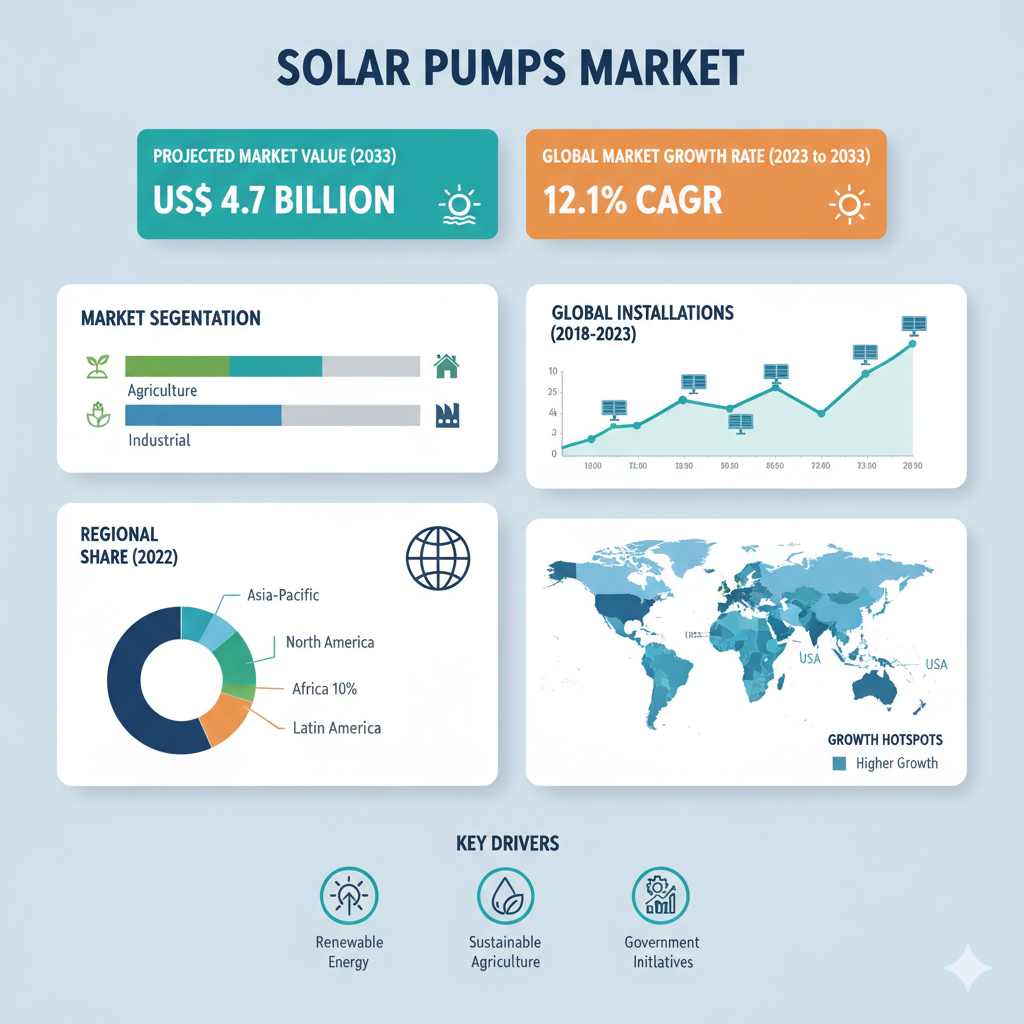

Expanding at a stellar CAGR of 12.1%, the global solar pumps market is forecasted to surge from a valuation of US$ 1.5 billion in 2023 to US$ 4.7 billion by the end of 2033. This strong growth projection highlights both the rising acceptance of solar pump solutions and the intensifying investments in renewable energy infrastructure worldwide.

The robust expansion of this market is driven by lower lifetime operating costs compared to diesel or grid-powered pumps, environmental benefits such as carbon emission reduction, and extensive government support through incentives and subsidies. These factors collectively promote the transition toward sustainable water pumping solutions, especially in remote or off-grid areas. As the market expands, capacity-specific segments and application domains will witness differentiated growth dynamics, shaped by local needs, energy policies, and agricultural or ecological priorities.

Capacity-Wise and Application-Wise Market Dynamics

Capacity Bands: Below 4 HP, 4–6 HP, and 6–8 HP

Solar pumps with capacities below 4 HP are primarily used in residential or small-scale agricultural settings, where modest water lift and flow are sufficient. The 4 to 6 HP segment serves mid-sized farms, commercial installations, and larger residences that require higher throughput and reliability. Meanwhile, pumps in the 6 to 8 HP range cater to large-scale farming operations, commercial water systems, and national parks, where both head and flow demands are substantial. Over the forecast period, higher-capacity units are expected to see stronger growth in commercial and agricultural segments, whereas lower-capacity pumps will dominate in residential and smallholding applications. This capacity-based segmentation allows manufacturers to design products suited to specific operational and regional needs.

Applications: Farming, Residential, Commercial & National Parks

Farming remains the largest application segment, as solar pumps help reduce dependency on unreliable grid power and expensive diesel fuel while enabling efficient irrigation. In the residential sector, solar pumps are increasingly used for household water supply, garden irrigation, and drinking water systems, particularly in rural or off-grid regions. The commercial segment includes installations for water features, swimming pools, and institutional facilities. National parks and protected areas are also adopting solar pumps to meet water supply and conservation needs in areas where grid power is limited or environmentally unsuitable. Across all these domains, the push toward sustainability and self-reliant infrastructure continues to drive adoption.

Recent Developments, Key Players & Competitive Landscape

Recent developments in the solar pumps market reflect significant innovation and strategic collaboration. Manufacturers are investing heavily in product innovation, introducing hybrid designs that combine solar power with grid or battery backup to ensure continuous operation in fluctuating weather conditions. Patent activity has also intensified, with companies like Shakti Pumps Limited developing grid-tied solar water pump systems that enable power generation and grid feedback. Similarly, KSB SE & Co. KGaA has expanded its product portfolio with larger submersible borehole pumps, broadening its reach in high-demand applications. Strategic alliances between manufacturers and government agencies are helping scale deployment by integrating subsidy programs, local manufacturing, and aftersales services.

Key players operating in the global solar pumps market include SunTech Drive LLC, Advanced Power Inc., Bernt Lorentz GmbH, Dankoff Solar, Grundfos, BW Solar (Waterboy), Vincent Solar Energy Company, Greenmax Technology, AQUA GROUP, Kirloskar Brothers Limited, Franklin Electric, Shakti Pumps (India) Ltd., Stanley Black & Decker, Glynncorp Electrical, C.R.I. Pumps Private Limited, Mono Pumps, and Solar Mill. These companies compete through a mix of technological innovation, geographic reach, and cost competitiveness.

Technological advancements such as maximum power point tracking (MPPT) systems, variable frequency drives, and hybrid solar-grid integration provide firms with a competitive edge. Regional players, particularly in developing markets, benefit from strong distribution networks and alignment with national subsidy programs. Broad product portfolios covering multiple capacity bands allow companies to capture a wider customer base, while efficient after-sales service and maintenance infrastructure enhance customer loyalty. As the upfront cost of solar pumps remains a concern in price-sensitive markets, firms that can optimize manufacturing and supply chains stand to gain a cost advantage.