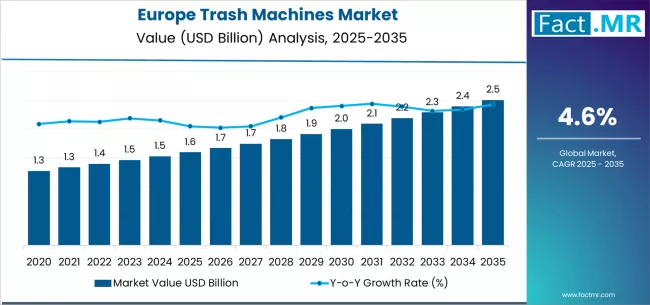

The demand for trash machines in Europe is projected to increase from USD 1.6 billion in 2025 to approximately USD 2.5 billion by 2035, registering an absolute gain of USD 0.9 billion over the forecast period. This represents an overall growth of 56.3%, with demand forecast to expand at a compound annual growth rate (CAGR) of 4.6% between 2025 and 2035.

As European nations intensify efforts toward sustainability, waste reduction, and circular economy adoption, trash machines—including compactors, shredders, balers, and automated waste sorters—are becoming integral to municipal and industrial waste management systems. These machines not only enhance collection and disposal efficiency but also promote recycling and energy recovery, aligning with the European Union’s Green Deal and zero-waste targets.

Strategic Market Drivers

- Rising Urbanization and Waste Generation

Europe generates over 200 million tonnes of municipal waste annually, with growing urban populations exerting additional pressure on waste management systems. Local governments and private operators are investing in smart trash machines to improve collection efficiency, optimize landfill capacity, and minimize greenhouse gas emissions.

Automated waste compactors and intelligent sorting systems are increasingly deployed in smart cities such as Amsterdam, Berlin, and Copenhagen, ensuring real-time monitoring and efficient segregation of recyclables.

- Circular Economy and Recycling Push

The EU’s Circular Economy Action Plan emphasizes waste prevention, reuse, and recycling—fueling the adoption of advanced trash machines. Industrial facilities and material recovery plants are upgrading equipment to handle complex waste streams, such as e-waste, plastics, and construction debris, using AI-integrated sorting technologies and robotic automation.

- Growth of Industrial and Commercial Waste Solutions

Europe’s expanding manufacturing, retail, and hospitality sectors are driving demand for on-site waste management equipment such as balers, compactors, and crushers. These machines help businesses reduce transportation costs, comply with environmental regulations, and maintain cleaner operations.

Browse Full Report: https://www.factmr.com/report/europe-trash-machines-market

Regional Growth Highlights

Western Europe: Policy-Driven Transformation

Countries like Germany, France, the U.K., and the Netherlands are at the forefront of the waste management revolution. Strong policy frameworks—such as Extended Producer Responsibility (EPR) and landfill taxes—are compelling industries to invest in efficient waste-handling machinery. Germany’s “Kreislaufwirtschaftsgesetz” (Circular Economy Act) and the U.K.’s Environment Act 2021 are key enablers of sustainable equipment adoption.

Northern Europe: Technological Pioneers

Nordic nations are leveraging automation, robotics, and IoT-enabled waste systems to achieve near-zero landfill dependency. Sweden and Finland have become early adopters of sensor-equipped trash compactors and AI-based recycling sorters.

Southern & Eastern Europe: Emerging Potential

Southern and Eastern European countries—including Spain, Italy, and Poland—are witnessing increasing investments in modern waste management infrastructure. EU-funded sustainability programs are accelerating the shift from manual collection to mechanized waste segregation and recycling operations.

Market Segmentation Insights

By Product Type

- Trash Compactors – Widely used in commercial and residential waste compression.

- Shredders and Crushers – Essential for industrial and construction waste management.

- Balers – Gaining traction in recycling centers for compacting paper, cardboard, and plastics.

- Automated Sorting Machines – Enabling advanced recycling through sensor-based technologies.

By End Use

- Municipal Waste Management – Dominant segment due to government-led sustainability programs.

- Industrial & Manufacturing – Growing adoption for reducing waste volume and handling hazardous materials.

- Commercial Establishments – Increasing demand from hospitality, retail, and logistics sectors.

- Recycling Facilities – Rapid deployment of automated sorting and baling equipment.

Challenges and Market Considerations

Despite positive growth prospects, the Europe trash machines market faces key challenges:

- High Capital Costs: Advanced automated systems require significant upfront investment.

- Maintenance and Training Gaps: Skilled workforce shortage and high maintenance needs impact smaller municipalities.

- Regulatory Complexity: Variations in waste management policies across EU member states affect standardization and adoption.

- Supply Chain Disruptions: Delays in component supply and energy cost fluctuations may affect production timelines.

Competitive Landscape

The European trash machines market is moderately consolidated, with leading companies emphasizing product innovation, automation, and sustainability to strengthen market share.

Key Players in Sales of Trash Machines in Europe:

- Veolia Environment S.A.

- SUEZ SA

- Waste Management Inc.

- Republic Services Inc.

- Biffa plc

- FCC Servicios Ambientales

- AVR-Afvalverwerking B.V.

- Remondis SE & Co. KG

- Bingo Industries Limited

These players are expanding recycling capacities, investing in digital waste tracking, and developing compact, energy-efficient machines to meet Europe’s ambitious circular economy goals.

Future Outlook: Toward Smart, Sustainable Waste Management

Over the next decade, Europe’s trash machines market is poised to evolve toward intelligent, interconnected, and eco-friendly systems. Manufacturers are focusing on AI-based automation, IoT integration, and low-emission machine designs to reduce environmental footprints and operational costs.

As Europe advances its 2030 waste reduction and net-zero emission targets, demand for efficient trash management machinery will continue to accelerate. Companies that combine technological innovation with sustainable engineering are expected to lead this transformation—building a cleaner, smarter, and more resource-efficient Europe.